This report was written for distribution at the seminar 'Immediate Challenges for Securities Firms in Response to New Regulations in 2024,' held by INF Consulting.

Since the approval of the Bitcoin ETF, traditional financial institutions have shown increased interest in blockchain technology.

JP Morgan has always been interested in blockchain technology and its adoption since 2015. Recently, in collaboration with asset management firm Apollo, they introduced a blockchain-based portfolio management system as part of the Monetary Authority of Singapore's Project Guardian.

The use of various blockchains and middleware infrastructure in portfolio management has enabled 1) highly efficient transaction settlement and portfolio rebalancing, 2) easy inclusion of alternative investment assets that are difficult to incorporate into model portfolios, and 3) solving the fragmentation issue where tokenized funds exist across multiple blockchain networks.

Given the nature of the financial industry, using private blockchains seems inevitable, and the growth of the private blockchain ecosystem is expected.

As time progresses, global financial institutions show a continuously growing interest in blockchain technology. This interest is expected to accelerate further following the long-awaited approval of the Bitcoin spot ETF on January 10. It's important to note that not only is the interest in Bitcoin itself increasing, but also the interest in adopting blockchain systems by financial institutions.

Even before the approval of the Bitcoin ETF, numerous financial institutions had been utilizing blockchain technology. One prominent example is tokenization. Asset management companies have opened doors for more individual investors to participate in private markets easily by tokenizing liquid assets and funds on the blockchain, thereby reducing inefficiencies in fund management. Here are some instances of tokenization by financial institutions:

UBS: Launch of digital bonds traded and settled on traditional and blockchain-based exchanges (Nov. 3, 2022)

KKR: Launch of a portion of Health Care Strategic Growth Fund II (HCSG II) on the Avalanche blockchain through Securitize (Sep 13, 2022)

Franklin Templeton: Launch of Franklin OnChain U.S. Government Money Fund (FOBXX) on the Polygon blockchain (Apr. 26, 2023)

Hamilton Lane: Launch of three funds (1, 2, 3) on the Polygon blockchain through Securitize and plans to tokenize another fund in 2024 on Nomura Laser Digital's Libre network in partnership with Brevan Horward

Besides tokenizing funds, global financial institutions have also tested and used blockchain in various other ways:

BNY Mellon: Settled securities lending transactions on the R3 Corda network with Goldman Sachs (Jul. 20, 2022)

DTCC: Developed a blockchain (R3 Corda) based settlement platform named Project Ion Platform (Aug. 22, 2022)

Citi: Built an FX trading application on a private Avalanche blockchain (Nov. 15, 2023)

UBS: Conducted cross-border repo transactions via a public blockchain with SBI and DBS (Nov. 15, 2023)

Source: Singapore MAS

One of the main reasons for the recent increase in blockchain technology pilot implementations by financial institutions is the Monetary Authority of Singapore's Project Guardian. This initiative is a collaboration between government policy-makers and the financial industry to explore the possibilities of asset tokenization and decentralized finance through blockchain. Policy-making participants in Project Guardian include the Monetary Authority of Singapore (MAS), the Swiss Financial Market Supervisory Authority (FINMA), the UK Financial Conduct Authority (FCA), and the Japanese Financial Services Agency (FSA), with financial institutions such as Citi, HSBC, UBS, and Apollo taking part. Many of the blockchain adoption cases mentioned earlier were conducted as part of Project Guardian.

A notable Proof of Concept (PoC) from Project Guardian in 2023 involved JP Morgan's blockchain subsidiary Onyx and asset management firm Apollo. This PoC went beyond simply tokenizing funds or testing trade settlements on the blockchain. Instead, it showcased a system capable of efficiently managing portfolios that included funds tokenized on various private blockchains.

2.1.1 Quorum

As one of the world's largest comprehensive financial companies, JP Morgan has shown early interest in blockchain technology, developing a corporate blockchain based on Ethereum named Quorum in 2015, when blockchain and cryptocurrencies were relatively new concepts. Quorum is now operated by Consensys after being acquired by them.

2.1.2 JPM Coin System

In 2016, JP Morgan began operating the JPM Coin System based on Quorum (currently, JPM Coin is based on Onyx Digital Assets developed by JP Morgan's blockchain subsidiary Onyx). JPM Coin is a blockchain-based stablecoin pegged to the US dollar, offering JP Morgan clients fast payments and settlements. When clients wish to use JPM Coin, they send funds to JP Morgan, who then issues an equivalent amount of JPM Coin. The clients can then use JPM Coin for fast payment and settlement processes.

Unlike public stablecoins, JPM Coin is traded only within private blockchain networks among JP Morgan clients, and the US dollars backing JPM Coin are strictly managed through JP Morgan's reserves. The JPM Coin System, which started as a simple settlement tool, expanded its services in November 2023 by adding 'programmable payments' functionality, allowing clients to set rules for funding accounts or parameters for payments to be executed based on margin calls or contract requirements. Siemens Group is a prominent company using the JPM Coin System, which, as of October 2023, handles transactions amounting to about $1B daily, indicating its significant network scale.

2.1.3 Onyx

Onyx, a blockchain subsidiary of JP Morgan, was established in 2020 with the goal of 'transforming the future of banking.' It offers blockchain platform services supporting wholesale payments. Onyx provides four main services:

Liink: A network that allows participants to securely and privately share information. So far, it has facilitated about 100 million transactions in over 20 countries by approximately 100 participating institutions. Participants can collaborate based on shared data and utilize various services like Confirm, CheckMatch, and Route Logic.

Coin Systems: This service uses blockchain for rapid payments and settlements, particularly addressing issues in cross-border transfers and liquidity management. For more details, refer to '2.1.2 JPM Coin System.'

Onyx Digital Assets: A blockchain for asset tokenization. Institutions can tokenize a variety of assets through Onyx Digital Assets and trade them, benefitting from blockchain features like automation, liquidity, and atomic settlements. JP Morgan reported that by the end of 2023, approximately $900 billion worth of tokenized US bonds were settled via the Onyx Digital Assets platform.

Blockchain Launch: A service within Onyx where the blockchain team provides blockchain technology support to clients.

JP Morgan, having consistently explored how to innovate finance through blockchain technology, released a report in 2023 with global asset management firm Apollo as part of the Monetary Authority of Singapore’s Project Guardian. The report, titled 'The Future of Wealth Management: Ultra-efficient portfolios of traditional and alternative investments powered by tokenization,' presents an important PoC case. While there have been many attempts to apply blockchain in traditional finance, most have focused on asset tokenization. JP Morgan and Apollo took a step further by applying blockchain technology to portfolio management, including tokenized assets, thus proposing a new paradigm in the asset management industry.

The goal of JP Morgan and Apollo's portfolio management system PoC is to enable portfolio managers to easily create, distribute, and automatically manage model portfolios, regardless of the type of assets involved. The PoC addresses the following questions:

How can the execution and settlement of transactions be made efficient and scalable?

How can alternative investment assets, which are more difficult to handle and less liquid than stocks or bonds, be incorporated into model portfolios?

In a situation with numerous blockchain networks created using different technology protocols, how can this fragmentation issue be resolved with interoperability solutions?

Can the complexity of blockchain technology be abstracted to make it user-friendly for portfolio managers?

2.2.1 PoC Overview

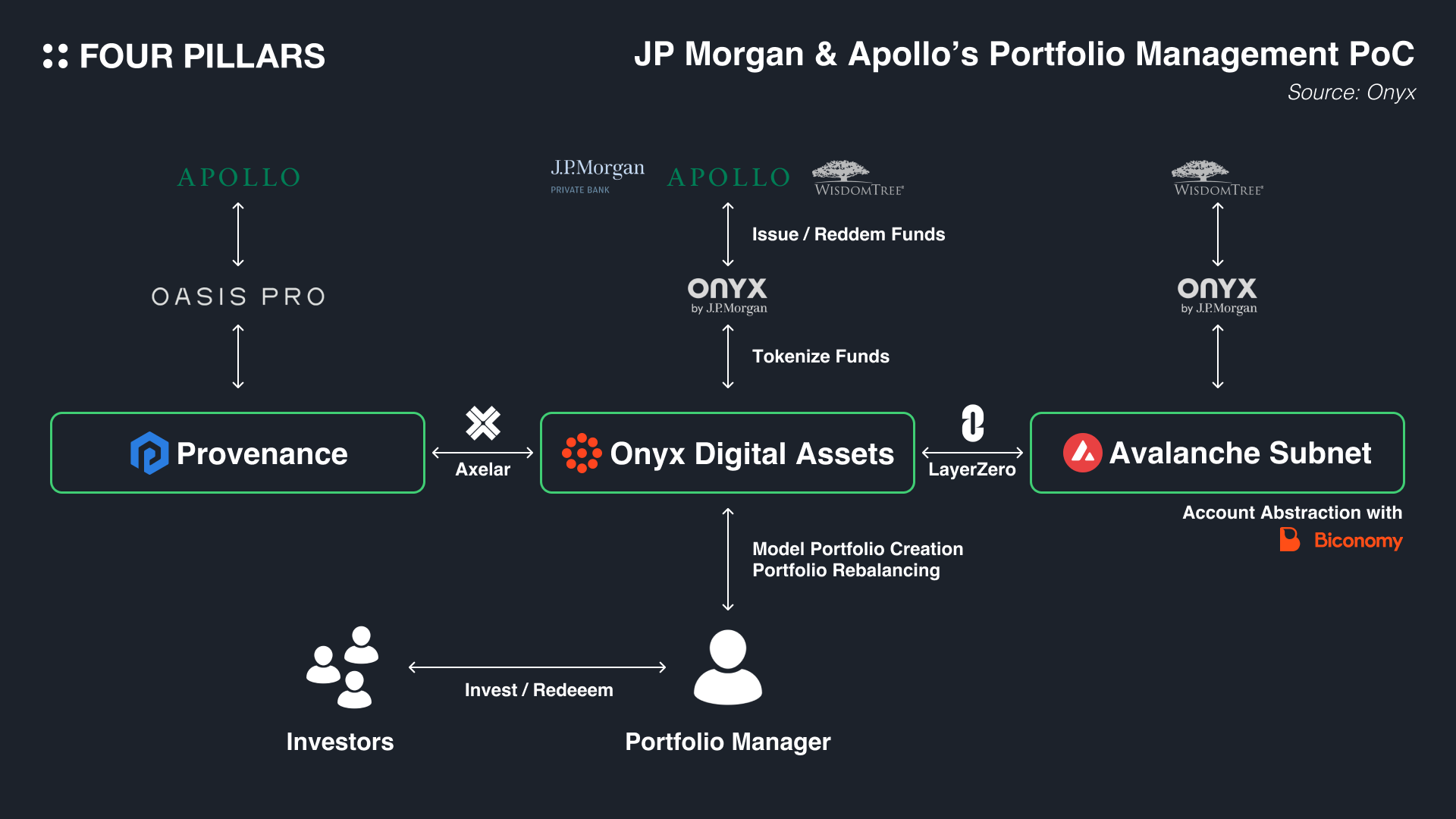

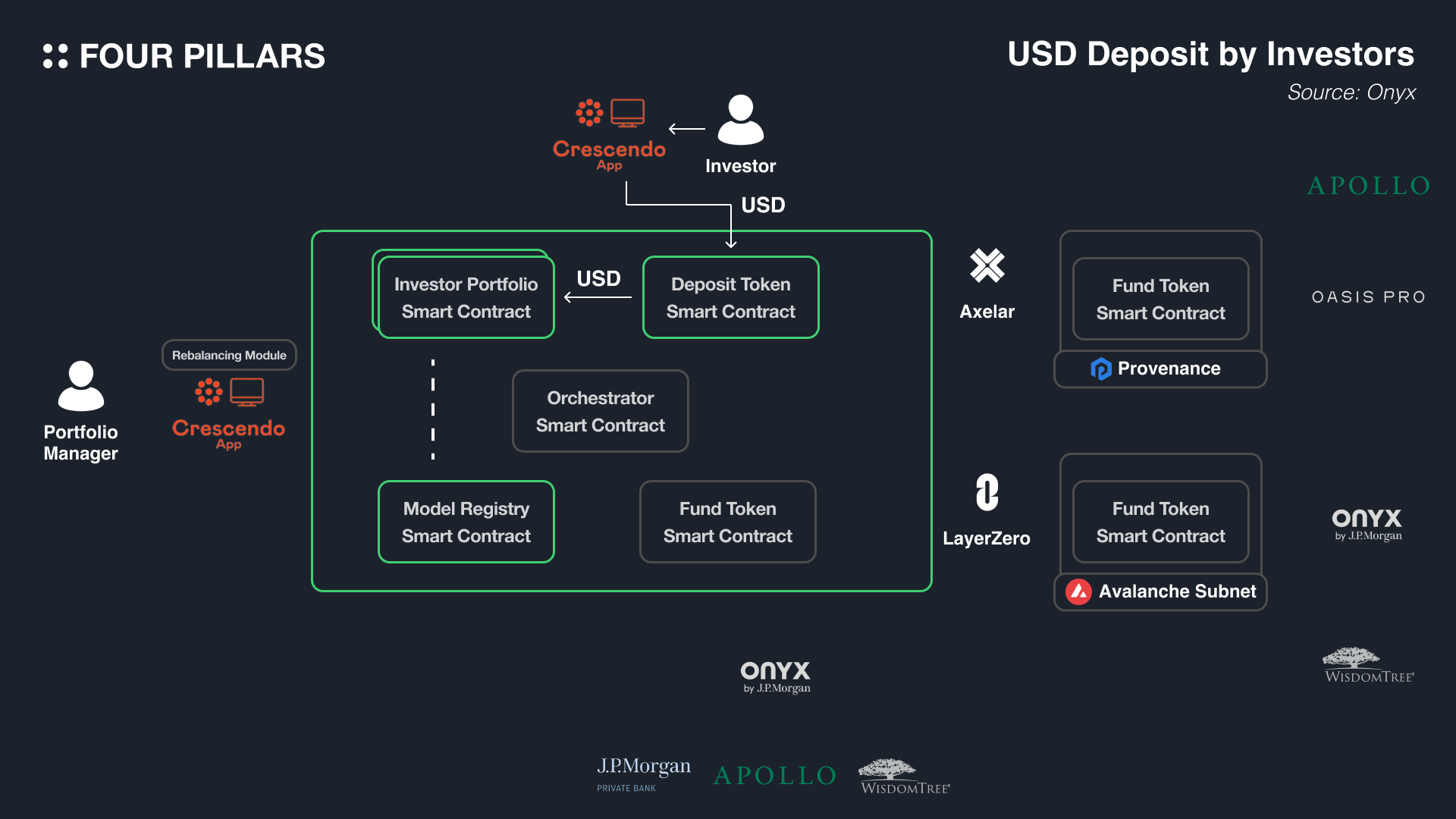

The overview of the PoC for portfolio management using blockchain technology is illustrated in the figure above. Three types of blockchains were utilized: the Onyx Digital Assets network and two others to explore various operational environments. These include Avalanche Subnet (EVM-based) and the Provenance Blockchain (WASM-based).

Different funds were tokenized on these three blockchains. On the Provenance Blockchain, Apollo's funds were tokenized via the OASIS PRO Tokenization service. On the Onyx Digital Assets network, funds from JP Morgan, Apollo, and WisdomTree were tokenized through Onyx. Lastly, on the Avalanche Subnet, WisdomTree's funds were also tokenized through Onyx.

The purpose of this PoC experiment was to demonstrate how a portfolio manager can efficiently manage a portfolio incorporating alternative investment assets (alts) across multiple networks (Onyx Digital Assets, Avalanche Subnet, Provenance Blockchain) using blockchain and smart contracts. This setup aimed to enable easy inclusion of alts, efficient management through automated processes using smart contracts, and near-instant settlement.

2.2.2 Protocol Overview

For readers unfamiliar with the blockchain ecosystem, this section briefly covers the protocols used in the PoC by JP Morgan and Apollo. Readers familiar with the following tech stacks can skip this section.

Onyx Digital Assets: This is a private blockchain operated by JP Morgan’s blockchain subsidiary, Onyx, specifically for asset tokenization. For more details, refer to ‘2.1.3 Onyx’. In this PoC, Onyx Digital Assets served as the main blockchain for portfolio managers to interact with, and funds from JP Morgan Private Bank, Apollo, and WisdomTree were tokenized on it.

Avalanche Subnet: This is a separate network from the Avalanche mainnet, involving some of its validators as participants. Unlike the general-purpose Avalanche mainnet, which supports a variety of applications, the Avalanche Subnet allows for the creation of blockchains tailored to specific applications. Examples of the Avalanche Subnet include the DFK Subnet for the P2E game Defi Kingdom and UPTN Subnet for SK Planet's loyalty program (OK Cashbag). The Avalanche Subnet used in this test is a private network, as opposed to public networks. Notably, Avalanche also provides a private Subnet service for financial institutions, known as the Avalanche Evergreen Subnet. In this PoC, WisdomTree's fund was tokenized on a private instance of Avalanche Subnet.

Provenance Blockchain: This blockchain, based on the Cosmos SDK, is designed specifically for the financial services industry. Institutions can use Provenance Blockchain to tokenize assets.

OASIS PRO: OASIS PRO is an infrastructure company for the digital securities market, offering services like ‘OASIS PRO Markets’ - a marketplace for issuing and investing in digital securities, ‘OASIS PRO Tokenization’ for tokenizing real-world assets (RWA), ‘OASIS PRO Transfer Agent’ for easy cap table management, and ‘OASIS PRO Connect’ - an API service bridging Web2 and Web3 infrastructures. In this PoC, OASIS PRO was used to tokenize Apollo’s funds on the Provenance Blockchain.

Axelar: Axelar is a cross-chain messaging protocol that facilitates interactions between blockchains based on EVM like Ethereum, Polygon, Avalanche, Arbitrum, Base, and those based on Cosmos SDK like Cosmos, Osmosis, Sei, Celestia. Validators verify its cross-chain messages within the Axelar network. In this PoC, Axelar handled cross-chain messaging between the EVM-based Onyx Digital Assets and the WASM-based Provenance Blockchain.

LayerZero: LayerZero is another cross-chain messaging protocol that assists interactions between EVM-based networks. It relies on decentralized verifier networks for validation. In this PoC, LayerZero was responsible for cross-chain messaging between the EVM-based Onyx Digital Assets and the Avalanche Subnet.

Biconomy: Biconomy offers a toolkit for account abstraction in EVM-based networks. Account abstraction is a technology that allows users to interact with dApps in a more user-friendly way. Typically, to use blockchain networks, users must possess native tokens to pay transaction fees, which can hinder user experience. In this PoC, Biconomy provided a feature where portfolio managers could interact with the Avalanche Subnet without needing to hold native tokens in advance, as Biconomy covered the transaction fees on their behalf.

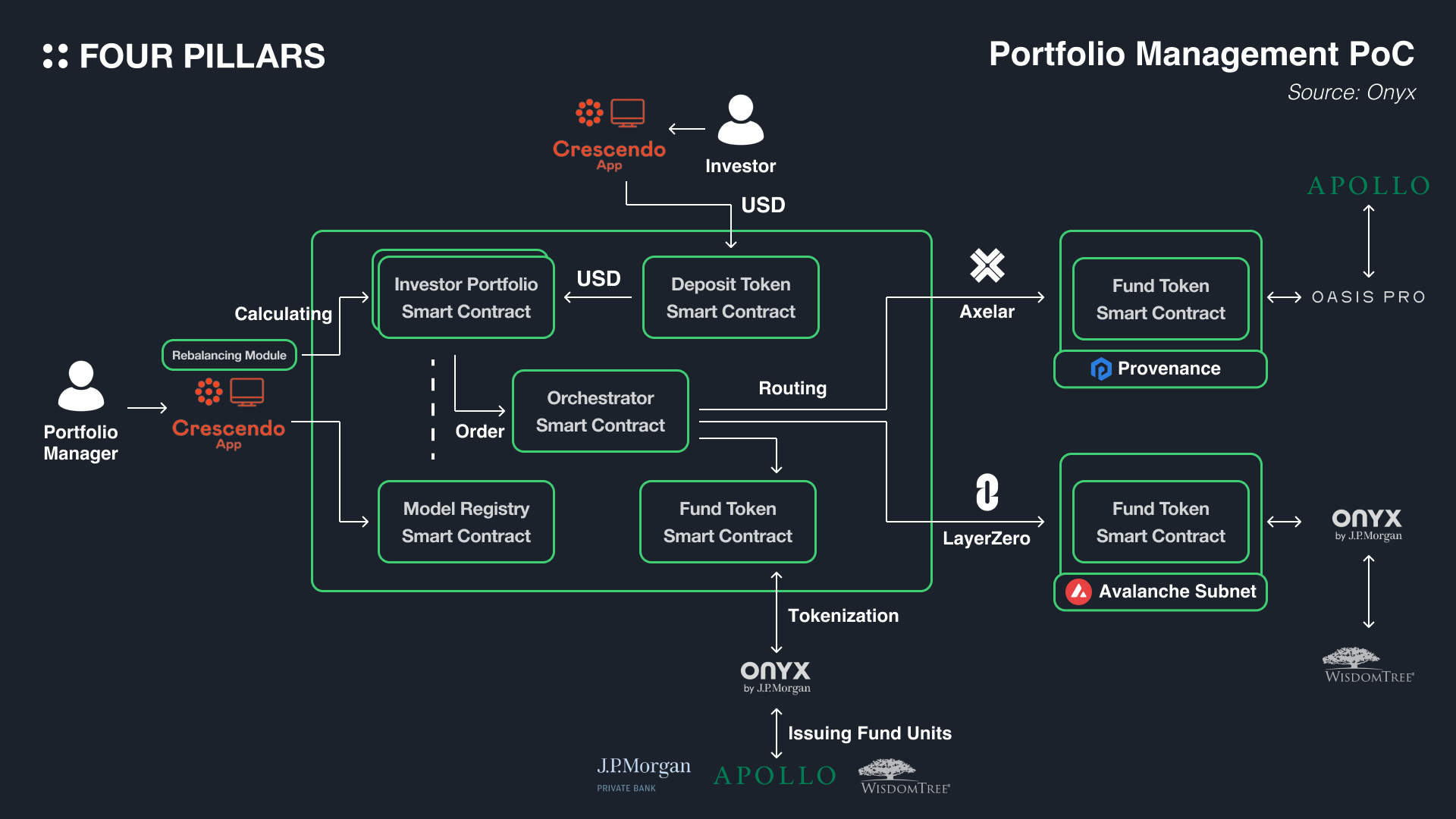

In the PoC test proposed by JP Morgan and Apollo, we examine how portfolio managers can trade fund tokens scattered across various private blockchains and manage their portfolios. This includes the entire process from investor capital infusion to portfolio rebalancing, looking at both front-end and back-end operations.

2.3.1 Model Portfolio Creation by Portfolio Manager

Source: Onyx, Apollo

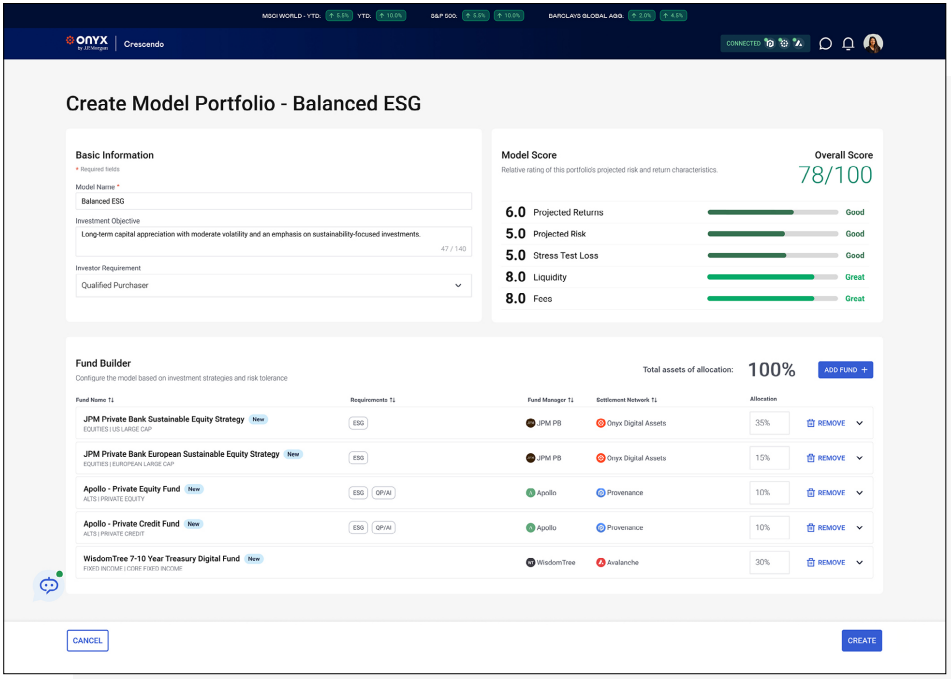

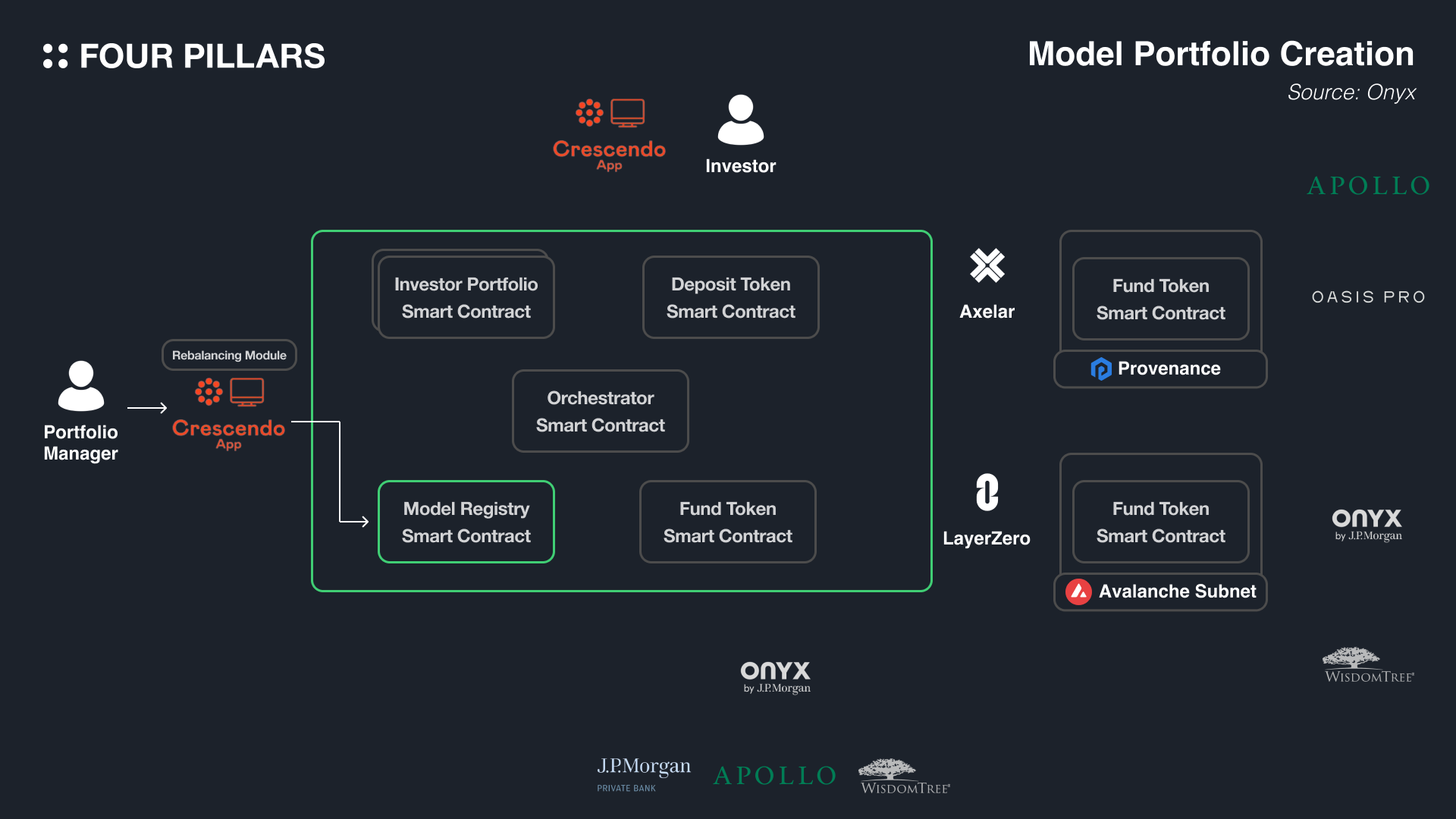

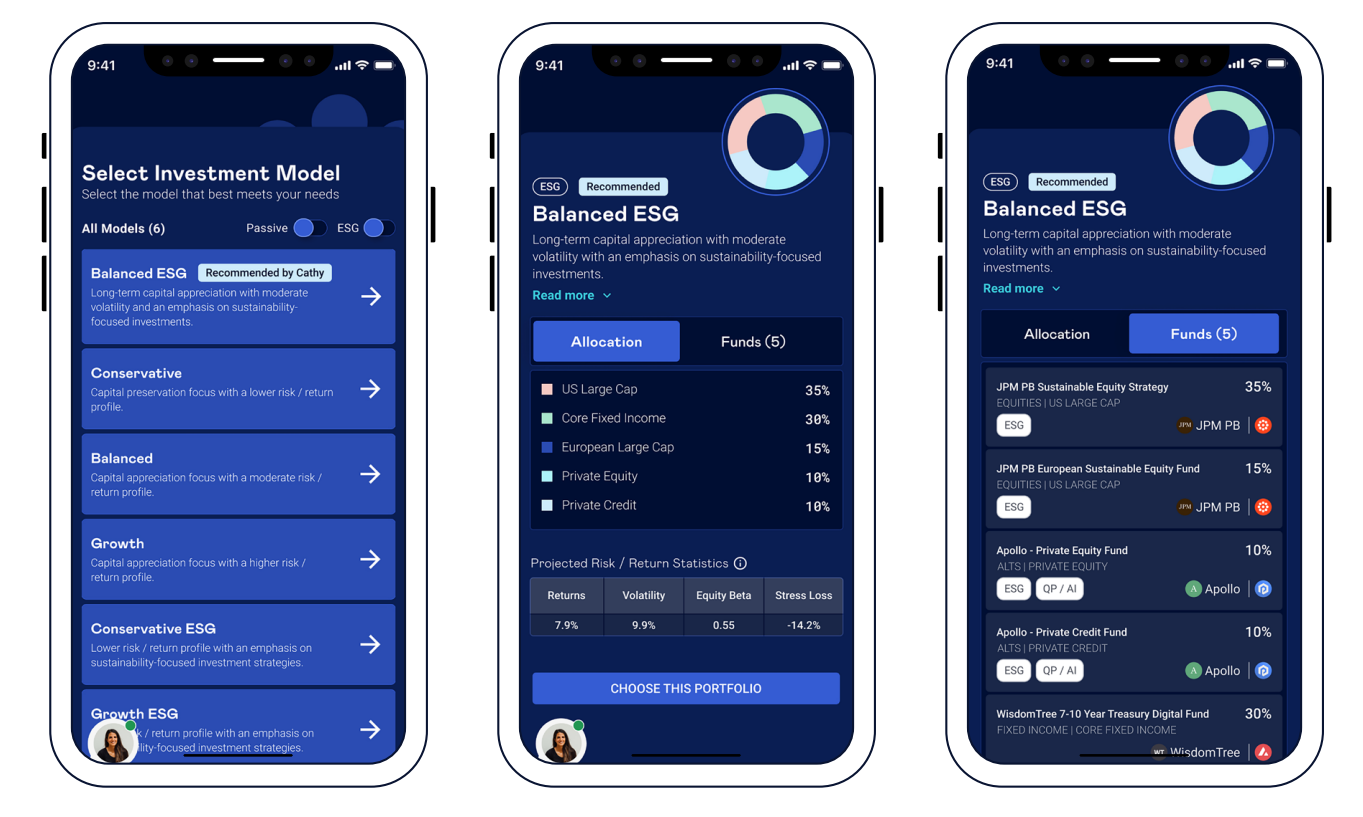

Portfolio managers create model portfolios through the front-end interface called Crescendo App. A model portfolio is a model comprising the types of assets, their proportions, and risk levels proposed by the portfolio manager to investors. An example shown here is the creation of a model portfolio named Balanced ESG, where the types and proportions of fund tokens on each blockchain can be set.

On the back end, information about the model portfolio is registered in the 'Model Registry Smart Contract.' This process involves registering details like the name of the model portfolio, types and proportions of tokens on the Onyx Digital Assets network's on-chain smart contract. The Model Registry Smart Contract is crucial as it is continuously referred to during portfolio rebalancing.

2.3.2 USD Deposits from Investors

Source: Onyx, Apollo

Investors interested in investing in the portfolio can explore various portfolios through the Crescendo App and select one for investment.

Source: Onyx, Apollo

To invest in a chosen portfolio, the investor simply enters the desired amount, and USD is transferred to the blockchain to complete the investment.

Looking at the back end, investors initially deposit USD into the Deposit Token Smart Contract before investing in a specific portfolio, essentially funding their account. Upon completing the investment in a chosen portfolio, USD moves from the Deposit Token Smart Contract to the Investor Portfolio Smart Contract. This is not a commonly managed smart contract but an individual one created for each investor, linked to the Model Registry Smart Contract of the selected model portfolio. For instance, if investors A and B invest in the Balanced ESG portfolio, their Investor Portfolio Smart Contracts are separately created and managed while both linked to the Balanced ESG Model Registry Smart Contract.

2.3.3 Automated Portfolio Rebalancing

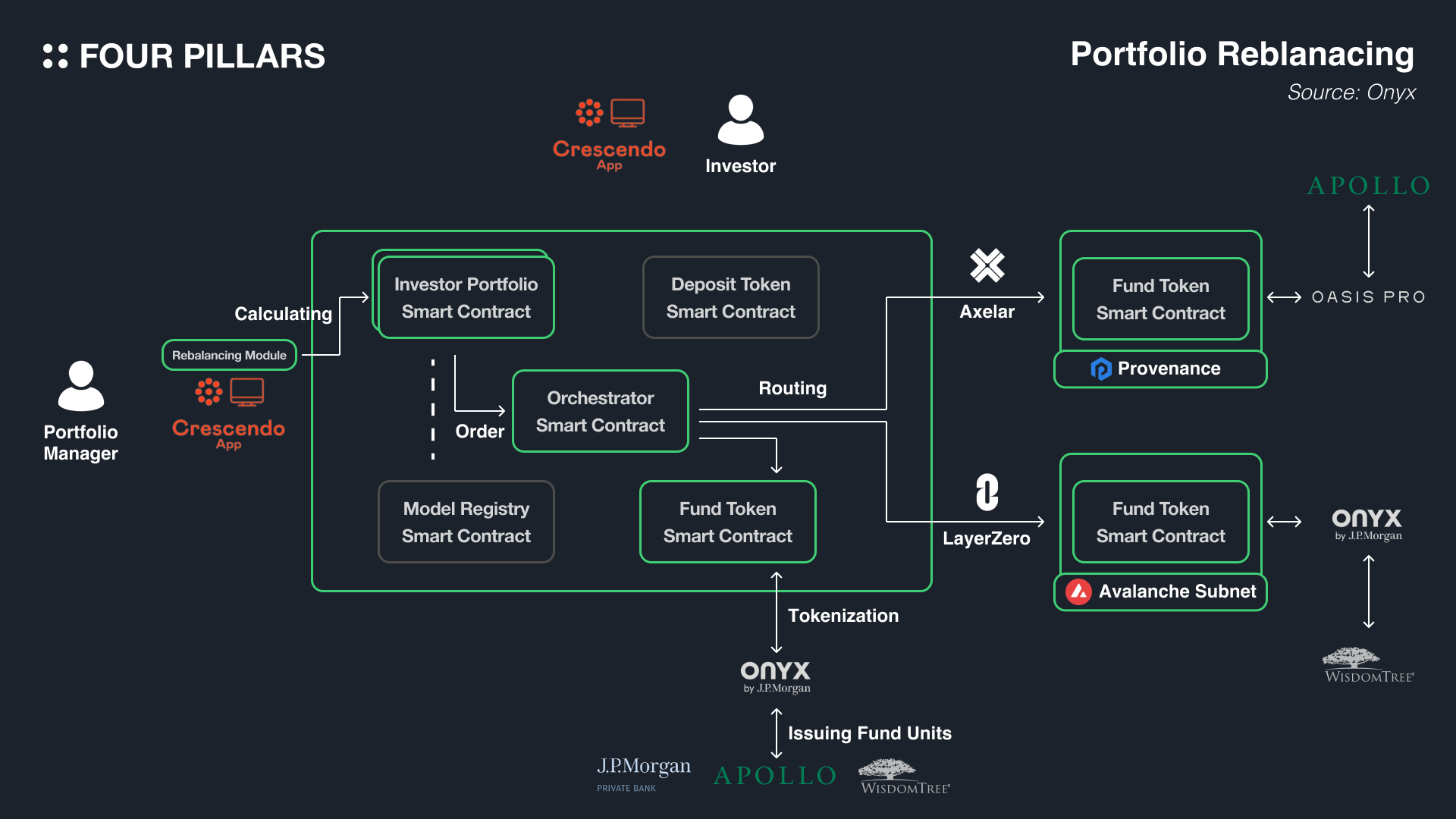

When an investor chooses a specific model portfolio and deposits USD, initially, the Investor Portfolio Smart Contract contains only cash. To align the investor's assets with the model portfolio at the initial investment stage, a process of purchasing the appropriate fund tokens is necessary. The Rebalancing Module of the portfolio manager calculates the difference between the current investor's portfolio and the model portfolio, determining the quantity of fund tokens to be bought. In this PoC, off-chain data was used in a centralized manner for the necessary asset price calculation. However, in the future, a decentralized oracle protocol like Chainlink could be applied to obtain asset prices more reliably.

Source: Onyx

Once the amount of fund tokens to be bought in each blockchain network is decided, the fund token purchase process for portfolio rebalancing automatically occurs via smart contracts. The Orchestrator Smart Contract on Onyx Digital Assets receives orders from the portfolio manager, and relays buy/sell orders to each network. Orders for fund tokens on Provenance Blockchain and Avalanche Subnet are intermediated by cross-chain messaging protocols Axelar and LayerZero, respectively.

When the fund managers receive an order, they confirm that the investor's cash has been frozen for settlement. Upon verification, they tokenize an amount of the fund equivalent to the frozen cash. Notably, within the Avalanche Subnet, the Account Abstraction technology by Biconomy is utilized. This technology enhances the user experience (UX) by enabling fund managers to create transactions on the Avalanche Subnet without needing to possess the native tokens used for transaction fees.

Once all fund tokens are issued, a confirmation message of settlement reaches from the fund managers, through the Orchestrator Smart Contract, to the Investor Portfolio Smart Contract. The Investor Portfolio Smart Contract, initially holding only cash, now stores information about fund tokens across various networks, completing portfolio rebalancing. The frozen cash tokens for settlement are then transferred from the Investor Portfolio Smart Contract to the wallets of the fund managers.

This rebalancing process is used not only for the initial capital investment by the investor but also for subsequent investments and monthly rebalancing due to asset class price fluctuations. Traditionally, in the financial industry, rebalancing a portfolio containing various asset classes like stocks, bonds, and alternative investments involves significant operational costs. However, this PoC demonstrated enhanced efficiency by handling complex rebalancing processes in one go through the use of blockchain, smart contracts, and cross-chain messaging protocols.

Let's revisit the initial purpose of the PoC conducted by JP Morgan and Apollo and review the answers to the four key questions they aimed to address.

3.1.1 How can the execution and settlement of transactions be made efficient and scalable?

Blockchain and other distributed data systems are not exempt from the trilemma of decentralization, scalability, and security. Public blockchains like Bitcoin and Ethereum, focusing on decentralization and security, often lack scalability, resulting in a low number of transactions per second. However, in this PoC, the use of centralized private blockchains overcame scalability issues.

The focus was instead on other blockchain advantages. Blockchains allow various parties to handle multiple assets in an automated workflow within a single ledger. Representing and recording asset ownership through smart contracts integrates portfolio management and operations in traditional industries into one automated process. This increased the efficiency of transaction execution and settlement between multiple parties.

Typically, an asset management firm with 100,000 clients would require 3,000 operational steps for monthly portfolio rebalancing. This PoC replaced it with just a few clicks. Additionally, the immediate settlement of transactions on blockchains minimized cash drag - the opportunity cost of uninvested cash. Considering that portfolio managers typically hold 3% of cash expecting 8% returns, resulting in 24bps of cash drag, and with the Q4’2023 discretionary portfolio fee being 1.09%, clients could potentially reduce costs by about 20%.

3.1.2 How to include alts in model portfolios, given their complexity and lower liquidity compared to stocks or bonds?

Investments in assets like private equity, private credit, real estate, and infrastructure, though less liquid, are attractive for portfolio diversification and risk management. However, in traditional finance, these assets were inaccessible to individuals outside institutions and difficult to include in model portfolios due to the diversity of assets and processes. In this PoC, tokenization platforms allowed easy inclusion and management of alternative investments in model portfolios. Smart contracts automated many tasks, significantly reducing the operational burden of handling alternative investments. Including these assets can improve portfolio returns or reduce volatility. According to Onyx, portfolio managers and asset management companies are expected to tap into a new revenue opportunity worth around $400 billion annually.

3.1.3 Interoperability Solutions for Fragmented Blockchain Networks

In a landscape where numerous blockchain networks coexist, each built with different technical protocols, a significant fragmentation issue arises. While there have been many instances of tokenizing real-world assets (RWAs) such as funds using blockchain, the process wasn't standardized on a specific blockchain. Instead, it occurred across various blockchains, each with its own protocol. This fragmentation is often seen as a major drawback of private blockchains. In this PoC, the use of cross-chain messaging protocols like Axelar and LayerZero was explored to address this fragmentation issue. This allowed for the consolidation of funds dispersed across multiple networks into a single portfolio management system.

3.1.4 Simplifying Blockchain Technology for Portfolio Managers

Blockchain, while a useful technology, can be complex and technically challenging for end-users. The PoC introduced Crescendo, a front-end solution that simplifies the investment process for investors. It enables them to easily invest in portfolios, while portfolio managers can conveniently track performance and rebalance assets.

From 2015 to 2018, as the blockchain market gained widespread recognition, many businesses and institutions experimented with it. These entities often preferred private blockchains over public ones due to legal risks associated with the regulatory gray areas of public blockchains. Furthermore, public blockchains' focus on decentralization sometimes came at the expense of scalability, making them less user-friendly. During this time, private blockchains like Hyperledger and R3 gained attention.

However, the blockchain market deteriorated rapidly, and the lack of adequate infrastructure meant that businesses and institutions did not feel a pressing need to adopt blockchain technology. Even more, the rise of scalable public blockchains like Solana, Avalanche, and Polygon from 2019 and 2020 led to a decline in interest in private blockchains.

Despite this, the blockchain ecosystem showed resilience and growth even after significant crises like the Terra and FTX incidents. The availability of sufficient middleware infrastructure has reignited corporate and institutional interest in blockchain. Unlike in the past, businesses now have a wider range of private blockchain options, including services offered by Polygon, Avalanche, and Onyx for tailored private blockchain solutions.

Some critics argue that private blockchains, lacking decentralization, do not represent the true essence of blockchain technology. However, this view is outdated. The PoC of Onyx and Apollo have demonstrated that blockchain offers numerous benefits beyond decentralization. As long as issues like privacy and scalability are not fully resolved in public blockchains, their adoption by enterprises and institutions remains challenging. This PoC serves as a valuable example for numerous businesses and institutions considering blockchain adoption, potentially leading to an expansion of the private blockchain ecosystem.

While blockchain, a system pursuing decentralization, is conventionally viewed as antithetical to the traditional finance industry, there has been a paradoxical increase in its adoption by numerous financial institutions recently. This trend, as seen in the cases of Onyx and Apollo, is partly because blockchain systems offer several advantages to traditional finance beyond decentralization, such as international transfer, quick settlements, and automated processes through smart contracts. So, what should institutions consider when adopting blockchain technology in the future?

Given the importance of regulatory compliance, such as KYC/AML, in the finance industry, institutions are likely to prefer private blockchains over public ones for the foreseeable future. Recently, there has been a rise in foundations and companies providing technical support for private blockchain infrastructure. Since private blockchains tend to create isolated ecosystems, institutions must choose their blockchain solutions carefully, considering the potential for network effects in the future.

However, as history has shown, blockchain is an industry where technology is still rapidly evolving. The balance of the industry has continually shifted over time and is likely to continue changing in the near future. Many technologies initially diverge in their development stages but eventually converge, and blockchain is expected to follow this pattern. Therefore, as demonstrated by Onyx and Apollo, the importance of middleware supporting seamless cross-chain messaging between isolated ecosystems will greatly increase, becoming essential for institutions looking to adopt blockchain.

A concern, however, is the intense competition that is expected to emerge within the private blockchain ecosystem. While this PoC has somewhat addressed this through the use of appropriate cross-chain messaging protocols, Onyx Digital Assets played a central role among the three blockchains used. Just as intense competition existed within the public blockchain ecosystem pursuing decentralization (e.g., Solana, Polygon, Avalanche, Near) and the Ethereum ecosystem seeking to expand Ethereum (e.g., Optimism, Arbitrum, Polygon, zkSync), the private blockchain ecosystem, inherently centralizing, will not be exempt from this fierce competition.

With developments like the listing of Bitcoin spot ETFs and the cryptocurrency market gaining recognition from traditional finance, a new era for the blockchain industry has begun. Previously, decentralization was touted as the blockchain industry's primary value, but now the industry is increasingly finding its product-market fit (PMF) characteristics beyond decentralization. Although blockchain technology is still used experimentally in the finance industry, the PoC by JP Morgan and Apollo has shown significant potential, and it is hopeful that more cases will emerge that accelerate innovation in the finance industry through blockchain.

Thanks to Kate for designing the graphics for this article.

We produce in-depth blockchain research articles

In the era of AGI, what will we consider valuable? Likely, content that is certified as "human-made" will stand out as valuable. In other words, the focus of value evaluation will shift from the quality of the content to who created it. Therefore, our next challenge is identifying what is human and what is not in the digital world. Let me introduce the Humanity Protocol, which is utilizing Proof of Humanity (PoH) to create the infrastructure needed to prove our humanity and distinguish between humans and AI in the era of AGI.

Starting with a social wallet using Web2 social logins, Particle Network now focuses on simplifying multi-chain complexities with their core product, Universal Account Stack (Universal Account, Liquidity, and Gas). In this article, let’s look into the core components when crypto users interact with and what exactly Particle Network is building to provide the “Future of Crypto UX.”

This is a piece explaining the problems defined by the KYVE Network and the unique structure of the KYVE Network.

In the trading phase of crypto adoption, where most crypto assets are concentrated, exchanges need an infrastructure that is both highly reliable and does not compromise the trading experience. A hybrid exchange design approach, like that of Cube.Exchange, can be suitable in this regard.