Perpetual DEXs leverage the core value of perpetual contracts, enabling traders to use leverage and hedge without expiry constraints, providing flexibility not available in traditional spot trading. Current low penetration in total addressable market implies its potential of significant growth in near future

The evolution of perpetual DEXs from initial virtual AMMs to more advanced models incorporating real liquidity and hybrid systems shows a significant technological progression aimed at stabilizing and enhancing market functionality

The evolution of perpetual DEX market highlights that key factors for successful perpetual DEX design include robust mechanisms for price discovery, adequate incentives for liquidity providers and coverage for long-tail assets

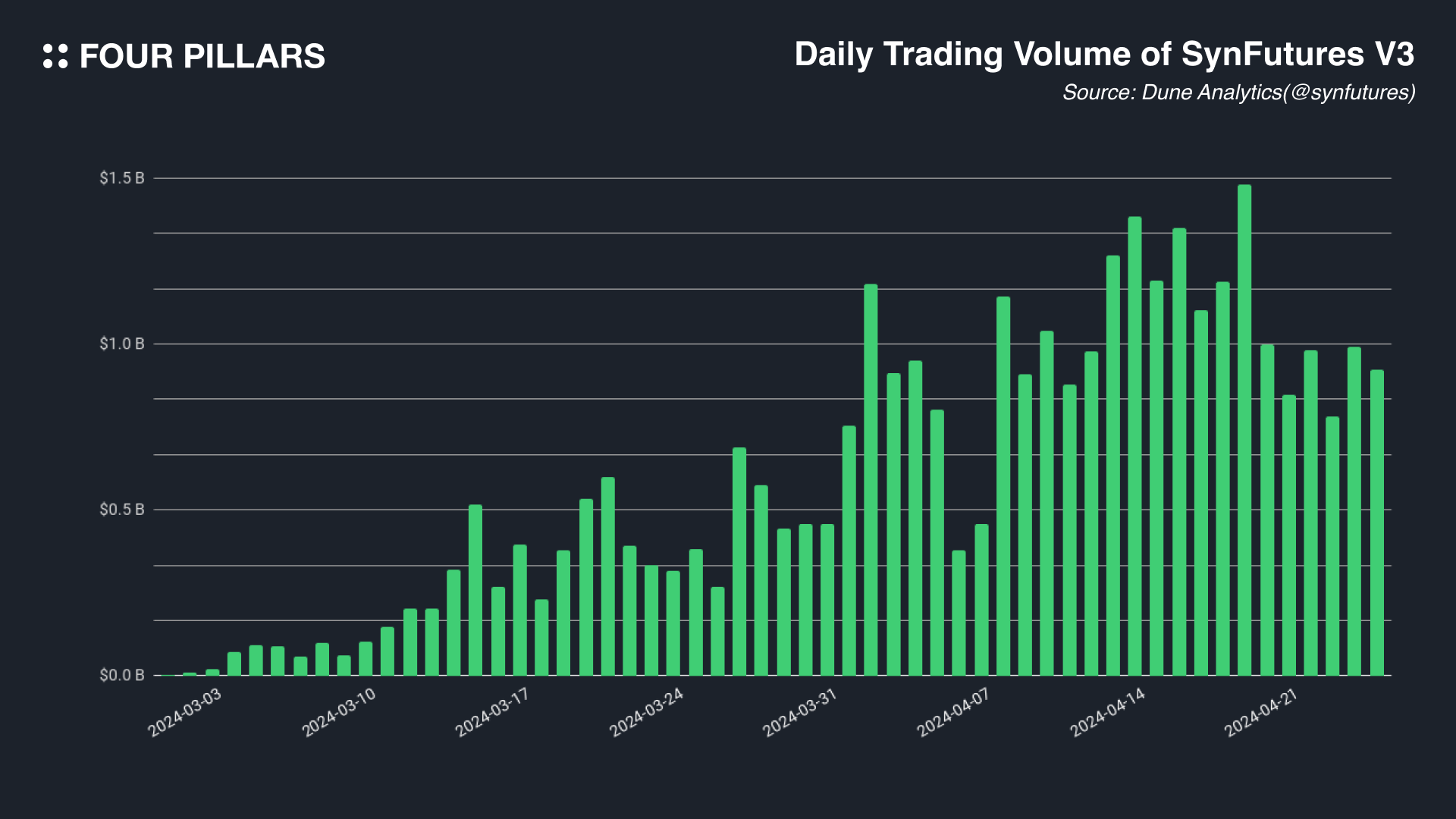

SynFutures exemplifies innovation in perpetual DEXs with recent upgrade to Oyster AMM, enhancing performance and scalability. Its unique design merges AMM and order book features, facilitating efficient liquidity provision and improved price stability, thus broadening its appeal and significantly boosting trading volume after migration to Blast L2

The perpetual market in cryptocurrency has rapidly become a pivotal battlefield for traders eager to leverage and hedge with the freedom that comes from no expiry dates. This market echoes the perpetual futures found in traditional financial sectors and carves out a significant niche within the expansive DeFi landscape. Despite its importance, perpetual trading DEXs is still in its nascent stages, especially when compared to the more mature markets on the centralized counterparty.

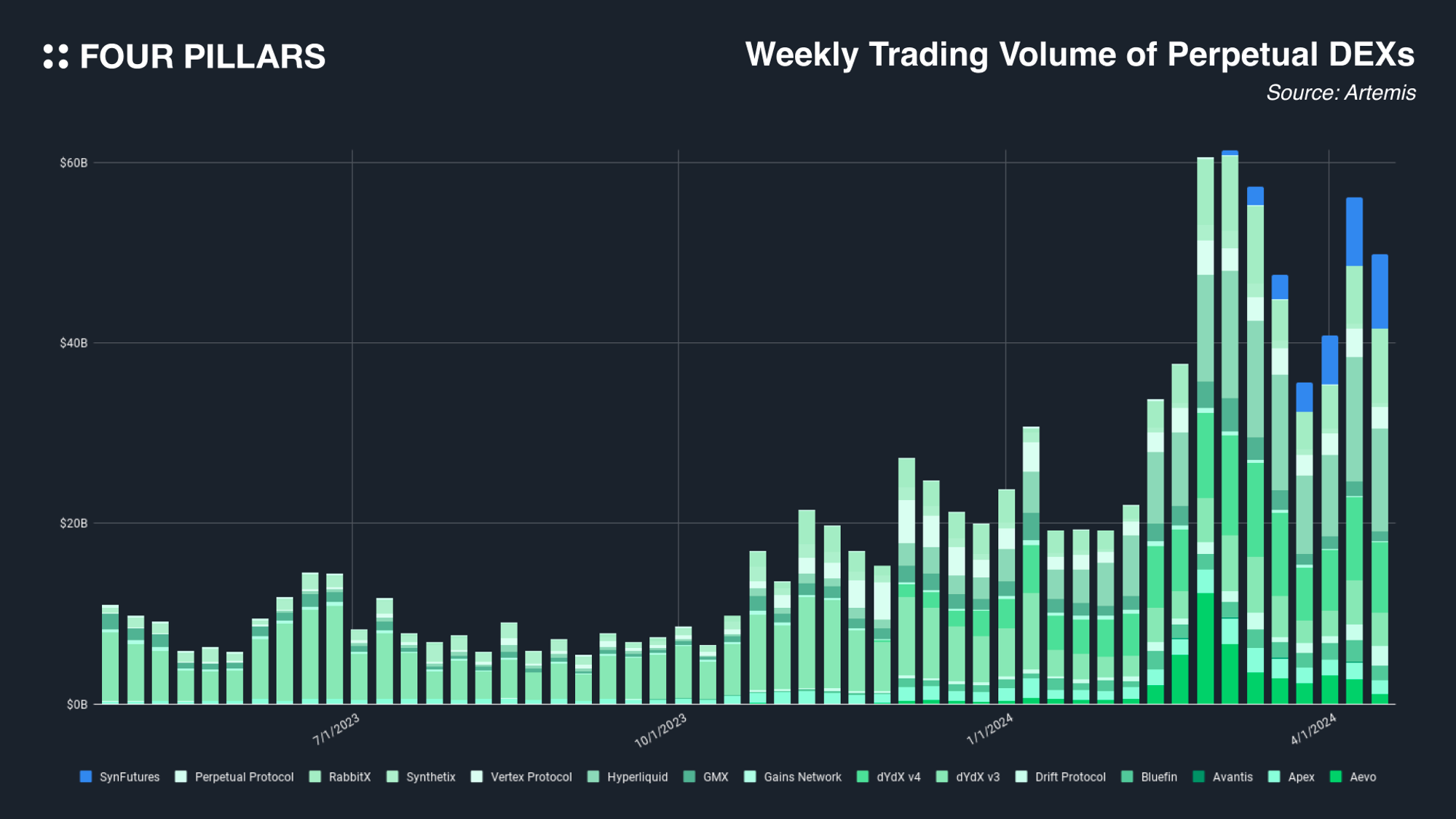

By 2024, onchain futures trading experienced remarkable growth, with monthly trading volumes soaring to $200 billion, which is over four times larger than the previous year’s. However, this impressive figure still constitutes just a fraction of the total market, implying enormous potential for expansion. While spot trading DEX volume now captures about 10% of the market, perpetual trading on DEXs lags behind at merely around 1-2% of total market. With increasing onchain activity and gradual improvement of technical dependencies, we anticipate a significant influx of capital into derivative sector, likely boosting the penetration of perpetual DEXs.

In this evolving landscape, SynFutures has made notable strides, particularly after its recent migration from Polygon to Blast L2. SynFutures has achieved a weekly trading volume over $10B, positioning it as the second largest Perpetual DEX and the leader on the Blast. This article delves into the potential of perpetual DEXs to revolutionize trading practices within the DeFi landscape by exploring their mechanisms, technological advancements, and core design factors. Especially, we will discuss the unique challenges and solutions presented by SynFutures, offering insights into the future direction of decentralized perpetual markets.

Let's delve into the concept of perpetual futures, a complex financial instrument distinct from traditional forms of trading, such as spot or margin trading. In futures trading, no actual asset is exchanged. Instead, transactions are confined to specific exchanges or pools. This is a notable departure from spot assets, which can be traded freely across various platforms. In spot asset trading, a token purchased on one platform can be traded identically on another, while futures contracts are bound to the market of their origin. This is why the implementation of perpetual futures can vary from one exchange to another. Each platform may highlight different features, applying unique design parameters that result in a variety of trading functionalities and potential trade-offs.

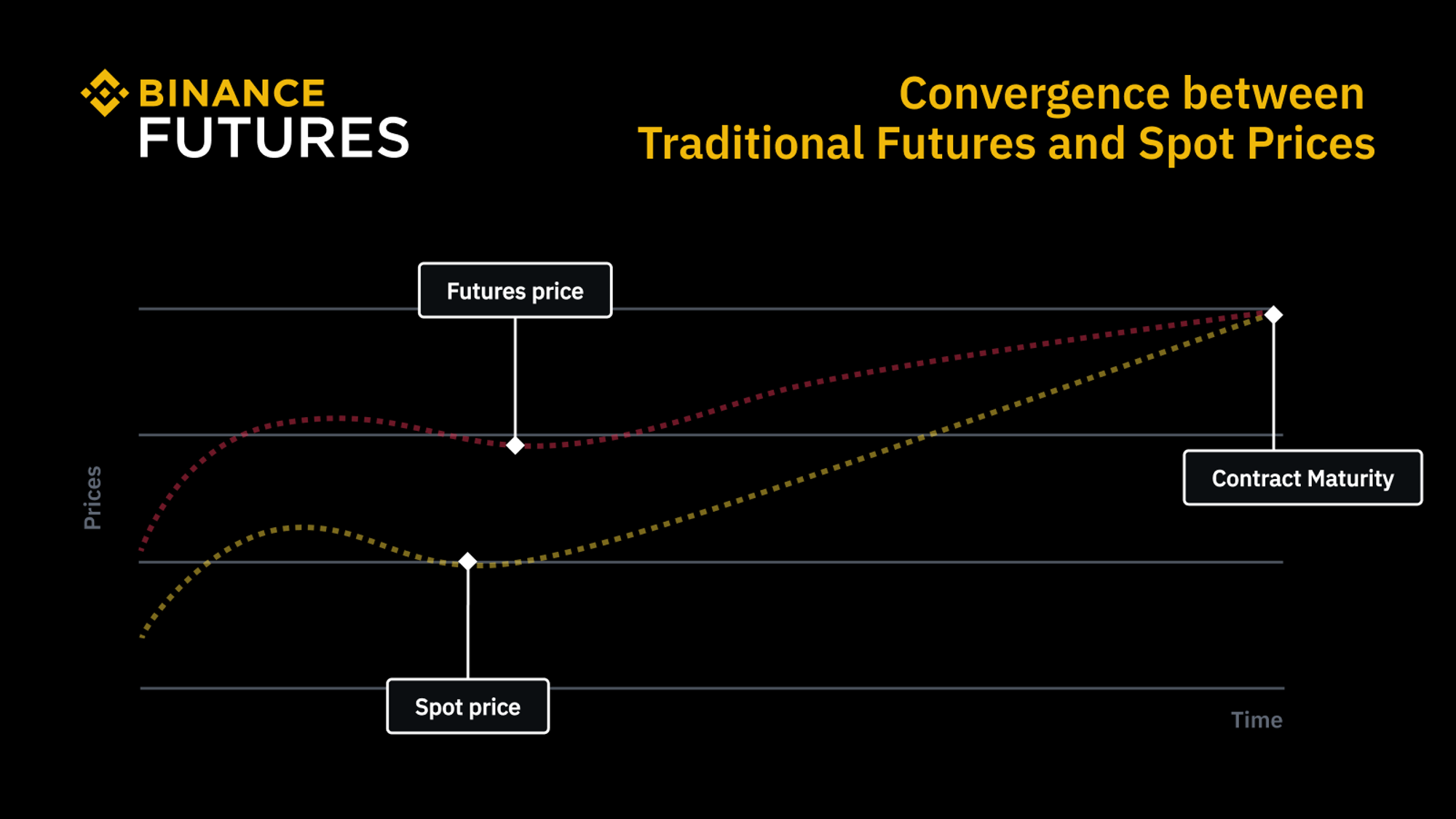

Core principle of perpetual futures is that the price of the traded futures must be the same as the price of the underlying asset. The price of the futures is referred to as the Mark Price, and the price of the asset determined in other exchanges or where price discovery occurs is called the Index Price or Spot Price.

Source: Price Convergence and Funding Fees in Perpetual Futures Markets

The mechanism that ensures the futures price remains equivalent to the index price is known as the funding mechanism or funding rate. The funding rate functions as a type of interest cost paid by traders, whether they hold a long or short position, to their counterparts. Thus, within the perpetual futures system, the funding mechanism serves as a feedback control system, ensuring that the mark price tracks the index price closely.

When the mark price converges to the index price, the futures are deemed to hold the same value as the underlying asset, indicating a healthy market condition. Conversely, discrepancies between these prices proposes need for realignment, through the exchange of a funding fee between traders of long and short positions. When these prices diverge significantly, traders on one side may be compelled to transact at a disadvantageous price, incurring substantial funding costs or even leading to incomplete settlements.

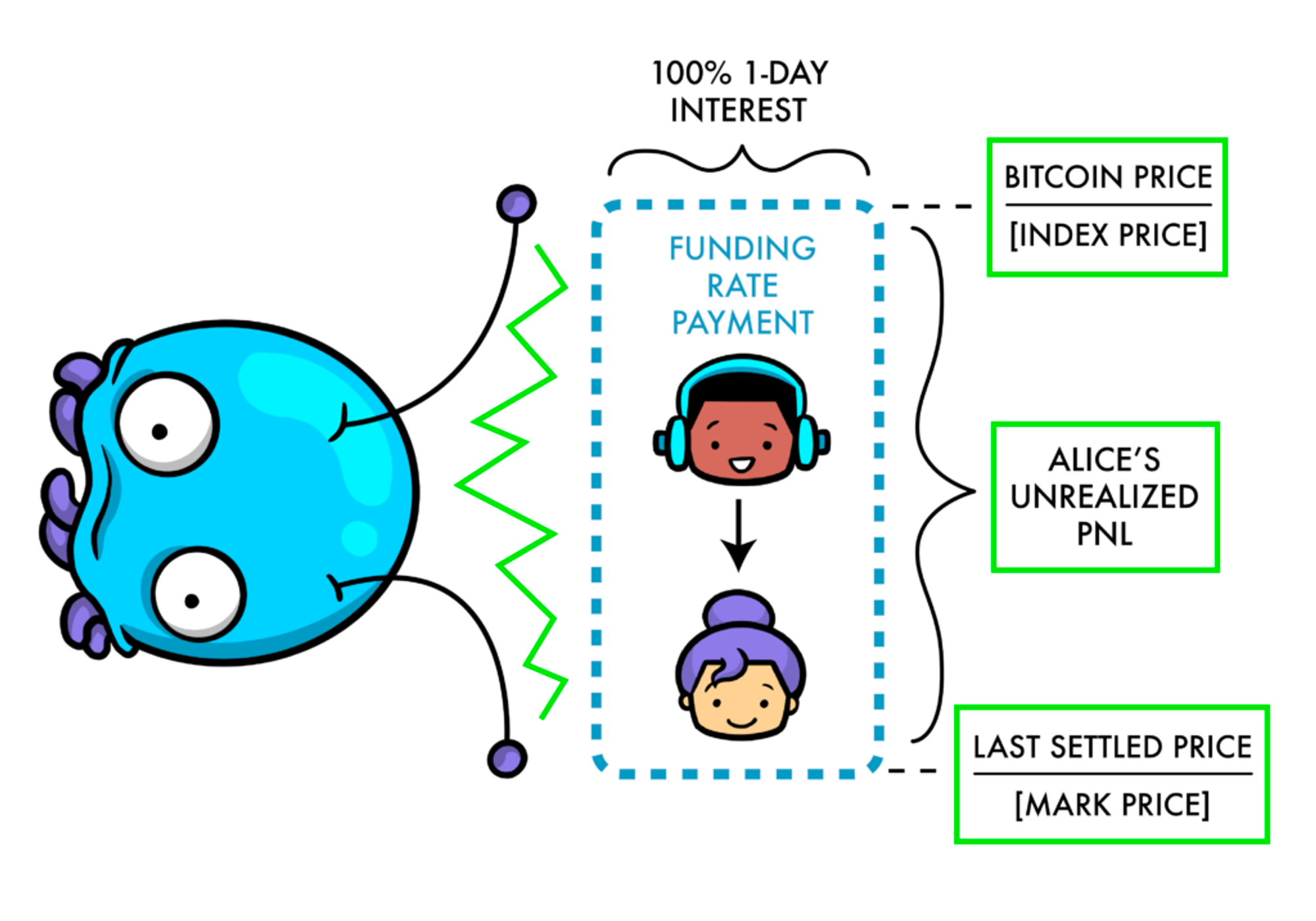

Source: The Cartoon Guide to Perps

To better understand how perpetual futures work, let's consider a simplified example of Alice and Bob. Imagine that the current price of bitcoin is $100k. Alice is interested in going long on bitcoin, meaning she anticipates the price will rise. Conversely, Bob is looking to go short, betting that the price will fall. However, Alice doesn’t have $100k to buy a bitcoin outright, and Bob doesn’t have a bitcoin to sell or borrow.

Instead, they agree to simulate a transaction where Alice "buys" a bitcoin from Bob at $100k, which we'll call the mark price. They decide to settle any profit or loss in cash as the market price of bitcoin, referred to here as the index price, fluctuates. This mark price will adjust as they exchange money to reflect profits or losses.

The very next day, the index price of bitcoin rises to $110k. Alice's position now shows a $10,000 profit. Bob owes Alice the exact amount because he took the opposite position. However, Bob needs an hour to transfer the funds. During this hour, the agreement stipulates that Bob pays interest on the unrealized profit, which was set to daily interest rate of 100%. This interest amounts to approximately $400 (calculated as $10,000 divided by 24 hours).

Once Bob transfers the $10,000 profit to Alice after an hour, their positions reset as if the new mark price of bitcoin is $110k. Essentially, they have replicated a perpetual futures contract here: Bob continues to owe Alice the difference between the index price and the mark price each day until he can settle this amount and adjust the mark price to match the current index price. In this example, the interest cost Bob paid to Alice corresponds to the funding fee in real perpetual market.

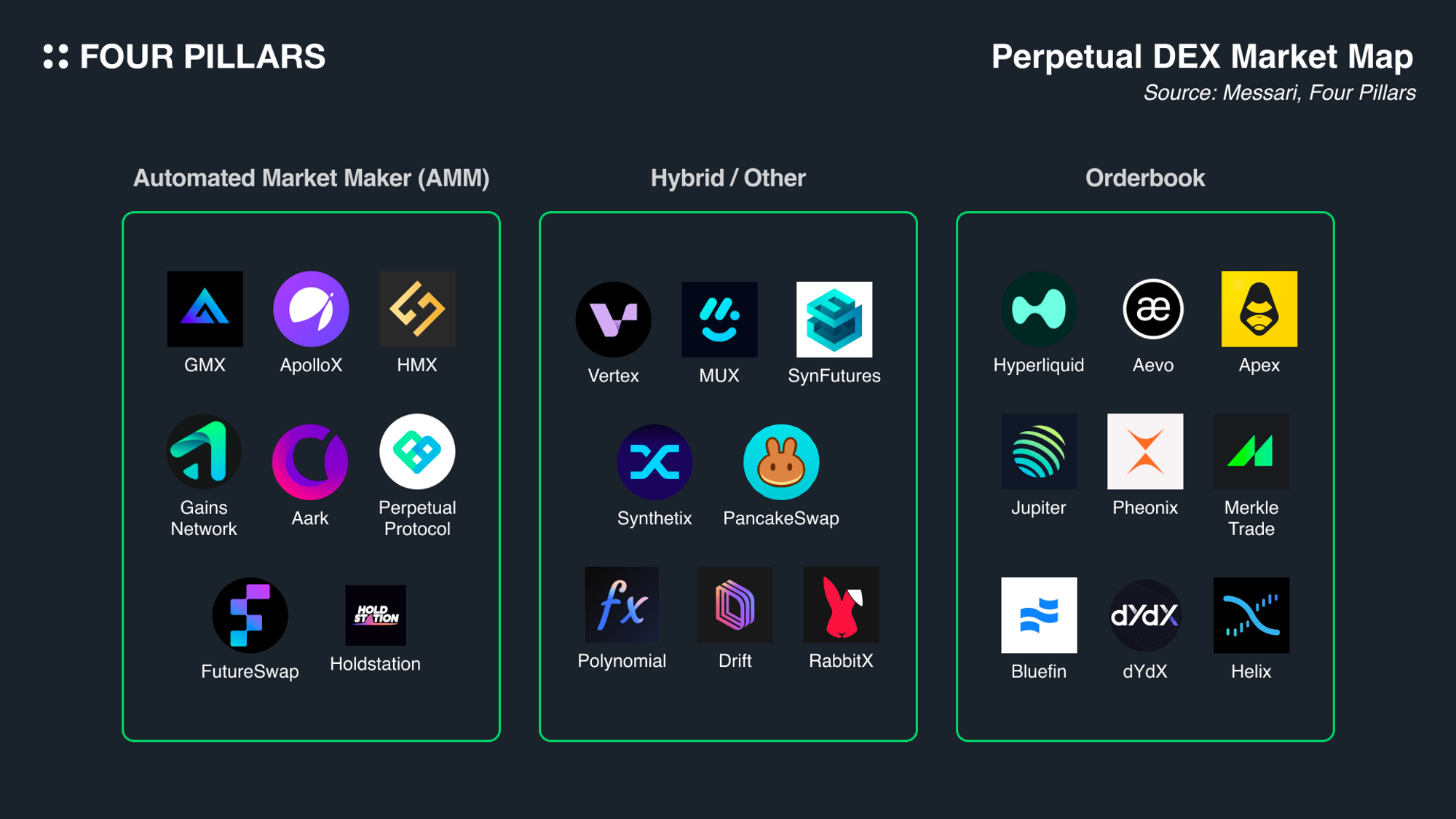

Initially dominated by traditional order book models like dYdX, the perpetual futures DEX market has significantly evolved with the adoption of the Automated Market Maker(AMM) model, which is one of the most innovative invention in DeFi. However, the integration of AMM into perpetual futures has faced various challenges and incidents, just like other sectors in Defi landscape. This progression offers crucial insights into the design and technical considerations necessary for developing effective perpetual DEXs. In this chapter, we will explore the development and critical factors of AMM-based perpetual DEXs in detail.

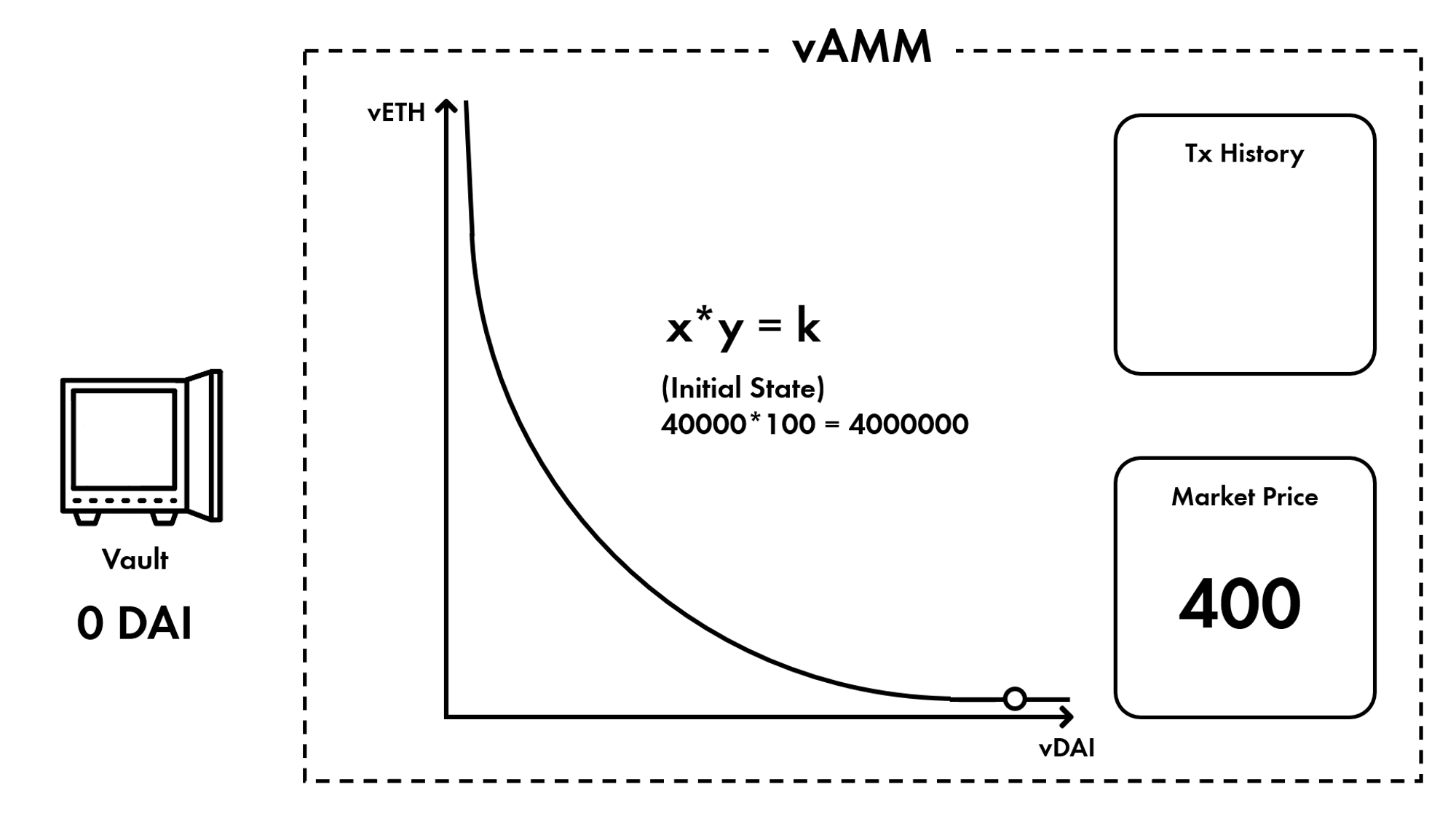

2.2.1 Introduction of Virtual AMM by Perpetual Protocol

Source: A Deep Dive into our Virtual AMM (vAMM)

The concept of virtual automated market makers (vAMMs) was pioneered by Perpetual Protocol. This innovative approach initially captivated the DeFi market due to its novelty for facilitating perpetual contracts without the need for provision of actual liquidity and bringing market makers, which is required for traditional order book or AMM model. Virtual AMMs did not require actual tokens to be present in the liquidity pool; instead, they used a virtual liquidity system to simulate trading environments, just like the example case I explained above. This model allowed for high leverage and no upfront capital, which initially attracted a significant user base and volume rapidly.

However, the lack of actual liquidity soon revealed limitations. The primary issue was market instability; without real assets to back trades, price slippage and volatility were significantly higher, making the market less sustainable for traders and the protocol itself. This inherent instability highlighted the need for a more robust system that could offer both the efficiency of AMMs and the stability of actual liquidity.

2.2.2 Adoption of liquidity pool and order book based approach

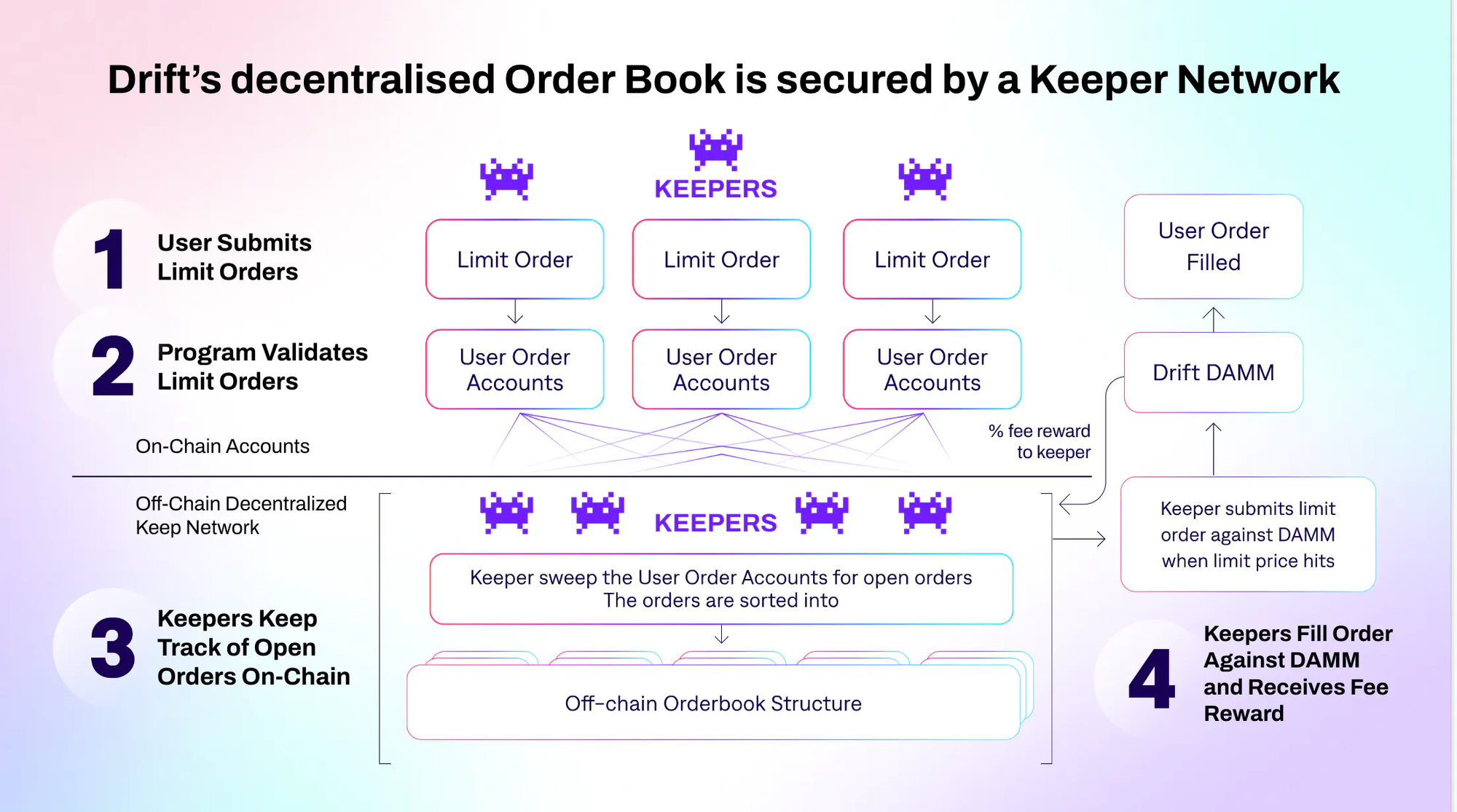

From the limitations faced by the first generation of virtual AMMs, it became clear that actual liquidity provision was essential for stable price convergence and low slippage. In response, Perpetual Protocol launched the next version of its virtual AMM, and similar yet distinct services such as SynFutures and Drift Protocol also emerged. Concurrently, new methodologies began to be proposed to complement the pros and cons of both AMM and order book based approaches. For example, Drift Protocol uses an AMM as its trading engine, but its user interface operates like an order book model. Drift Protocol's hybrid system introduces an innovative design where a operators called Keeper processes user orders and delivers the outcome, which is similar to the Intent mechanism used in Uniswap X.

Source: Drift Docs

There are clear advantages and trade-offs between AMM and order book-based models. In AMMs, where prices are automatically determined by equations, anyone can become a market maker without the need for specialized trading skills, facilitating participation by retail users. Similarly, this lowers the barrier to entry for adding new futures market, providing advantages in market expansion, especially for supporting long-tail assets.

On the other hand, the order book model, which concentrates liquidity near the price of the asset, typically has lower slippage than the single pool AMMs. However, highly volatile assets pose significant risks for market makers, which make it challenging to attract sufficient liquidity in the market pool. Additionally, the relatively slow execution speed of the EVM also acts as a significant constraint in creating a fully onchain order book system. As a result, most order book-based perpetual protocols typically operates on high-performance blockchains like Solana, Sui or app-chains or are processed on a centralized server.

2.2.3 Diversification and Expansion

After the explorative stage, the perpetual DEX market is evolving into a vibrant ecosystem with significant innovation and diversification in terms of mechanisms and design. The perpetual DEX market is showing development in both AMM-based and order book-based models, meeting the diverse demands of users and liquidity providers. For example, Elixir Protocol, used as a market-making engine by HyperLiquid, Bluefin, etc, offers methodologies to overcome the limitations of the traditional order book model. On the other hand, the AMM based models also have shown impressive improvements, including the hybrid models of AMM and order book introduced by Synfuture's Oyster AMM.

In 2024, both camps have shown significant growth in terms of trading volume. Alongside traditional powerhouse like dYdX, new order book-based models such as Aevo and HyperLiquid are gaining attention, providing a user experience familiar from CEXs while also offering an effective trading functionalities. Existing AMM-based protocols like SynFutures and Drift Protocol are also maintaining a strong presence in the market with continuous growth.

The Perpetual DEX market, while still showing a low penetration rate compared to the overall perpetual volume, is likely to benefit much more from market expansion rather than competition. With the recent increase in user adoption of onchain services and the continuous technical improvements, the perpetual DEX market is expected to remain active and continue to grow in near future.

Summarizing the standpoints covered above, when designing Perpetual DEXs, several critical elements must be prioritized to ensure their functionality and market fit.

Price Stability and Funding Mechanism: Inherent to their nature, futures markets operate independently from the spot markets, and thus the assets they trade do not have intrinsic value. Implementing a funding mechanism is crucial to link futures prices closely with those of the spot market. The low stability in convergence mechanism can lead to high slippage and market inefficiencies if not devised stricktly. Therefore, a well-designed system capable of managing these discrepancies effectively without substantial price differences is vital for maintaining a stable and equitable trading environment

Incentives for Liquidity Provision: Liquidity providers face inherent risks and opportunity costs, especially in AMM-based perpetual DEXs where market makers compensate arbitrage traders. The provision of actual liquidity in sustaining a stable perpetual market is inevitable, as proved from the first experiment of virtual AMM; hence, meaningful incentives are necessary to draw liquidity from market makers. Recognizing these risks and offering appropriate rewards are fundamental for securing the continuous liquidity required for the efficient functioning of perpetual markets

Lowering Barriers for Long-Tail Assets: Perpetual DEXs need to leverage its competitive advantage compared to CEXs. A significant benefit of using AMMs for DEXs is their capability to host long-tail assets, which are often difficult to list on conventional exchanges due to stringent requirements and criteria of listing. Perpetual DEXs could thus position themselves in the market by facilitating the listgin of diverse but highly volatile assets through lower entry barriers, thereby attracting a wider array of assets and enriching diversity in the market

User Experience: The significance of user experience is increasingly acknowledged across all crypto applications, including financial products. For Perpetual DEXs, of which volume of retail users occupy great share of total activity, delivering a decent user experience is critical as well. Recently, it was shown that services with superior user experience generally achieve better tractoin in terms of trading volume and user engagement. Prioritizing faster settlement and lower fees, particularly through Layer 2 solutions or high-performance blockchains, and streamlining the onboarding process are proved highly effective for acquiring and keeping high-value users in their platform

These key factors collectively contribute to the success and sustainability of Perpetual DEXs, addressing both technical challenges and user-focused considerations to create a robust but efficient trading environment.

SynFutures has emerged as one of the few services to not only survive but also thrive through the DeFi Summer of 2021 and the subsequent bear market. Maintaining significant trading volumes from its inception to the present, SynFutures, alongside Perpetual DEXs like Solana's Drift, continues to be a prominent player in the evolving landscape of decentralized finance protocols.

3.1.1 Synthetic AMM (V1): Q4 2021 – Q3 2022

In 2021, SynFutures launched its first iteration, V1, introducing a synthetic AMM (sAMM) model. The first model allowed Liquidity Providers (LPs) to supply just one asset of a trading pair, such as a stablecoin, while the protocol automatically synthesized the counterpart asset within the pool. This initial version quickly gained traction, with cumulative trading volumes surpassing $3 billion by mid-January 2022, reaching $4 billion in February, and escalating to $5 billion by March—demonstrating a robust MOM growth of about $1 billion.

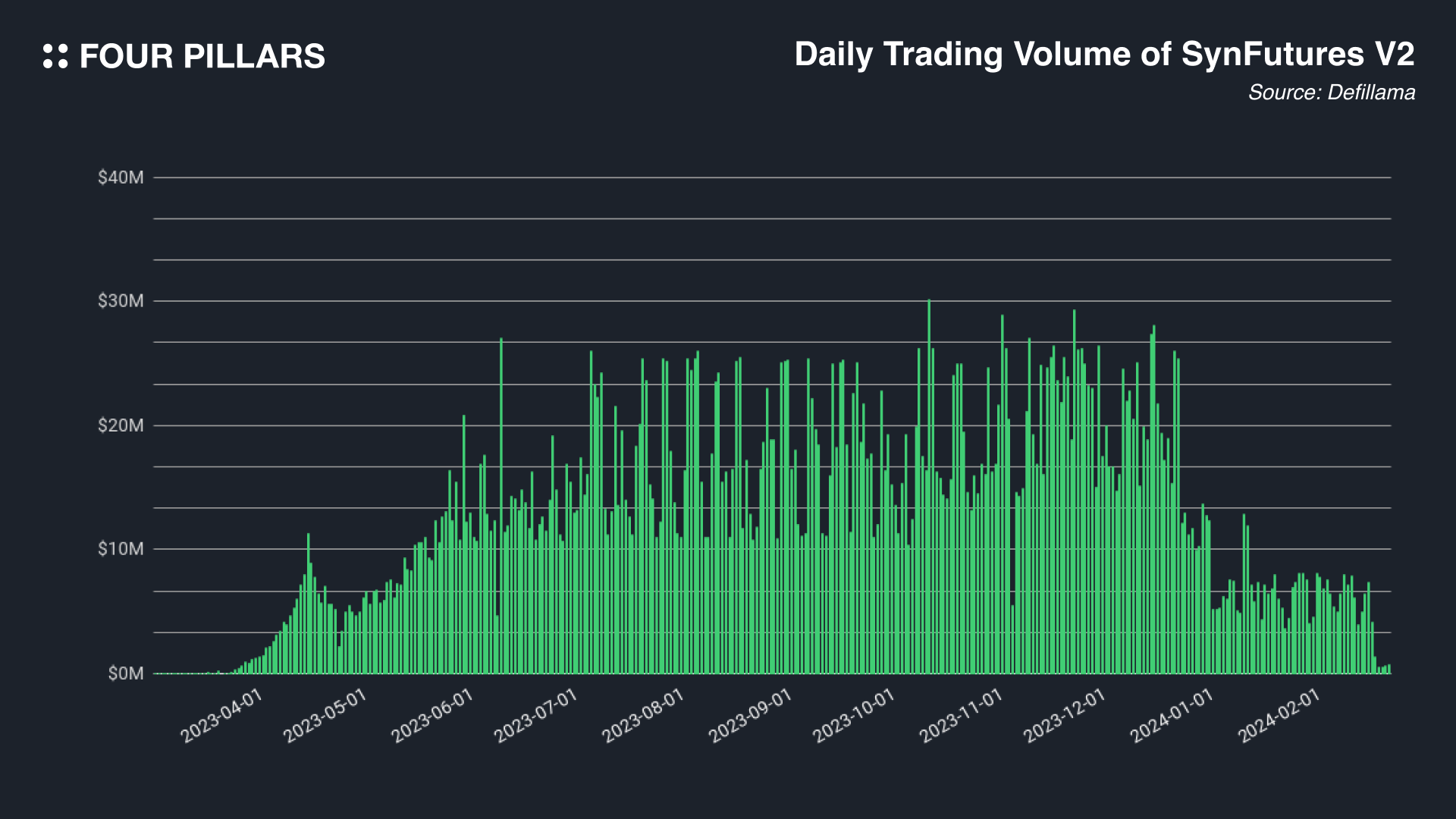

3.1.2 Synthetic AMM (V2): Q4 2022 – Q1 2024

The second version, V2, introduced in late 2022, marked a significant upgrade over its predecessor by eliminating the need for LPs to set initial prices for new expiry dates, allocate margins for maintaining hedge positions, or periodically rebalance margins to meet margin requirements. These enhancements significantly reduced the operational complexities traditionally associated with listing an asset pair.

While preserving the constant-product AMM for each expiry date, V2 implemented numerous upgrades to improve the LP experience. It automated the setting of initial prices using spot price and maturity, enhancing the ease of entry for new listings. Furthermore, V2 introduced new methods of liquidity provision to increase capital efficiency and provide more flexibility for advanced LPs. The revised sAMM model combined the simplicity of general sAMM, allowing typical users to add liquidity with just two clicks, and the precision of range and order book strategies favored by more experienced market makers. Synthetics V2 also reached meaningful achievements, including $600 M of monthly trading volume in last December.

3.1.3 Oyster AMM (V3): Q1 2024 – Present

In April 2024, SynFutures migrated to the Blast L2, significantly enhancing the trading experience and expanding its user base. With this transition, the new Oyster AMM model was launched, bringing a substantial influx of trading volume to Blast L2. Leveraging Blast's point system, the effective GTM strategy of Oyster Odyssey. contributed to a sharp increase in trading volumes. According to defillama, SynFutures recorded weekly volume of more than $10B, ranking the second highest position among all derivative-related protocols and top on the Blast L2.

Detailed explanations of the newly launched Oyster AMM continue below, highlighting its innovative features and impact on the design of perpetual DEX.

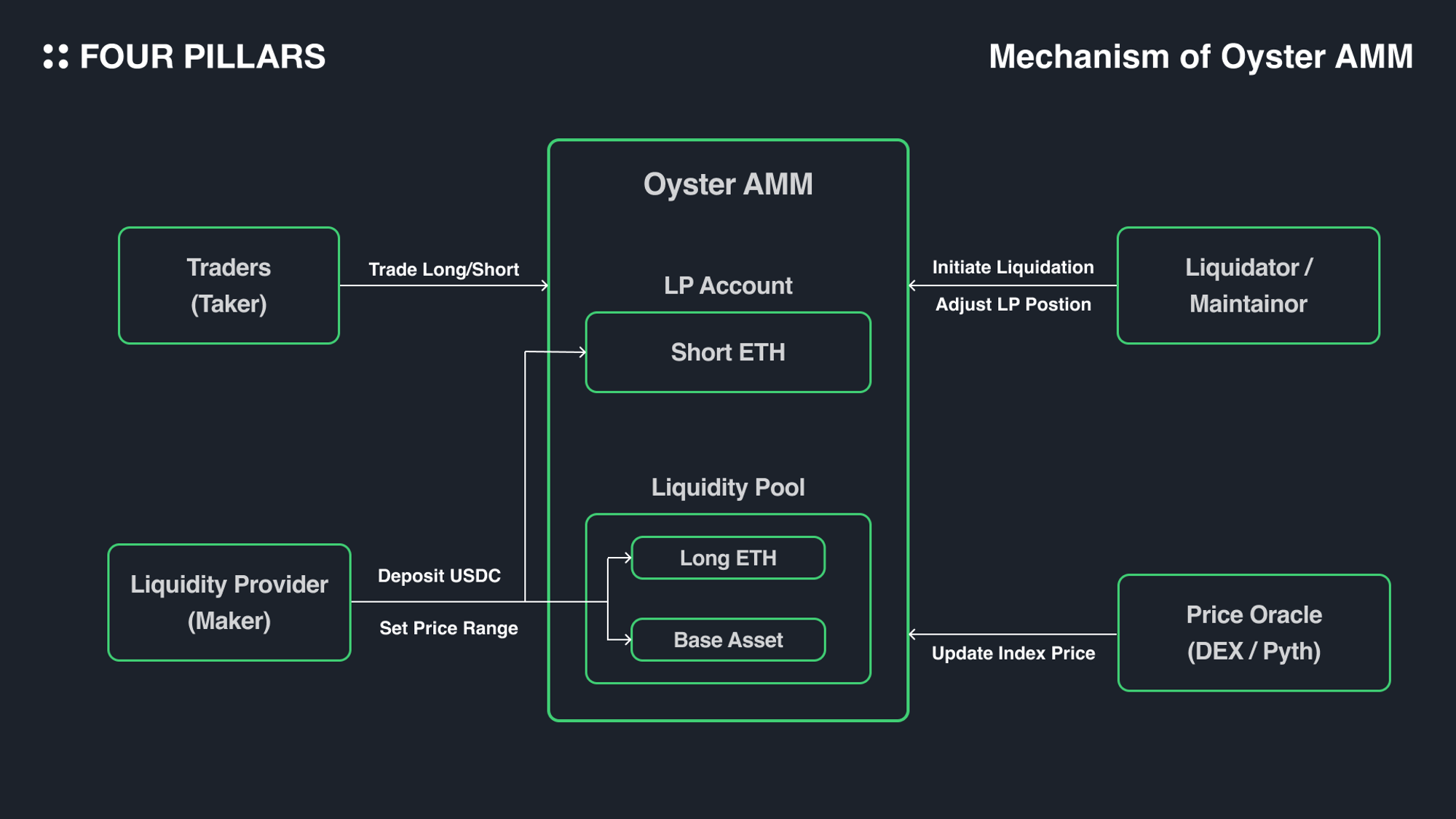

3.2.1 Creation of synthetic assets with single-token liquidity

In Oyster AMM, the process of adding liquidity and creating synthetic assets is designed to cater specifically to the needs of a derivatives trading environment. Liquidity providers begin by depositing a single type of asset, such as USDC, into the system. This single-token approach simplifies the initial step for providers compared to traditional systems that require pairs of assets.

Once the liquidity is deposited, Oyster AMM uses this capital to create synthetic assets that represent long and short positions in the market:

Part of the deposited liquidity is used to back a long position in the asset being traded, such as ETH. This position assumes that the price of ETH will increase.

Simultaneously, an equivalent short position is created to balance the market and mitigate risk. This position is essentially a bet against the price of ETH, providing a hedge against the long position.

The synthetic long position is placed into the liquidity pool, making it available for traders to buy and sell. The synthetic short position is held in the liquidity provider's account, offsetting the long position and stabilizing the provider's overall market exposure.

Moreover, Oyster AMM refines the concept of liquidity management by introducing concentrated liquidity. This approach allows liquidity providers to target specific price bands where they expect the most trading activity or the most significant price movements. By concentrating their resources in these areas, providers can increase capital efficiency. They're not spreading their funds across a wide range of prices where there might be little trading activity, but instead focusing on ranges where their liquidity will have the most impact.

3.2.2 Concentrated liquidity management

As market prices fluctuate, if the price moves beyond the upper or lower bounds of the set range, Oyster AMM automatically adjusts the LP's positions. This adjustment involves converting the inactive liquidity (the portion that no longer falls within the active price range) into an actual trading position. This trading position reflects the net exposure at the time of conversion and is handled as follows:

The LP's inactive liquidity is transformed into a trading position equivalent to the implied net position created by the price movement out of the designated range.

This position can then be managed by the LP as a regular trading position, allowing them to close it or adjust according to their strategy.

This system's beauty lies in its flexibility and protection. By allowing LPs to specify their active trading ranges, Oyster AMM helps them manage risk more effectively, confining their exposure to price levels they are comfortable with. When the price exits these ranges, the automatic conversion of liquidity into trading positions helps protect the pool's integrity and provides LPs with options to manage their new positions according to market dynamics.

Through the intelligent use of concentrated liquidity and automatic adjustments based on market conditions, Oyster AMM optimizes capital efficiency while offering robust protection mechanisms for liquidity providers. This approach not only stabilizes the market but also enhances the predictability of investment outcomes within the volatile cryptocurrency trading environment.

Source: Diving Deep: Understanding the SynFutures’ Oyster AMM Design

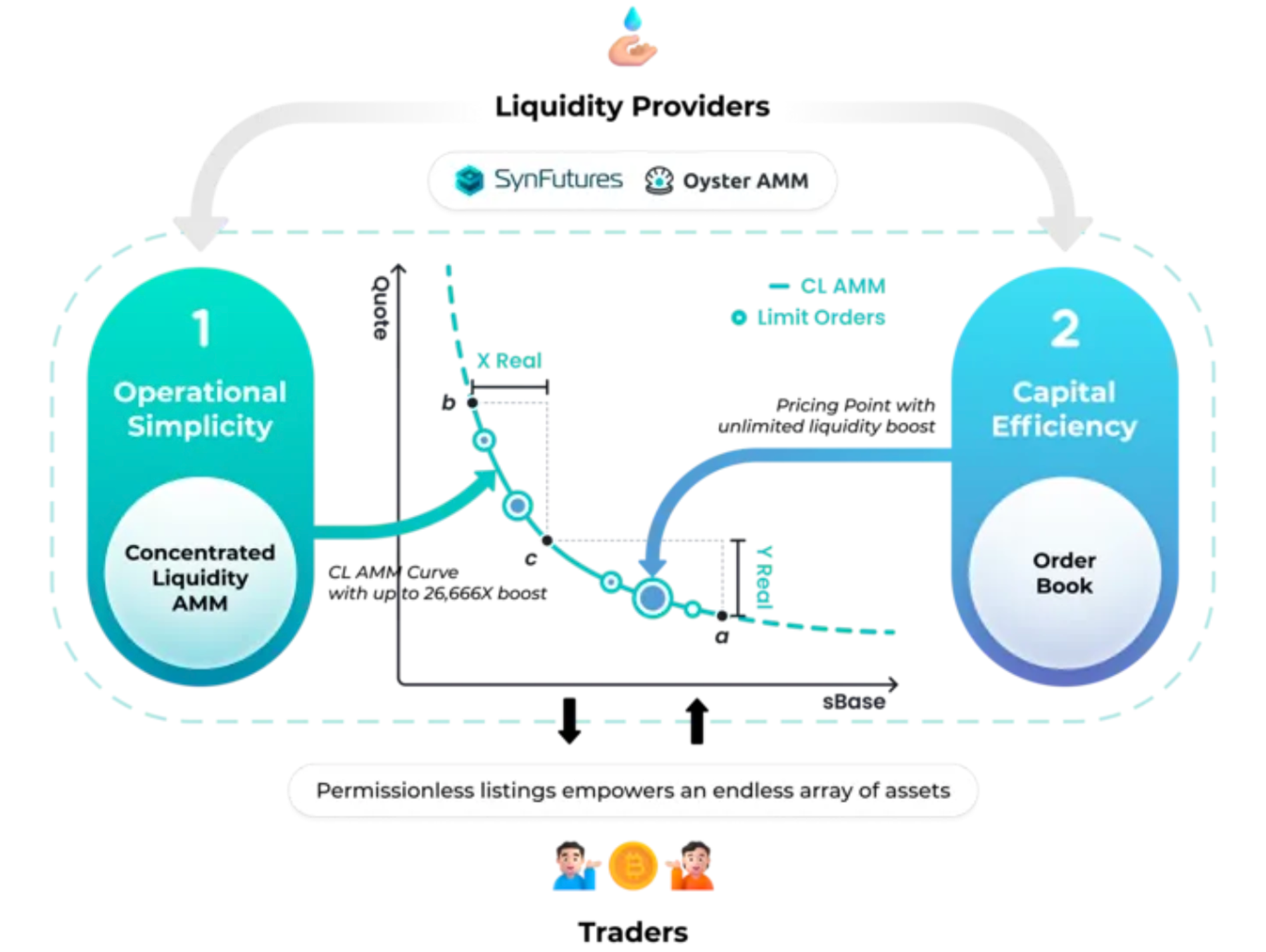

One of the most notable features of the Oyster AMM is the integration of concentrated liquidity and limit orders under a single model. Oyster AMM uses AMM as a continuous source of liquidity while combining the precision of traditional order books, thus facilitating liquidity provision and enhancing price stability.

The order book in Oyster AMM is not just a simple list of buy/sell orders, but a model that is seamlessly integrated with the liquidity pool of the AMM. In Oyster AMM, orders executed at specific prices are prioritized as limit orders, with AMM liquidity used as a secondary resource, thus more effectively utilizing liquidity. Liquidity at each price point is differentiated into structures called 'Range', corresponding to a specific price range in AMM, and 'Order', corresponding to the liquidity of limit orders. Ultimately, the two types of liquidity at a specific price point are represented as a structure called 'Pearl', which contains information on all AMM and limit orders that can be executed at requested price.

The swapping process in Oyster AMM proceeds as follows:

Order Check: Upon receiving a new order, the limit orders at that price point in the price range are first checked.

Fulfill Limit Orders: If existing limit orders provide enough liquidity, the order is filled and the transaction concludes

Utilization of AMM: If the transaction cannot be fulfilled with limit orders, the liquidity of the AMM curve is used, which may adjust the price.

Repetition: If the order is not fully executed, the process moves to the next price point (Pearl), prioritizing limit orders and using the AMM curve if necessary. This process repeats until the order is fully executed.

As explained here, unlike traditional order books that operate on a first-in-first-out (FIFO) basis, Oyster AMM has applied a matching process specialized for the AMM environment. The integrated model combining AMM and order books uses limit orders along with the AMM price curve to significantly reduce overall slippage and facilitate more favorable trade execution. Additionally, the simultaneous use of AMM and limit orders eliminates the need to create excessively narrow ranges of concentrated liquidity to mimic limit orders. This simplification significantly reduces the complexity of fee distribution mechanisms for liquidity providers compared to other DEXs, while reducing engineering complexity in implementation.

The Oyster AMM incorporates several stabilization mechanisms designed to maintain a robust and efficient market. These mechanisms include the Oyster AMM’s funding mechanism, dynamic penalties, and liquidity provision with improved capital efficiency. These help mitigate market volatility and ensure stable price convergence.

3.3.1 Funding Mechanism

The funding rate in Oyster AMM is continuously calculated to align the prices of perpetuals with underlygin spot prices by adjusting the cost of holding positions Similar to other perpetual systems, the funding rate is calculated based on the difference between the mark price and the index price, and is processed on an hourly basis.

Additionally, to handle the volatility of market dynamics, the funding costs are adjusted based on the open interest of long/short positions. When long position holders pay the funding fee, short positions receive the fee weighted according to the ratio of total long/short open interest. Conversely, when short positions pay the funding fee, long position holders receive the funding inversely weighted to the open interest ratio. This mechanism dynamically reflects market conditions, promoting price stabilization and convergence to external market prices.

For example, let's assume the index price is $100 and the mark price on Oyster AMM is $102. The total open interest for long positions is $1M, and $500K for short positions. To simplify the calculation, let's set the base funding rate equal to the percentage difference between the mark price and the market price, which would be 2% in this case. Since the open interest of long position is twice larger than that of short positions, the funding fee paid by long positions would be twice the base funding rate, i.e., 4%.

3.3.2 Dynamic Penalty

Complementing the funding mechanism is a dynamic penalty system designed to prevent price manipulation and excessive volatility by imposing additional fees on trades that cause significant price deviations. The penalty ratio is defined by a cubic function of the deviation, which means the penalty fee will be proportional to the deviation caused by the trade. This system ensures that trades leading to large, abrupt price changes are penalized, thus maintaining more stable and predictable price movements within the platform

For example, assume the penalty fee is 0.1% of the cubic of the price deviation caused by a trade. If a trader executes a large order that moves the price of an asset from $100 to $105, the price deviation would be $5. Then the penalty calculated would be $0.125 per dollar traded (which is 0.001 * 5^3). If the trade volume was $1,000, the total penalty would be $125. This fee helps to suppress excessive speculation and imbalance in the futures market, thereby contributing to stabilize market prices.

This exploration into the world of perpetual DEXs has revealed both the complexities and the immense potential of derivatives market. As we've seen, despite their significant potential, perpetual DEXs currently handle only a small fraction of the trading volume compared to centralized counterparts. However, the substantial increase in onchain trading volumes in 2024 demonstrates a clear trajectory towards greater adoption and market penetration.

Reflecting on the virtual AMM's evolution since its debut by Perpetual Protocol, we can point the pillars of a successful perpetual DEXs: robust price convergence mechanism, incentives for liquidity providers, and an intuitive user interface. Among the standout examples, SynFutures has shown novel approach with its recent Oyster AMM launch. This innovative system enables providers to focus liquidity within a narrow price range, adeptly navigating the volatile derivatives market. Moreover, Oyster AMM simplifies the process by allowing single-token deposits and enhances trading efficiency by merging AMM liquidity with limit order liquidity. Additionally, innovative price stabilization strategies, including funding mechanisms and dynamic penalties, bolster the futures market's health and efficiency. With these advancements, SynFutures has risen to prominence, boasting over $8 billion in weekly trading volume on the Blast L2 platform.

Looking ahead, the perpetual futures DEX market's expansion seems inevitable. Success of diverse plarforms like Blast, Base, and Solana is expected to lead to surge in participant of retail users, as well as more utility of applications through network effects. Furthermore, technical advancements such as account abstraction and high-performance VMs promise to significantly refine functionality and user experience. As user influx and technological improvements progress, we anticipate not only enhanced accessibility but also a substantial increase in the overall utility of onchain applications.

Thanks to Kate for designing the graphics for this article.

We produce in-depth blockchain research articles

The approval of the Ethereum ETF could boost yields for Ethena's synthetic dollar, sUSDe, much like the yields observed following the Bitcoin ETF approval.

Bluefin rapidly grew by transitioning through Arbitrum and finally settling on Sui. Bluefin now has $26.3 billion in trading volume and holds 70% of the market share, showcasing strong user base and liquidity Bluefin plans to become a comprehensive decentralized trading platform by introducing features like a DEX aggregator, easy on-ramps, and cross-chain functionality. Similar to Jupiter on Solana, Bluefin aims to leverage Sui's growth to achieve expansion and generate synergies

Let's take an in-depth look at the structure of Ethena's USDe, which claims to be an on-chain dollar asset, and the problems that USDe aims to solve.

DeFi Dapps hit the limitations in terms of customization, user experience and new trials with their current architecture. They are still showing interesting developments and expansion but are limited.