Ethena's product, USDe, is a digital dollar asset. It is referred to as a synthetic dollar asset, rather than a stablecoin, because the assets backing it differ from those backing USDC and USDT.

Despite being backed by relatively volatile crypto assets, USDe can be redeemed at a 1:1 ratio at any time. This is possible because USDe employs a delta-neutral strategy to trade its collateral assets, making it independent of market volatility. This approach, previously attempted by stablecoins like UXD, is notable for USDe’s plan to utilize the abundant liquidity of centralized exchanges (CEX), unlike UXD which only used decentralized exchanges (DEX).

Several risks exist, including the necessity of custodianship for using CEX and the risk associated with negative funding rates. Nonetheless, Ethena Labs aims to create a digital dollar asset that is safer than USDC and USDT by minimizing these risks with various tools.

Even now, when we hear 'stablecoin', a particular word comes to mind: Terra. The blockchain industry, paradoxically, was significantly shaken by the instability of Terra, which was supposed to be one of the most stable assets. At that time, TerraUSD (UST) was the third most used stablecoin, following USDT (Tether USD) and USDC (Circle USD), ranked within the top 10 cryptocurrencies globally in terms of market cap. Considering that USDT and USDC are fully centralized, UST's performance held great significance. Of course, that was until UST failed.

UST's collapse further strengthened the market share of USDT and USDC, which now dominate the stablecoin market. Does this mean we no longer need any on-chain dollar assets other than these two? Saying 'yes' would mean being too insensitive to the potential risks of these stablecoins. Admittedly, I use USDT and USDC frequently and find them very convenient, but I’m not keen on rejecting new dollar assets because having more alternatives means more choices.

Both USDT and USDC have reserves deposited in American banks. The entities behind these stablecoins are theoretically obligated to provide customers with dollar assets equivalent to the value of the stablecoins they hold, should they request redemption. The issue arises here. Many might not remember, but there was a time when USDC broke its $1 peg. This happened when a portion of USDC’s reserves, held in Silicon Valley Bank, went bankrupt, leading to a sell-off in the market due to fears of USDC becoming insolvent. The same goes for USDT. There was a rumor that Tether, the issuer of USDT, held commercial paper from the crisis-ridden Evergrande Group as part of its reserves, causing a bank run-like situation and a drop in USDT’s price below $1. Considering these risks and historical instances where the dollar peg was broken, it’s reasonable to see the need for alternatives to these stablecoins.

What do we need, then? Is a decentralized stablecoin, as Terra advocated, necessary? I think that’s correct, but more importantly, we should consider what we can gain from a decentralized stablecoin. How about creating a safe on-chain dollar asset not linked to traditional banks and financial institutions? That seems quite rational. Unlike Terra, if there is an asset that is stable and does not require over-collateralization (thereby maintaining capital efficiency) and is independent of the traditional financial sector, wouldn’t it be worth exploring? Today, I introduce USDe, a synthetic dollar asset created by Ethena. In this article, we’ll explore the structure of USDe and compare it with existing stablecoins to understand its unique features.

Ethena is an Ethereum-based synthetic dollar asset protocol. Its goal is to issue a crypto-native (completely separate from traditional finance and not connected to any real-world financial assets) yet dollar-linked asset (USDe) and create an environment where it can be utilized (via an Internet Bond, which I will introduce later). To understand Ethena more deeply, it’s important to grasp the concepts of USDe and Internet Bond, its most significant features. What are they, and what do they mean?

USDe is an on-chain dollar asset issued by Ethena. Interestingly, Ethena does not refer to USDe as a stablecoin. Instead, they call it a synthetic dollar asset. Why? Because it is fundamentally different from stablecoins like USDT and USDC. As mentioned, the collateral backing USDT and USDC is linked to the real economy (e.g., corporate or national bonds, physical dollars). In contrast, the collateral for USDe includes not just assets but also crypto assets and futures positions, hence the term 'synthetic dollar asset'. To understand why USDe was created, we need to examine the problems with existing dollar-linked assets. Most of these assets have collateral directly tied to the real economy, which can be categorized into 1) assets collateralized by bonds or promissory notes of specific companies or countries, and 2) assets partially or wholly deposited in traditional banks. This creates dependency on off-chain events, making them less than completely safe.

What about already decentralized stablecoins like MakerDAO’s DAI? These are overcollateralized, meaning they absorb rather than add liquidity to the blockchain (as they usually require a 1.5 times crypto asset collateral to issue $1 worth of stablecoin). This is highly inefficient in terms of capital. Thus, the ideal asset would be decentralized (not for decentralization’s sake but to be independent from traditional financial assets) and replicate liquidity on the chain in a 1:1 ratio. And that’s what USDe claims to be. So, what structure does USDe have to achieve both?

1.1.1 USDe’s Structure

To understand USDe, we need to be familiar with a few concepts, with 'Delta Neutral' being the most crucial. 'Delta' measures the sensitivity of prices to changes in the value of an underlying asset. Positive delta values imply that the value increases with the underlying asset, and vice versa for negative delta values. A delta value of zero means the value is unaffected by the underlying asset price fluctuations.

For instance, if you are long and short the same asset in equal proportions, the profit from price changes is zero. The profit from the short position offsets the loss from the long position in case of a price drop, and vice versa for a price increase. This is the delta neutral strategy. In Ethena’s case, they open short positions equal to the value of the backing asset, thus allowing the issuance of capital-efficient stablecoins without over-collateralization of volatile crypto assets. I’ll bring some examples to demonstrate how this works in different scenarios.

First, to mint 1 USDe, you need $1 worth of Ethereum as collateral and a short position of $1 in Ethereum. As Ethereum is the collateral, the amount of Ethereum changes with its volatility (since holding Ethereum as collateral is essentially a long position). Let's assume a dreadful scenario where 1ETH=$1.

Issuing USDe with Ethereum, but Ethereum’s Price Falls

Imagine a worse scenario where Ethereum drops from $1 to $0.1. The short position on Ethereum profits, increasing the amount of Ethereum (1ETH—>10ETH). However, the dollar value of Ethereum has dropped ($1—>$0.1), so the total collateral value in dollars remains the same ($1 x 1ETH = $0.1 x 10 ETH). Thus, irrespective of Ethereum’s price drop, the dollar value of the asset remains unaffected.

Issuing USDe with Ethereum, but Ethereum’s Price Rises

What if Ethereum rises from $1 to $100? The short position on Ethereum incurs a loss, reducing the amount of collateral Ethereum (1ETH—>0.01ETH). However, the dollar value of Ethereum has increased ($1—>$100), so the total collateral value in dollars remains the same ($1 x 1ETH = $100 x 0.01ETH). Hence, regardless of the Ethereum price rise, the dollar value of the asset remains unaffected.

In simple terms, the dollar value of the assets backing USDe remains constant, irrespective of the collateral asset's volatility. This strategy allows for the issuance of on-chain dollar assets without relying on real-world assets and without over-collateralizing crypto assets.

1.1.2 Is This Scalable?

Those who have been in the blockchain industry for a while might remember another project that tried a similar strategy for its stablecoin. UXD in the Solana ecosystem is one example. According to Multicoin Capital’s “Solving the Stablecoin Trilemma,” UXD operated similarly to USDe. However, UXD failed to achieve major success due to "liquidity" issues. UXD was limited to DEXs (Decentralized Exchanges) for shorting its collateral assets, leading to lower liquidity compared to centralized exchanges. Consequently, for more UXD to be minted, both the amount of collateral assets and the volume of short trades needed to increase, which was beyond the capacity of DEXs. This was the crux of UXD’s scalability issue.

Therefore, USDe uses the liquidity of centralized exchanges rather than that of decentralized exchanges. In fact, statistics show that the open interest in centralized exchanges is over 25 times larger than that in decentralized exchanges. This suggests that USDe could resolve the liquidity issue that UXD faced.

In terms of collateral assets, USDe has significant growth potential because it uses staked Ethereum, one of the most liquid assets in the market. As the amount of staked Ethereum increases over time, utilizing it as collateral ensures that scaling USDe to a market capitalization of tens of billions should be feasible without much difficulty(According to a tokenomics article released by Ethena Labs, following the Shard Campaign, there's a new campaign initiative called the Sats Campaign. This campaign is an initiative to issue USDe using Bitcoin, which is among the most liquid of cryptocurrencies, as collateral. The Sats Campaign is set to last for approximately five months or until the supply of USDe reaches $5 billion. Essentially, the aim is to mitigate issues of liquidity shortage and scalability by using the two largest assets by market capitalization in the crypto market as collateral).

Of course, the proportion of collateral assets constituting USDe can change depending on market conditions. In a bull market, the income generated from funding fees is significant, thus reducing the relative importance of returns from stETH. Consequently, the proportion of ETH in the collateral increases.

Conversely, in a bear market, the income from funding fees is not substantial, making the returns from stETH significantly more meaningful. As a result, the proportion of stETH in the collateral increases compared to ETH.

In this way, Ethena dynamically adjusts the collateral mix in response to market conditions. The basis for this adjustment is to provide USDe holders with the optimal interest rate given the prevailing market environment.

1.1.3 So How Does Ethena Use Centralized Exchanges Safely?

The difference between UXD and USDe lies in where they utilize liquidity. While USDe, using the liquidity of centralized exchanges, is much more efficient than UXD in terms of the abundance of liquidity, there's an inherent risk of centralization when relying on centralized exchanges. To mitigate this, Ethena introduced the concept of Off-Exchange Settlement Providers (OES Providers). These providers are all institutional-grade custodians, and the collateral assets required by Ethena are entrusted to them. Thus, Ethena can delegate collateral assets to centralized exchanges without the associated risks.

Using OES Providers has the advantage of reducing dependency on centralized exchanges, but it inevitably creates a dependency on the OES Providers. However, the risks associated with direct use of centralized exchanges don’t directly transfer to the OES Providers. This is because the assets held by most OES Providers are bankruptcy-remote. Bankruptcy remoteness means that although the assets are nominally under the custodian’s control, they are substantively for the beneficiary's benefit and, thus, can't be included in the custodian’s bankruptcy estate. Simply put, for the most part, the assets held by OES Providers can be protected independently of the providers' status. Currently, Ethena's OES Providers are Copper, Ceffu, and Fireblocks, all independent entities not based in the United States.

What risks might arise when using OES Providers?

Accessibility and Availability Issues: If problems occur with the OES Providers, hindering Ethena from withdrawing, depositing, or delegating collateral assets from/to centralized exchanges, it could impact the minting and redemption of USDe.

Operational Response Issues: If issues arise with centralized exchanges requiring a response, the proactive cooperation of OES Providers is necessary. This means there’s a dependency on how actively the OES Providers cooperate.

Ethena, of course, has put in place proactive monitoring of OES Providers and established multiple providers to eliminate single points of failure, aiming to preempt such issues.

1.1.4 Pegging Mechanism

Since USDe is an asset pegged to the dollar value, the stability of its peg to the dollar is crucial. After all, most dollar-linked assets, including stablecoins, fail due to the malfunctioning of their pegging mechanisms. Let's understand how Ethena maintains this peg through arbitrage in different scenarios:

When USDe falls below 1 dollar:

Purchase USDe.

Redeem the USDe to receive collateral of equivalent value (most likely stETH).

Sell the obtained asset.

Repeat steps 1-3 until the peg is restored.

When USDe rises above 1 dollar:

Mint USDe.

Sell the minted USDe.

Use the collateral asset to mint more USDe.

Repeat steps 1-3 until the peg is restored.

The method to restore the peg is similar to other stablecoins. However, USDe has the advantage of easier peg restoration, as it has a 1:1 collateral backing.

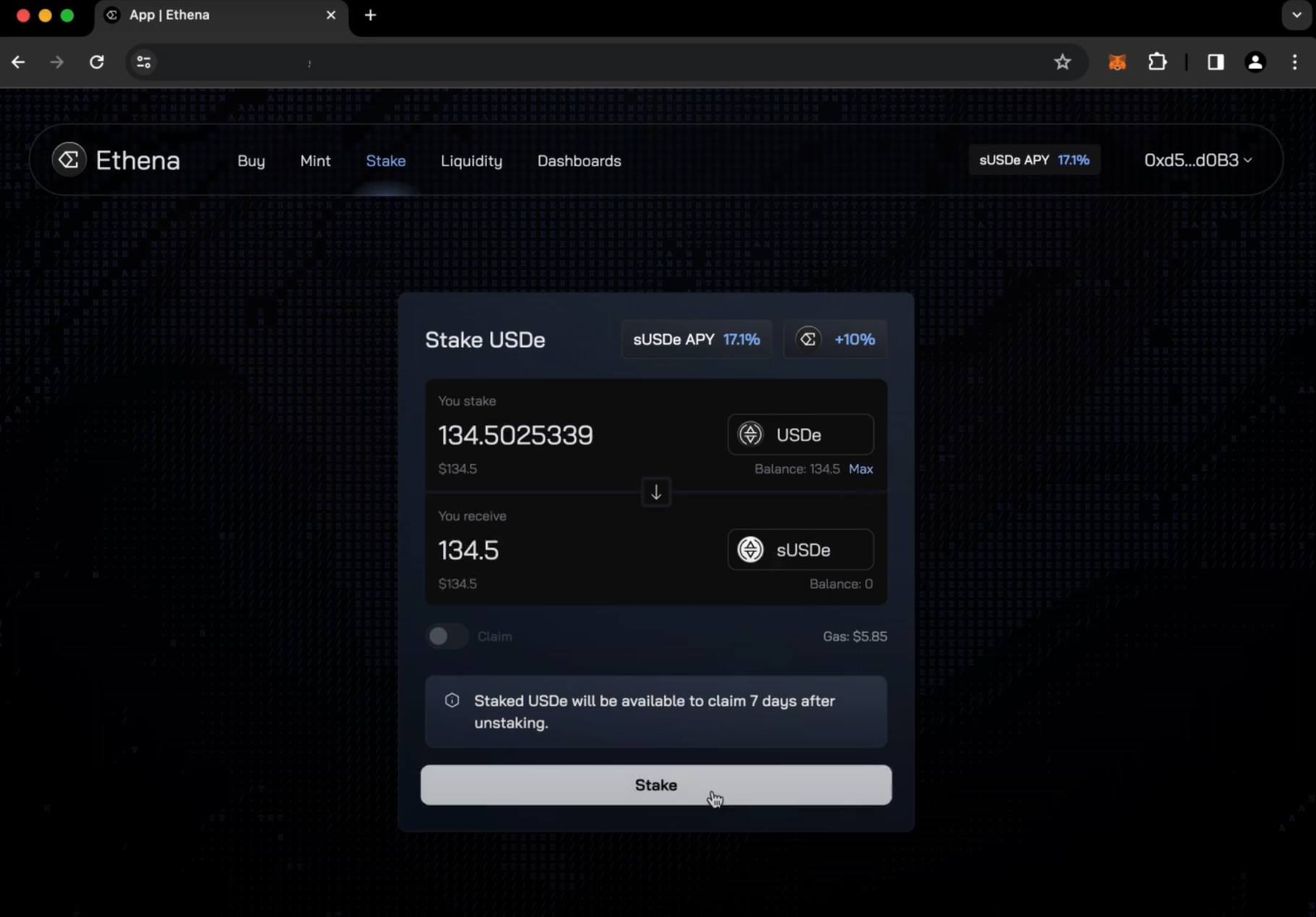

Another key concept in Ethena’s product suite, as important as USDe, is the Internet Bond, sUSDe. Treasury Bills are essentially certificates issued by the U.S. Treasury to supplement its fiscal deficit and solve funding problems. They are considered one of the safest investment assets since they are guaranteed by the U.S. government. Those holding these bonds earn interest, as they are effectively lending money to the government.

The Internet Bond, as built by Ethena, is a seperate token and a reward-accuring token for staking USDe. So where does this interest come from? Does it work like a bank, earning interest by lending deposited USDe (sUSDe) to others? Firstly, since the collateral asset for USDe is staked Ethereum (stETH), Ethereum staking rewards accumulate (from consensus layer inflation, operation layer fees, and MEV). Secondly, profits come from funding fees and basis spread earnings in perpetual futures exchanges (if the price of perpetual futures is higher than the spot price of the underlying asset, investors in long positions pay funding costs to those in short positions and vice versa. Through this exchange of funding costs, investors can earn basis spread profits in the perpetual futures market). It's important to note that these funding fees and basis spread profits, which usually generate the capital for interest, can be quite volatile. The comparison to an Internet Bond originates from the reward accruing nature of sUSDe, as well as the fact sUSDe is dollar denominated, democratizing access to a USD instrument across borders.

We have now learned about USDe and the yield it generates. So, how is USDe minted, staked, and how can it be redeemed for collateral assets?

Source: Ethena

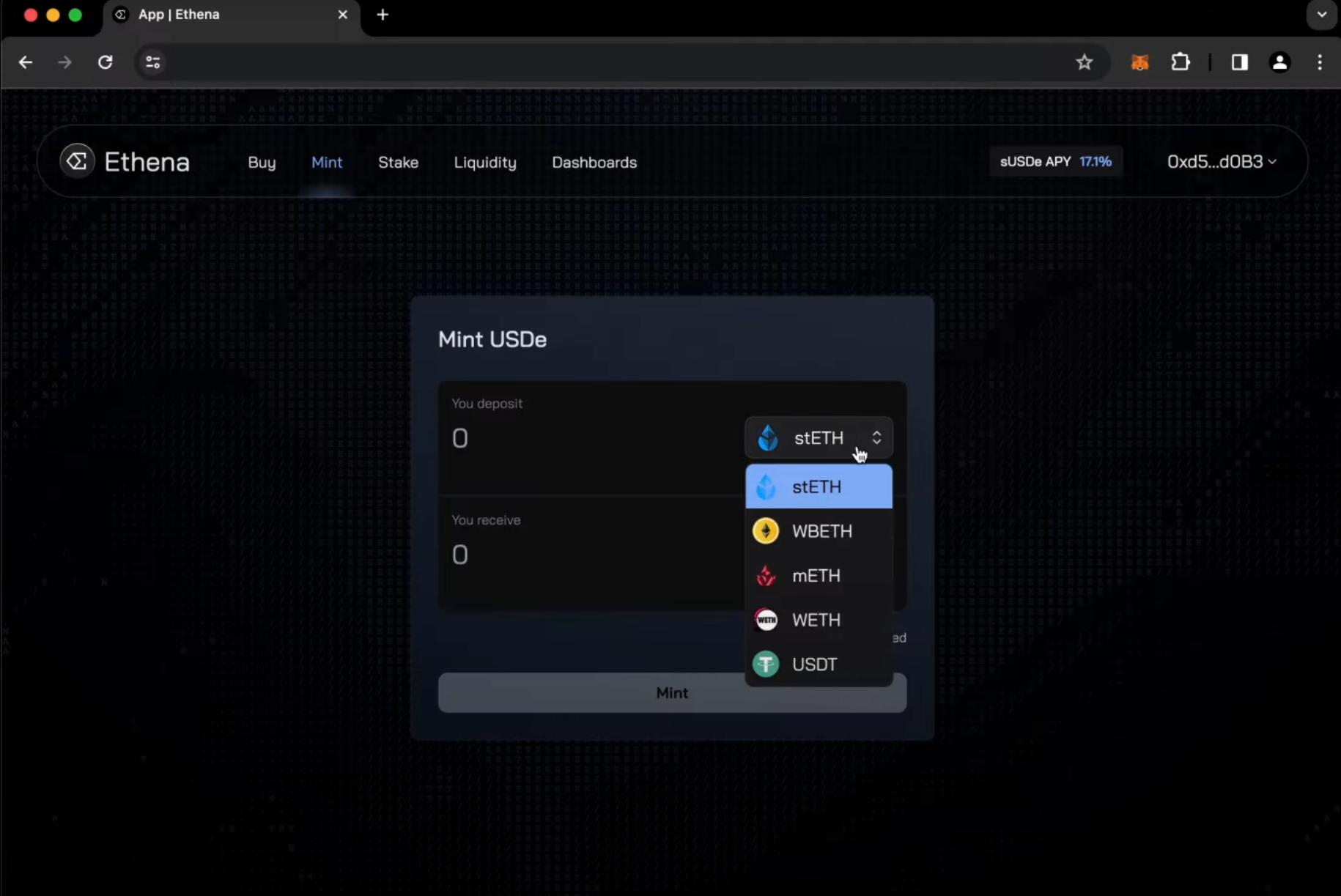

Minting USDe is a direct process on Ethena, but not everyone can do it – only market makers who are whitelisted can mint. Essentially, minting involves selecting designated collateral assets for USDe, minting, and then receiving USDe. The minting cycle for USDe is as follows:

Clicking the mint button allows for the use of an EIP 712 style signature. This standard predefines the message format and then hashes it, ensuring data integrity and allowing for signature verification. It precisely defines the collateral assets, their quantity, and the amount of USDe.

Once the user signs the transaction, Ethena verifies the request and submits the transaction to the blockchain.

After the transaction is confirmed, the user’s predetermined collateral assets are exchanged for USDe.

Users who are not identified on the whitelist can exchange their stablecoins for USDe through Ethena’s app via decentralized exchanges. During this process, Ethena uses CowSwap to provide MEV (Miner Extractable Value) protection, allowing users to access various on-chain liquidity without worrying about MEV and swap at the best rates(Non-whitelisted users can acquire USDe and sUSDe on DEXs).

Source: Ethena

Staking in Ethena is straightforward: by staking USDe on Ethena, users receive sUSDe and can earn the returns of the Internet Bond (as mentioned earlier). However, the interest does not accumulate directly on sUSDe; it accumulates in the staking contract. This means the value of sUSDe increases over time, and the interest is realized when sUSDe is converted back to USDe. Users do not need to take any additional actions to earn interest on their sUSDe; it accumulates automatically, so this should be kept in mind when staking.

Redeeming is also done through Ethena, similar to the minting process. This allows users to receive their collateral assets back in the same form as when they minted USDe.

Currently, due to the popularity of USDe, Ethena is receiving significant attention in the market. As a result, many users are participating in various airdrop farming (Shard Campaigns) to receive airdrops of Ethena's protocol token, $ENA. What utility does the $ENA token have, and how are its tokenomics and vesting schedule designed?

Like many application tokens, $ENA also serves as a governance token for the Ethena protocol, allowing holders to make decisions on various matters. Decision types include the following:

Deciding on USDe collateral assets (modifying or adding).

Decisions regarding custodian entities (OES Providers).

Decisions on cross-chain implementations.

Decisions related to grants.

Decisions on which exchanges to use.

Decisions on selecting a risk management framework.

The total supply of $ENA is 15 billion, with an initial supply of 1.425 billion. 30% of the total supply is earmarked for core contributors, subject to a 1-year lockup and 3-year linear vesting. This means that after 4 years, all tokens allocated to core contributors will be fully released.

25% of the total supply is designated for investors, who are also subject to a 1-year lockup and 3-year linear vesting.

The foundation is allocated 15% of the total supply, which will be used for the continuous development of the protocol. These tokens will be gradually released following the Token Generation Event (TGE) and the supply will increase over time.

The remaining 30% is dedicated to the ecosystem, with the first 5% being used for the Shard Campaign airdrop tokens (ENA tokens can be claimed on April 2nd). The rest will be used for partnerships, incentive campaigns, and other ecosystem activities.

In the blockchain industry, there are a few businesses with a proven Product Market Fit (PMF), and stablecoins or digital dollars are among those with the most clearly defined utility. This already suggests they have market viability. The key is how they differentiate from existing products and their Go-To-Market (GTM) strategy. Ethena's growth trajectory in this regard is quite impressive.

According to Token Terminal, Ethena’s 30-day revenue ranks high, following Ethereum, Tron, Solana, and MakerDAO. On a 7-day basis, it even surpasses MakerDAO, which is particularly encouraging considering how recently Ethena was launched. As of the time of writing, USDe’s market capitalization stands at $1.5 billion, ranking it 5th in the stablecoin market cap (even though USDe isn’t strictly a stablecoin). This rapid growth is nothing short of phenomenal. At first glance, it seems that USDe might soon dominate the stablecoin market share.

However, there are clear risks involved. Since USDe uses perpetual futures markets for its delta-neutral position, there’s a risk of having to pay money into the market when funding rates turn negative, known as funding risk. While various measures like a Reserve Fund are in place to mitigate these moments, the risk remains. Additionally, there’s custodial risk from the OES Providers entrusted with the collateral assets. Despite Ethena's efforts to hedge these risks, they still exist.

Ethena is one of the fastest-growing protocols I've seen recently. We know that there is a market for digital dollar assets that are separated from traditional financial assets and ensure capital efficiency. There’s no doubt about the product's clear upside. However, as always, it’s crucial to meticulously assess the risks associated with owning, investing in, or dealing with any asset. Despite these risks, from a position of supporting the existence of decentralized digital dollars, I hope for Ethena's successful growth.

Thanks to Kate for designing the graphics for this article.

We produce in-depth blockchain research articles

The approval of the Ethereum ETF could boost yields for Ethena's synthetic dollar, sUSDe, much like the yields observed following the Bitcoin ETF approval.

Bluefin rapidly grew by transitioning through Arbitrum and finally settling on Sui. Bluefin now has $26.3 billion in trading volume and holds 70% of the market share, showcasing strong user base and liquidity Bluefin plans to become a comprehensive decentralized trading platform by introducing features like a DEX aggregator, easy on-ramps, and cross-chain functionality. Similar to Jupiter on Solana, Bluefin aims to leverage Sui's growth to achieve expansion and generate synergies

SynFutures is a decentralized exchange for perpetual contracts that combines AMM and order book features to provide efficient liquidity, improved price stability, and significant trading volume growth following its migration to Blast L2

DeFi Dapps hit the limitations in terms of customization, user experience and new trials with their current architecture. They are still showing interesting developments and expansion but are limited.