This article revisits the journey of Klaytn and Finschia through their mainnet cycles, reviewing the recent proposal for a mainnet merger by the two foundations, and exploring the details, anticipated synergies, and community concerns. It also suggests future directions if the merger proposal is approved.

Regardless of the merger's outcome, both foundations must prioritize continuous engagement and communication with ecosystem participants and the community to maintain their trust.

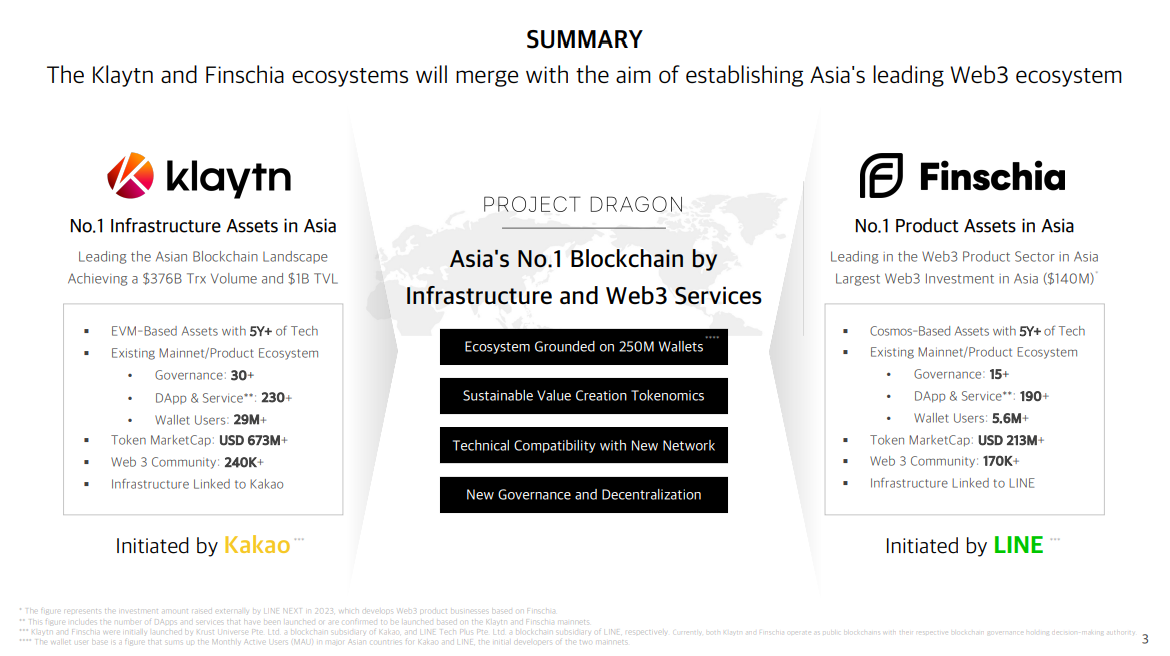

The blockchain sector in South Korea is currently abuzz with the news of a proposed merger between the Klaytn and Finschia foundations, announced on January 16, 2024. The foundations have shared their vision of building Asia's No.1 blockchain, proposing the merger to their community. Klaytn's mainnet token, KLAY, ranks around 90th in market capitalization, while Finschia's mainnet token, FNSA, is around 220th. However, their merger could elevate them to around 70th. This has garnered significant attention, particularly as both are blockchain projects initiated by Asia's leading IT services, Kakao and Line.

The sudden merger proposal by two mainnets, each with a substantial ecosystem and community, is unprecedented in the history of blockchain. Especially post-approval of the Bitcoin ETF and with an expected acceleration in blockchain adoption by financial institutions and Web2 companies in 2024, the fact that both mainnets originated from major Asian IT companies is a noteworthy aspect in the blockchain industry.

Consequently, the Four Pillars team decided to write a research article on this case, striving for neutrality given its sensitive nature. The article begins by examining each mainnet's background, followed by an exploration of the merger proposal's background, details, pros and cons, and community reactions. It concludes with suggestions on future directions should the merger occur. Please note that since the merger proposal and process are ongoing, some details may change.

In this section, we explore the paths taken by Klaytn and Finschia, examining the stages each mainnet is currently in within its growth process.

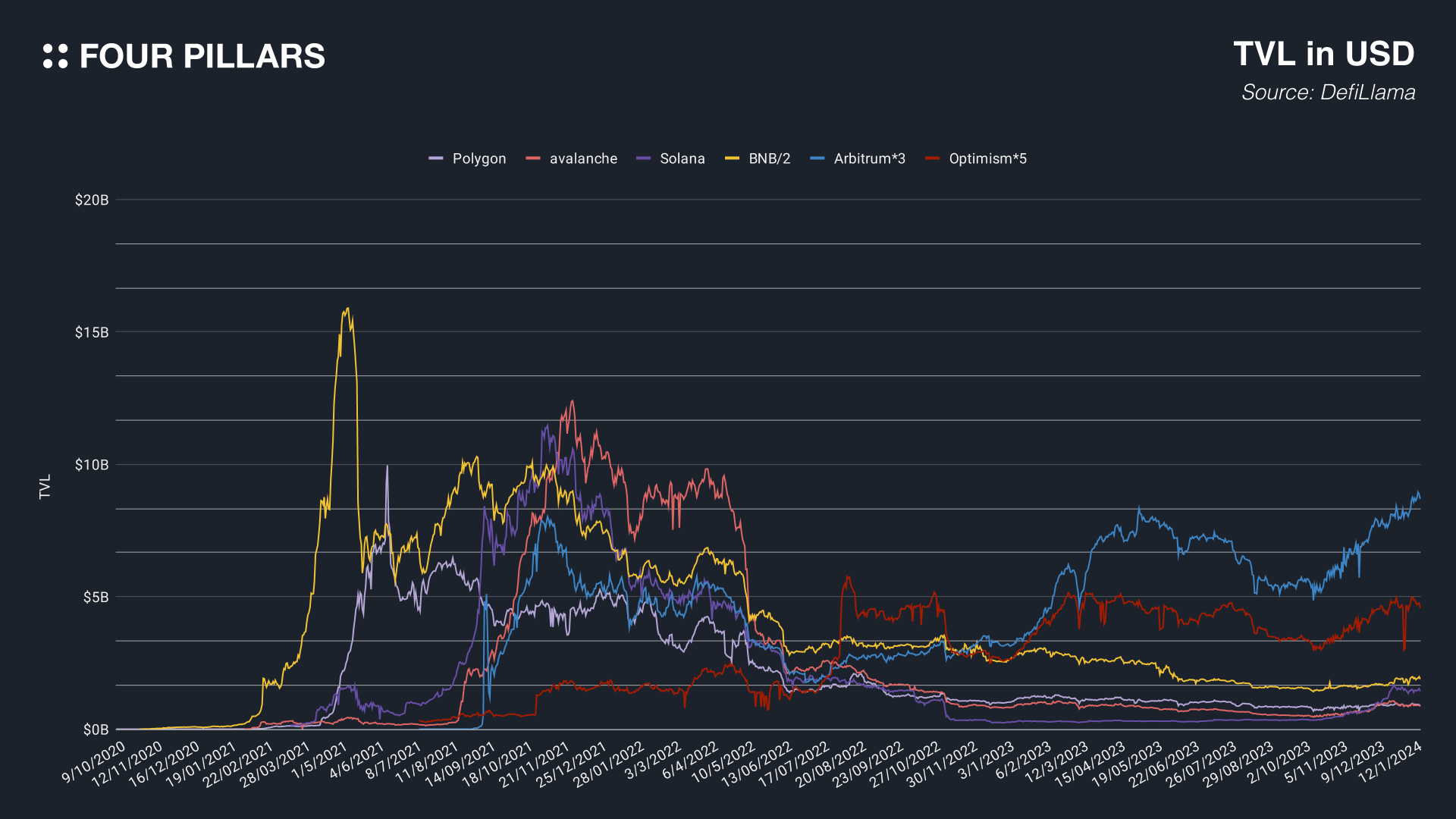

The period from 2021 to 2023 was marked by significant ups and downs in the market, impacting the blockchain industry negatively but also being a period of profound significance. This era witnessed many blockchain mainnets undergoing trial and error, eventually building meaningful ecosystems. Prominent examples of rapidly growing ecosystems include various Layer 1 networks like BNB Chain, Polygon, Solana, Terra (though now rekt), and Avalanche, as well as Layer 2 networks like Arbitrum and Optimism.

While these networks each grew in different ways and at different times, they shared similar patterns in their ecosystem growth cycles. The graph above represents the Total Value Locked (TVL) trends of these representative L1 and L2 networks. By identifying their commonalities, we can divide their growth into five stages (note that the terminology used here is arbitrary and not universally accepted). Interestingly, the mainnet cycles resemble the Gartner hype cycle, as blockchain mainnets are also IT technologies that interact with humans.

(1) Early Stage: After going live, mainnets initially have very small developer and user communities due to a lack of applications and infrastructure. This phase is characterized by early adopter developers and users exploring and interacting with the mainnet, despite inconveniences.

(2) Hype: When the cryptocurrency market is on fire or a specific narrative brings attention to the mainnet, there's a surge of capital inflow. A prerequisite for entering the Hype stage is having an appropriate foundation (applications, infrastructure) built during the Early Stage that can accommodate the influx of users and funds.

(3) Maturity: The funds and users that enter during the Hype stage interact extensively with the mainnet, forming a robust ecosystem. This is the most active phase, marked by the launch of numerous applications, yield farming, and airdrops that continuously inject liquidity into the ecosystem.

(4) Exit: If the cryptocurrency market enters a bear phase or the ecosystem's incentives begin to diminish and lose appeal, there's a rapid outflow of funds and users.

(5) Transformation: If a mainnet finds new growth drivers, such as technological innovation or new narratives, it can complete one cycle and transition to the next.

Almost all mainnets share stages (1) to (4), but the final (5) Transformation stage varies among them. This variance arises because not all ecosystems find new technological innovations or narratives. Optimism and Arbitrum exemplify the (5) stage well, as these Ethereum Layer 2 networks continually develop their technology and benefit from the strengthening Ethereum ecosystem narrative, such as the Dencun hard fork.

Similarly, Solana is making strides into the next phase, overcoming the FTX crisis and introducing new narratives and technologies like Firedancer. For Polygon and Avalanche, the (5) stage is not yet evident in their network TVL. They are innovating in different ways: Polygon focuses on various Ethereum Layer 2 solutions (like zkEVM, Miden), and Avalanche focuses on subnets for app chains and blockchain solutions for financial institutions, thus their (5) stage transformation isn't reflected in TVL charts.

Where, then, do Klaytn and Finschia stand in these stages? Understanding the current position of each mainnet in the cycle is crucial for deducing the pros and cons of their merger, as it represents a new beginning for both. Let's examine the history and background of each mainnet.

2.3.1 Background

Klaytn was launched on June 27, 2019, by Ground X, the blockchain subsidiary of one of South Korea's largest IT companies, Kakao. KakaoTalk, Kakao's flagship messaging service, is the most widely used messaging application in South Korea, with approximately 94.2% of the population using it. As of the third quarter of 2023, KakaoTalk's global Monthly Active Users (MAU) were 53.6 million. In the past, KLIP, a wallet based on the Klaytn network, was integrated into the KakaoTalk service.

Initially developed and operated by Ground X, Klaytn's mainnet business was transferred in January 2022 to Krust Universe, to focus solely on NFT business. However, Krust eventually felt the limitations of operating and developing a blockchain in a decentralized manner as a corporation. Consequently, the team was transitioned to the Klaytn Foundation, which now manages and develops Klaytn. It's important to note that the Klaytn Foundation is financially and legally independent of the Kakao Group, though it maintains a cooperative relationship with Kakao affiliates.

2.3.2 The History of the Ecosystem

Launched in June 2019, the Klaytn mainnet has experienced all the cycles of a mainnet lifecycle. The Klaytn network marked the first encounter with on-chain investments for many users in South Korea and its growth and decline mirrored that of global mainnets like Ethereum and Solana.

Klaytn, a BFT-based blockchain network supporting the EVM execution environment, boasts incredibly low gas fees, rapid block generation of 1 second, and low latency. Initially, its validators (Governance Council; GC) included major Korean corporations such as LG Electronics, SK Networks, and Shinhan Bank. However, in May 2023, the GC system was overhauled, replacing members with entities more closely aligned with the Klaytn network.

The ecosystem initially resembled Ethereum's DeFi summer. While CEX trading was vibrant in the Korean market, on-chain investment trends always lagged slightly behind global mainnets. The Klaytn network, originating from a Korean company and supporting many dApps in Korean, was a monumental network for many Korean investors' first on-chain investment experiences.

Starting in early 2021, various DeFi protocols began launching with KLAYswap, a simple AMM DEX. Unlike Ethereum's robust DeFi infrastructure, Klaytn's DeFi ecosystem wasn't as solidly established, often leading to rapid declines in DeFi token prices or stablecoin pegging issues. Additionally, many Korean DeFi users being beginners attracted scammers, resulting in numerous rug pulls.

In early 2022, the NFT boom hit the Klaytn network, with many Korean users starting to invest in NFTs. MetaKongz initiated this boom, a PFP project inspired by Ethereum's CyberKongz and Solana's Degenape Academy. Despite numerous NFT projects emerging, like the DeFi boom, many ended up being rug pull projects. Nonetheless, the DeFi and NFT booms led to overflowing liquidity in the Klaytn ecosystem, making it one of the most active mainnets in Asia.

However, between April and May 2022, Klaytn's TVL plummeted from $1B to $0.4B. This decline was attributed to the unfavorable macroeconomic environment, diminishing ecosystem incentives, alleged misuse of governance funds by the foundation, KLAY selling by Klaytn employees, and, crucially, the Terra network crisis. Subsequently, despite onboarding famous global projects like DeFi Kingdom, LayerZero, and Wormhole, reversing the downward momentum proved challenging.

2.3.1 Background

The development and operation of the Finschia network and ecosystem are managed by the Abu Dhabi-based Finschia Foundation and various subsidiaries of LYC (LINE Xenesis, LINE NEXT Corp., LINE NEXT Inc., etc.). LYC, owned by A Holdings, a joint venture between Naver and SoftBank, is listed on the Tokyo Stock Exchange (TSE) with a market capitalization of $24.7 billion. LINE, LYC's flagship messaging service, is one of Asia's most widely used applications, boasting about 200 million monthly active users (MAUs). It is particularly dominant in Japan, where over 80% of the population uses LINE.

2.3.2 Ecosystem History

Unlike Klaytn, the Finschia network is still in the early stages of its ecosystem cycle. Although Finschia's history dates back to August 2018, various challenges such as the prolonged bear market, operational difficulties of services, regulatory uncertainties in the Japanese market, frequent mainnet core upgrades, and a closed ecosystem have hindered its growth.

Initially, the LINE blockchain (now Finschia) utilized a mainnet based on Iconloop, and LINE took a leading role in launching services to operate the ecosystem. Later, it also incorporated services from external companies. However, many services were discontinued due to the long bear market in 2018-2019 and the inability to find a product-market fit.

Source: DOSI

Fortunately, as regulatory uncertainties around cryptocurrencies began to clear in Japan, the LINK token (now FNSA) was officially listed in the Japanese market, and options to use LINK in LINE Pay were added, reigniting the ecosystem's growth momentum. Notably, in September 2022, the launch of DOSI, a global digital marketplace, attracted significant popularity in Asia. It achieved over 5.4 million wallets and 4.7 million NFT holders within ten months of its launch. Moreover, the LINE blockchain was reborn as the Cosmos SDK-based Finschia network, heralding the birth of a new ecosystem.

Before the merger proposal was made public, LINE NEXT Corp. received a $140 million investment from Crescendo Equity Partners, backed by Peter Thiel, planning to expand the ecosystem aggressively. As part of the initiative to open up its previously closed ecosystem, Finschia onboarded new validators like SEGA Singapore, Bughole, and Cosmostation, listed on various CEXs, and opened public endpoints, allowing external developers to build dApps based on Finschia without permission. The network is also planning to onboard various applications like DeFi, M2E, etc., preparing for the real start of its mainnet cycle.

Source: Project Dragon

On January 16, 2024, the Klaytn and Finschia foundations unexpectedly announced a blockchain merger plan named Project Dragon to their communities. This unforeseen announcement caused significant ripples in the community and the Korean cryptocurrency industry.

Source: Project Dragon

Following the approval of Bitcoin ETFs, it's anticipated that institutional and traditional industry interest in blockchain will accelerate. Additionally, considering the favorable macroeconomic environment and the upcoming Bitcoin halving, 2024-2025 are expected to be crucial for the blockchain market. However, Asia's influence in the global blockchain market remains minimal despite its significant share of over one-third of the global GDP and active cryptocurrency trading. The market value share of Asia-based blockchains is less than 5%. Consequently, Klaytn and Finschia, two of the largest mainnets based in Asia, aim to merge to become the leading blockchain in Asia and spearhead the mainstream adoption of Web3.

From the perspective of the mainnet cycle, Klaytn has already completed a full cycle and is currently in a state of stagnation. Although there are efforts to find a new narrative by focusing on Real World Assets (RWA), the Klaytn ecosystem faced a setback when its largest bridge, Orbit Bridge, was hacked, leading to broken pegs of assets within the ecosystem and making it challenging to transition to the next mainnet cycle. Klaytn's ecosystem needs a catalyst to lead it into the next cycle.

Finschia, despite being operational for a long time, hasn't yet experienced a full mainnet cycle due to its conservative and closed operations. However, with recent developments such as the $140M investment from LINE NEXT Corp., the opening of public endpoints, and the onboarding of DeFi and M2E projects, Finschia is just beginning to emerge. It needs aggressive business development for rapid ecosystem growth.

As both mainnets have been operational for a long time, successful merging requires careful coordination. Let's explore the detailed proposal for the merger as presented by the two foundations.

3.2.1 Tokenomics

Tokenomics is a sensitive topic for the community. While merging ecosystems with a small or emerging community might not face significant friction in tokenomics, the fact that both Klaytn and Finschia have established ecosystems and communities makes this a highly contentious issue.

Source: Project Dragon

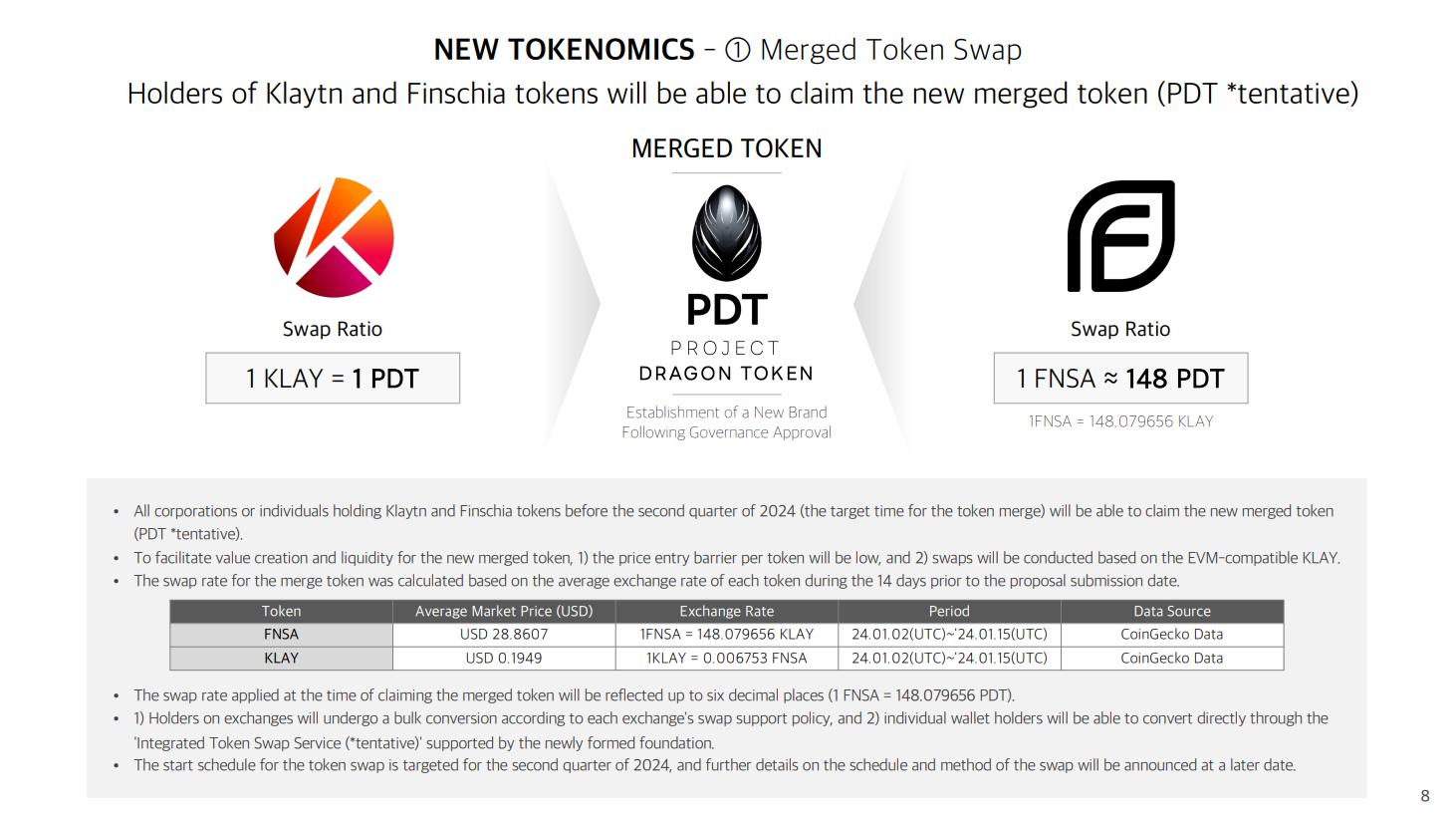

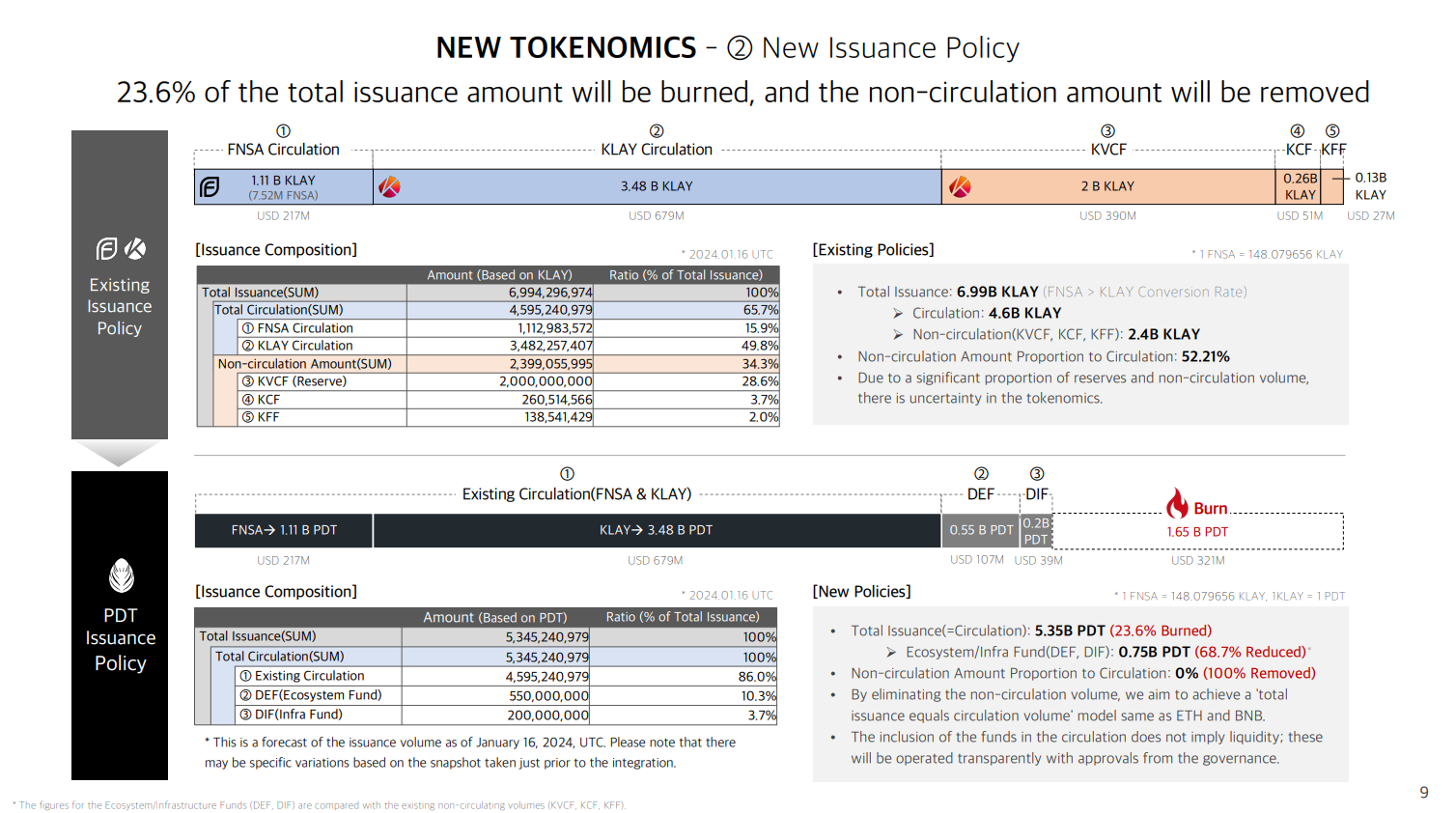

If the merger proceeds, KLAY and FNSA holders will be able to exchange their tokens for a new token (tentatively named PDT). The initially proposed exchange rates are 1 KLAY = 1 PDT and 1 FNSA ~ 148 PDT. These rates were calculated based on the average prices of each token two weeks before the merger proposal submission. The average prices over those two weeks were $28.8607 for KLAY and $0.1949 for FNSA.

Source: Project Dragon

In the new tokenomics, 68.7% of KLAY not yet in circulation, valued at $321 million, will be burned, and the remaining unissued KLAY will be converted into governance funds named DEF (Dragon Ecosystem Fund) and DIF (Dragon Infrastructure Fund). Consequently, the new PDT tokenomics will not have any unissued supply, and the circulation will be regulated solely by inflation and a new burning model, similar to the tokenomics of ETH and BNB which also have no unissued supply.

DEF, aimed at fostering ecosystem growth, will allow fund allocation with governance approval, and all transactions will be disclosed based on a new transparency protocol. Of the 550 million PDT allocated to DEF, 350 million PDT will be delegated to LINE NEXT's governance wallet and distributed over five years as a reward for migrating various products from the original Finschia mainnet and building new Web3 products on the new mainnet.

DIF will be a fund for infrastructure, foundation operations, and marketing, with the unified foundation's board having the authority to allocate funds. Like DEF, fund disbursements will be transparently disclosed under the new transparency protocol.

Source: Project Dragon

The inflation rate will also change in the unified mainnet. The new rate is calculated using a weighted average of the existing inflation rates of each mainnet token, adjusted for token circulation, and applying a discount. The rate, initially between Klaytn's 5.7% and Finschia's 15%, will be adjusted to a lower rate of 5.2% after applying the discount. Of the tokens issued through inflation, 50% will go to validator rewards, 25% to DEF, and 25% to DIF.

Moreover, the unified mainnet will develop a new 3-Layer Burning Model. While details of the model are not yet public, it will include burning mechanisms based on 1) transactions, 2) validating, and 3) business activities. This model, which increases burning with more on-chain activity and business transactions, is expected to positively impact the sustainability of the tokenomics.

3.2.2 Method of Network Integration

Source: Project Dragon

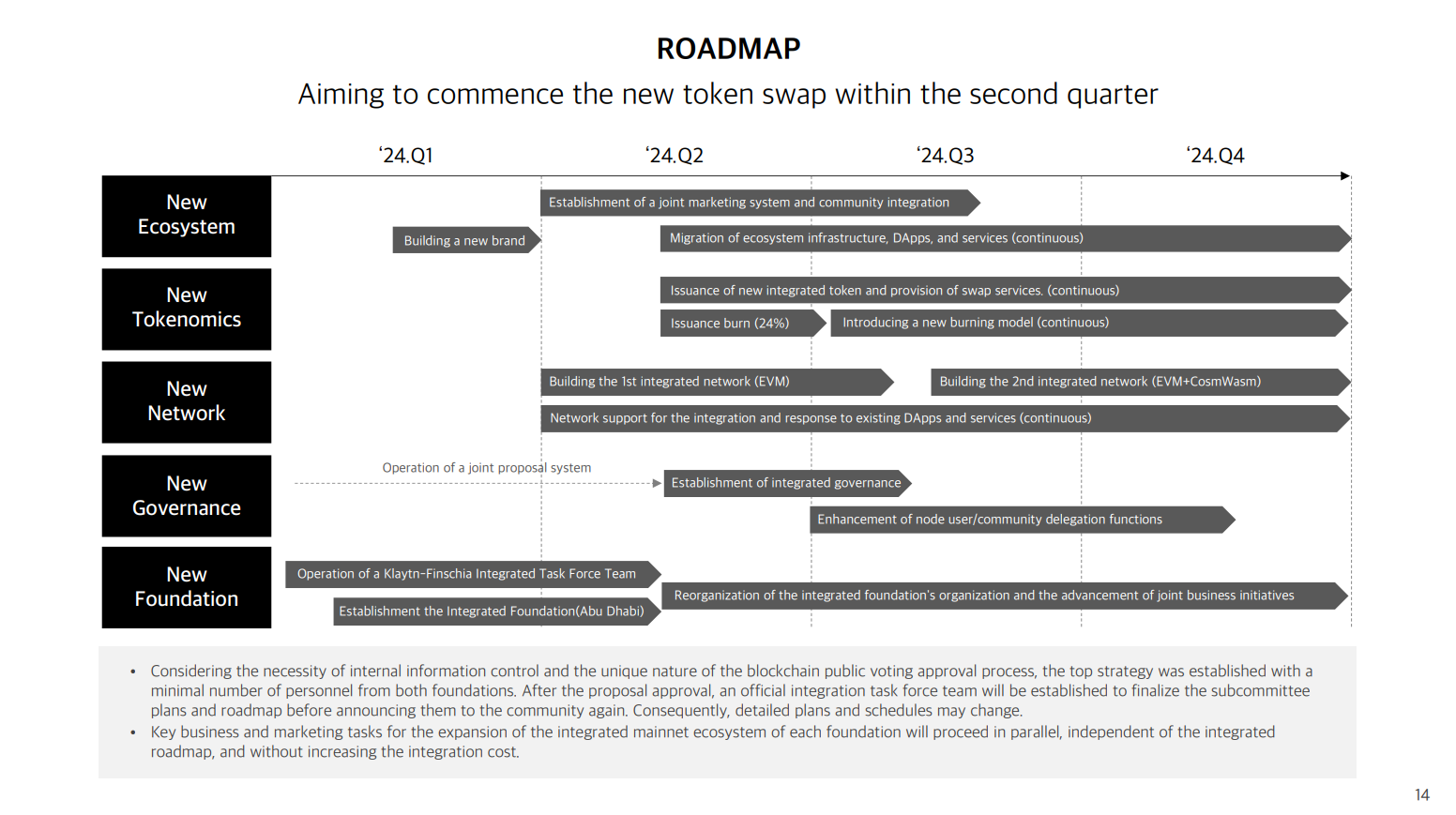

Although technical details on how Cosmos SDK and WASM-based Finschia will merge with EVM-based Klaytn have not been disclosed, the roadmap suggests an initial upgrade of the Klaytn chain to EVM in Q2 2024, followed by the construction of a unified network supporting both EVM and CosmWasm in Q3 2024. Initially, with the EVM-based integration, Finschia's network will remove its inflation and transition its governance. For the secondary phase supporting both EVM and CosmWasm, the integration specifics will be further discussed by the unified foundation, reflecting community input, as the proposal has not yet been approved, and the unified foundation has not yet been established.

3.2.3 2024 Business Initiatives

Both foundations have disclosed eight business initiatives that they will pursue if their proposal is approved:

Infrastructure for Institutional Demand: Developing an on/off ramp system for PDT tokens and building infrastructure to enhance access for institutional investors.

Strengthening DeFi Infrastructure: Expanding the DeFi ecosystem and RWA services.

Launching a Native Stablecoin

Rebuilding the Asian Community: Expanding developers, communities, and ecosystem partners in various Asian countries.

AI dApps Onboarding

Onboarding Web2 Assets to On-chain: Bringing traditional Web2 assets like digital items, memberships, and tickets onto the blockchain.

Onboarding Asian SSS Gaming Companies: Introducing Web3 games using IP from Japanese SSS-rated gaming companies.

Collaborating on Global IP Projects: Onboarding major global IP companies and strengthening infrastructure.

The initiative to strengthen the DeFi infrastructure was detailed on January 22, 2024, with a specific plan disclosed. The D2I (Dragon DeFi Initiative), an incentive program to grow the DeFi ecosystem in the new integrated chain, emphasizes the importance of DeFi protocols that can create synergy or find PMF, encouraging builder participation.

3.2.4 Governance Voting Schedule

Governance voting is scheduled for seven days, starting January 26, 2024, at 05:00 UTC (14:00 KST). If the proposal is approved, the new tokenomics will be launched, a unified foundation will be established, and governance integration will be completed within the second quarter, followed by implementing new business initiatives for the integrated mainnet.

3.3.1 Complementary Relationship

Judging from the current state of the Klaytn and Finschia ecosystems, they seem to fit each other's needs. The merger with Finschia, which is just emerging and backed by a strong product like LINE, is an appropriate catalyst for Klaytn to move into the next cycle. Conversely, for Finschia, merging with Klaytn, which has experienced a full mainnet cycle and possesses numerous on-chain assets and infrastructure, can enable aggressive ecosystem growth. The recent $140M investment from LINE NEXT Corp. will further accelerate this.

3.3.2 Developer Ecosystem Development

If the merged Finschia network, which previously only supported WASM VM, begins supporting the EVM environment, ecosystem development will likely become more feasible. Since Finschia opened its mainnet ecosystem quite late, it remains uncertain how much of a new developer ecosystem can be established in the already somewhat established blockchain industry. Although Finschia has a developer incentive system called SCR (Service Contribution Reward), there is a possibility that the ecosystem may be limited to small and medium protocols that onboard focusing only on SCR in the future.

3.3.3 Tokenomics

From a tokenomics perspective, both Klaytn and Finschia are networks that have gone through many trials and errors. Klaytn has faced numerous challenges due to aggressive use of issued tokens and ecosystem funds. Conversely, Finschia has operated its ecosystem conservatively through a zero-reserve approach, failing to drive aggressive growth when necessary. Since both foundations have experienced different kinds of trials, there is potential for better tokenomics in the new mainnet.

3.3.4 Influence in the Asian Region

Significant synergies are also expected in the Asian region. The Finschia Foundation is based in Abu Dhabi, and its flagship NFT service, DOSI, has seen meaningful activities not only in Korea but also in Thailand, Japan, and Taiwan. On the other hand, the Klaytn Foundation has a business base in Korea and Singapore, and the Klaytn network has been active in Vietnam. Forming a new integrated foundation could result in a mainnet with significant influence across the Asian region.

3.3.5 New Narrative

Although it's challenging to predict immediate common grounds in the near future, both mainnets originated from two of Asia's largest IT services, Kakao and LINE. The blockchain operated by foundations associated with these two major IT giants in Asia will undoubtedly attract significant narrative attention in the region, potentially garnering increased interest from various Web2 and Web3 companies. Additionally, as regulatory uncertainties decrease and blockchain products find significant PMF, the possibility of additional touchpoints with Kakao and LINE could be higher compared to other networks.

3.3.6 Smoother Business Development

If the mainnets are integrated, the bargaining power in collaborations with external companies and protocols could increase compared to before. As revealed in an AMA session after the merger proposal, attempts by the Klaytn and Finschia Foundations to partner with major infrastructure companies separately did not receive favorable responses. However, after announcing the integration plans, the reactions from these companies improved significantly. Thus, mainnet integration is expected to boost business development.

3.3.7 Institutional Investment Perspective

For tokens to become targets of institutional investment, they must achieve high market capitalization and liquidity, be listed on several global exchanges, and be included in the asset management lists of custody companies, among other criteria. Although there's a long journey ahead for the token to become an institutional investment target even after the merger of the two mainnets, the process will certainly be more straightforward than before. For more details, refer to ‘[Article#2] Project Dragon: Responding to Institutional Demand’.

3.3.8 Two Mainnets with Contrasting Characteristics

The two mainnets have contrasting characteristics in many aspects, such as their approach to business and their stage in the mainnet cycle. If the intentions of the two mainnets align well and their roadmaps are successfully implemented to create synergy, becoming the No.1 blockchain in Asia beyond Korea is not too far-fetched a plan. However, there are concerns from the community about whether the merger proposal was made too hastily.

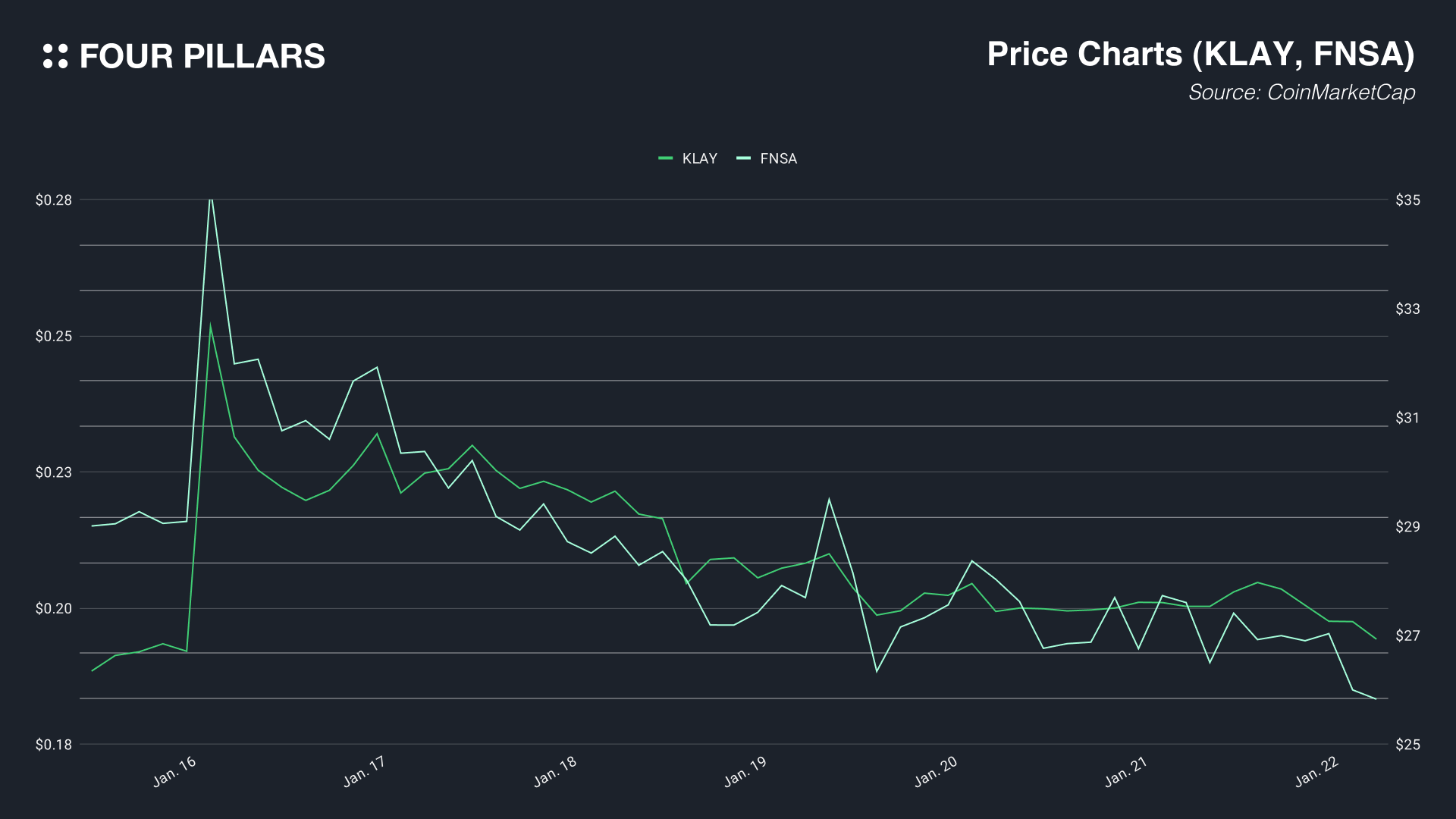

Interestingly, on January 16th, when the merger proposal between KLAY and FNSA was announced, the prices of both tokens surged significantly (+31% for KLAY and +19% for FNSA). However, as time passed, growing community concerns about the merger have resulted in KLAY returning to its pre-announcement price and FNSA even trading below its pre-proposal price. Initially, the substantial vision presented by the two mainnets attracted a lot of attention, leading to a price spike. However, due to the sudden nature of the proposal, lack of information, and resulting community apprehensions and misunderstandings, there's been a continuous sell-off of the tokens.

3.4.1 KLAY <> FNSA Exchange Ratio: Can an Optimum Point be Found?

One of the main contentious points is the exchange ratio between KLAY and FNSA tokens in the event of a mainnet merger. Although initially, a ratio of 148 KLAY to 1 FNSA was derived based on a two-week average price, there has been significant backlash from the Finschia community for several reasons:

Relative Dilution of FNSA: If the merger occurs, KLAY's market cap will increase by about 53%, while FNSA's would surge by about 381%. Pre-merger, FNSA, ranked around 230th in market cap, would rise to 73rd post-merger. Since a lighter market cap usually entails greater price growth expectations, FNSA holders have more grievances than KLAY holders.

Growth Prospects of Finschia: Unlike Klaytn, which is seeking new growth drivers after completing a full mainnet cycle, Finschia, backed by substantial investments from LINE NEXT Corp. and having recently opened its endpoints, is at a different growth stage. The Finschia community feels the token exchange ratio does not reflect this potential future growth.

Conversely, considering the unpredictability of the future, the mainnet, once merged, could become more active than if Finschia remained independent, potentially leading to a higher appreciation rate for PDT tokens. Nevertheless, FNSA holders seem more discontented with the exchange ratio than KLAY holders.

The token exchange ratio is one of the most critical and sensitive issues for both the Klaytn and Finschia communities, as economic incentives are a significant motivator in a blockchain market. In fact, both foundations announced plans to revise the exchange ratio in an AMA on January 19th in response to these opinions. However, since Finschia's growth prospects are quite subjective, determining a fair exchange ratio could be challenging, and if the new ratio is deemed favorable to Finschia, backlash from the Klaytn community is expected.

3.4.2 Concerns about Governance Integration

With the integration of the mainnets, validators and governance will also merge. However, as observed in the tokenomics section, the significantly lower number of FNSA tokens compared to KLAY raises concerns about the relative weakness of Finschia's governance voting power. The foundations have mentioned considering delegations for validators from the Finschia side who might not meet the minimum token requirement to become validators. Furthermore, they clarified that instead of considering the governance of the two mainnets separately, there will be 45 new validators in the new mainnet, with voting power determined by user delegations.

Yet, the primary concern lies in the dilution of voting power. Since KLAY has a larger volume than FNSA, the dilution rate for FNSA validators would be significantly higher. This issue was addressed in the January 19th AMA, where plans for certain adjustments were disclosed.

3.4.3 Addressing the Orbit Bridge Hack

On January 2, 2024, right after the new year, the Orbit Bridge suffered a significant hack, losing $81M in funds. Since Orbit Bridge was heavily used in the Klaytn ecosystem, there is now substantial depegging of assets related to the bridge within the Klaytn DeFi ecosystem. Unless the $81M is recovered or restored, it seems challenging to resolve this depegging issue. The Finschia community expresses reluctance about merging with an ecosystem experiencing such significant depegging, while the Klaytn Foundation has declared its intent to resolve this issue, independent of Project Dragon, in cooperation with the Orbit Bridge team before the merger.

If the bridge issue remains unresolved post-merger, the value of oAssets transferred via Orbit Bridge may be difficult to recover, potentially causing considerable confusion for DeFi users and AMM and lending protocols associated with oAssets. Therefore, for Project Dragon's success, launching a native stablecoin, one of the eight business initiatives, seems critical. Moreover, it would be advisable to use globally verified bridges like LayerZero or Wormhole for connections with the existing Klaytn mainnet.

3.4.4 Legal Risks for Klaytn

Unlike Finschia, which has avoided legal issues through conservative operations, Klaytn faces current legal risks due to aggressive business development and various trials related to tokens. A civic group in Korea has accused insiders at Kakao and its affiliates of unfairly profiting from KLAY tokens, and the Korean prosecution has been investigating since October 2023. The Klaytn Foundation, after consulting with law firms, believes that this investigation will not impact Project Dragon and will strive to minimize any potential issues in the operation of the integrated foundation and chain.

Some in the Finschia community pride themselves on their foundation's lack of legal risks and are thus strongly opposed to merging with Klaytn, which has such risks. While it's difficult to assess the impact of these legal risks on the mainnet integration, if the Klaytn Foundation's response is accurate, convincing Finschia community members who are opposed will be key.

3.4.5 Exchange Listings

Key exchanges listing KLAY include Binance, OKEx, and Bithumb, while FNSA is listed on exchanges like Bithumb and Huobi. Notably, both coins are whitelisted by Japan's Financial Services Agency, allowing trading in the Japanese market. A point of contention is whether the new integrated token will require re-evaluation for listing on existing exchanges and what happens to its whitelisted status in Japan. Conversely, if the re-evaluation process by exchanges is not required or is easily passed, the FNSA community could benefit from automatic listing on exchanges like Binance, where it was not previously listed.

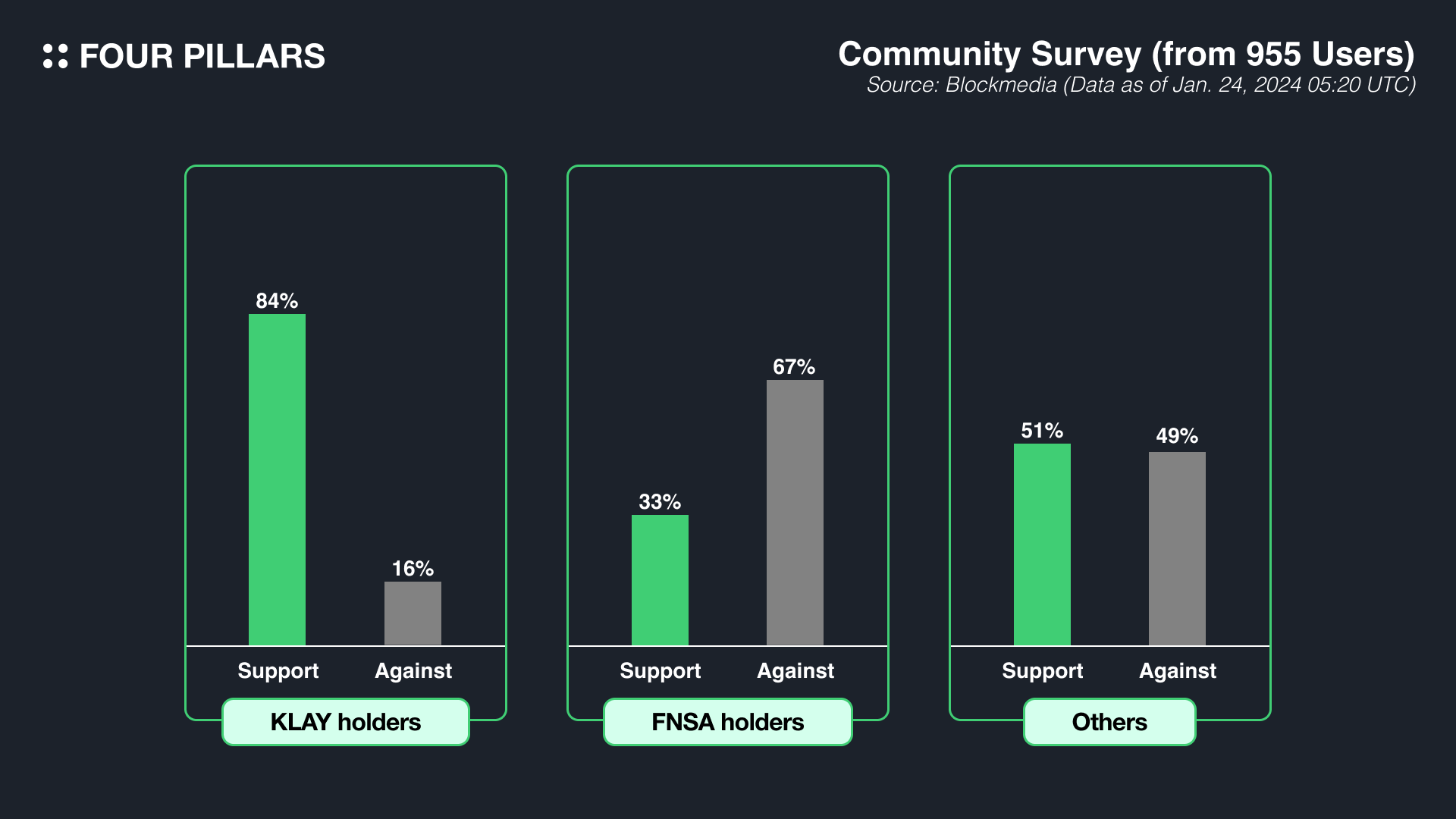

Can the mainnet merger proposal succeed? To predict the outcome, it's important to examine the reactions of key voters from each mainnet community and the community's overall response to the proposal. According to a survey conducted by Blockmedia on January 24th through their Telegram channel, there is a noticeable difference in opinion among the communities. Investors not holding either KLAY or FNSA tokens showed a slight majority in favor of the merger, with a 51:49 ratio. However, while a significant 84% of KLAY investors supported the merger, 67% of FNSA investors displayed opposition opinions.

Community opinion is important, but the ultimate decision on the merger rests with the validators who actually carry out the governance vote. Excluding entities related to LINE, significant voting power among Finschia mainnet validators lies with companies like BUGHOLE (~30%), GoodGang Labs (~23%), and NEOPIN (~7%). NEOPIN plans to conduct its own poll and vote on-chain accordingly. Since BUGHOLE and GoodGang Labs together exceed 50% voting power, their decision is highly anticipated and could be decisive in the merger. The internal consensus within these validators and whether they will vote according to community preference, like NEOPIN, remains unclear. Thus, readers interested in the merger's outcome should keep an eye on these entities.

As we've seen, Project Dragon has the potential for significant synergy, but there are also many concerns to address. If the merger proceeds as the foundation hoped, Project Dragon must focus on gaining community trust.

A completely decentralized blockchain ecosystem is nearly non-existent from the start. To grow the initial ecosystem, some centralized operation by the foundations is inevitable. However, if the foundations do not properly reflect community opinions or misuse tokens, it could break the community's trust. To prevent this, it's suggested that the integrated mainnet should make the use of the governance fund as transparent as possible.

There have been disappointments with how both the Klaytn and Finschia foundations managed their ecosystem funds. Finschia introduced a new paradigm with Zero Reserves, focusing on fairness among ecosystem participants, and attempted transparency by disclosing transaction IDs on its Disclosure page, although the exact usage of the reserves was not fully clear.

On the other hand, the Klaytn ecosystem faced more issues. Its tokes were excessively allocated to the foundation's reserve. The execution and post-management of the Klaytn Growth Fund (KGF) investments were opaque, leading to failures, rug pulls, or migrations of funded projects to other ecosystems. To solve previous issues, the Klaytn Foundation has been making gradual improvements. Since 2023, they have implemented a requirement for the Governance Council's approval to use the Governance Fund. They have also introduced on-chain voting for quarterly budget proposals and have made significant efforts to enhance transparency. This includes real-time disclosure of all transactions made through the Governance Fund's wallet, transparent to users via Klaytn Square.

Source: Optimism

Then, what would be the ideal way to utilize the governance fund? While there's no definitive answer, in my opinion, the most commendable approach in the current blockchain ecosystem is Optimism's RetroPGF (Retroactive Public Goods Funding). RetroPGF supports projects in the Optimism ecosystem with a public good nature, awarding funds to projects that have already contributed. This approach is less risky and more effective than funding projects at their inception. The funds are sourced from pre-allocated OP tokens and revenues from the Optimism network's sequencer. Reinvesting issued tokens and actual earnings (sequencer revenues) back into public good projects is an excellent model for a sustainable ecosystem.

Project selection in RetroPGF is more decentralized compared to other ecosystems. The authority to choose projects lies not only with the foundation but also with the Citizens’ House, part of the Optimism Collective, allowing badge holders to participate in the vote. Badge holders are either designated by the foundation or those who participated in previous RetroPGF voting. The RetroPGF program is not the only-once program, ensuring the ecosystem's sustainability and the selected projects and their funding are transparently disclosed.

Applying RetroPGF's advantages to Project Dragon's DEF and DIF funds might result in the following:

Prioritize supporting projects with a public good nature over token-issuing projects, fostering a positive cycle in the ecosystem.

Avoid large initial funding for projects upon onboarding; instead, aim for retroactive support based on the performance of services over time.

Ensure fair and decentralized project selection involving deeply engaged community members or credible outsiders rather than the foundation making unilateral decisions.

Aim for sustainable growth by using not only token inflation but also actual network revenues for governance fund expenses.

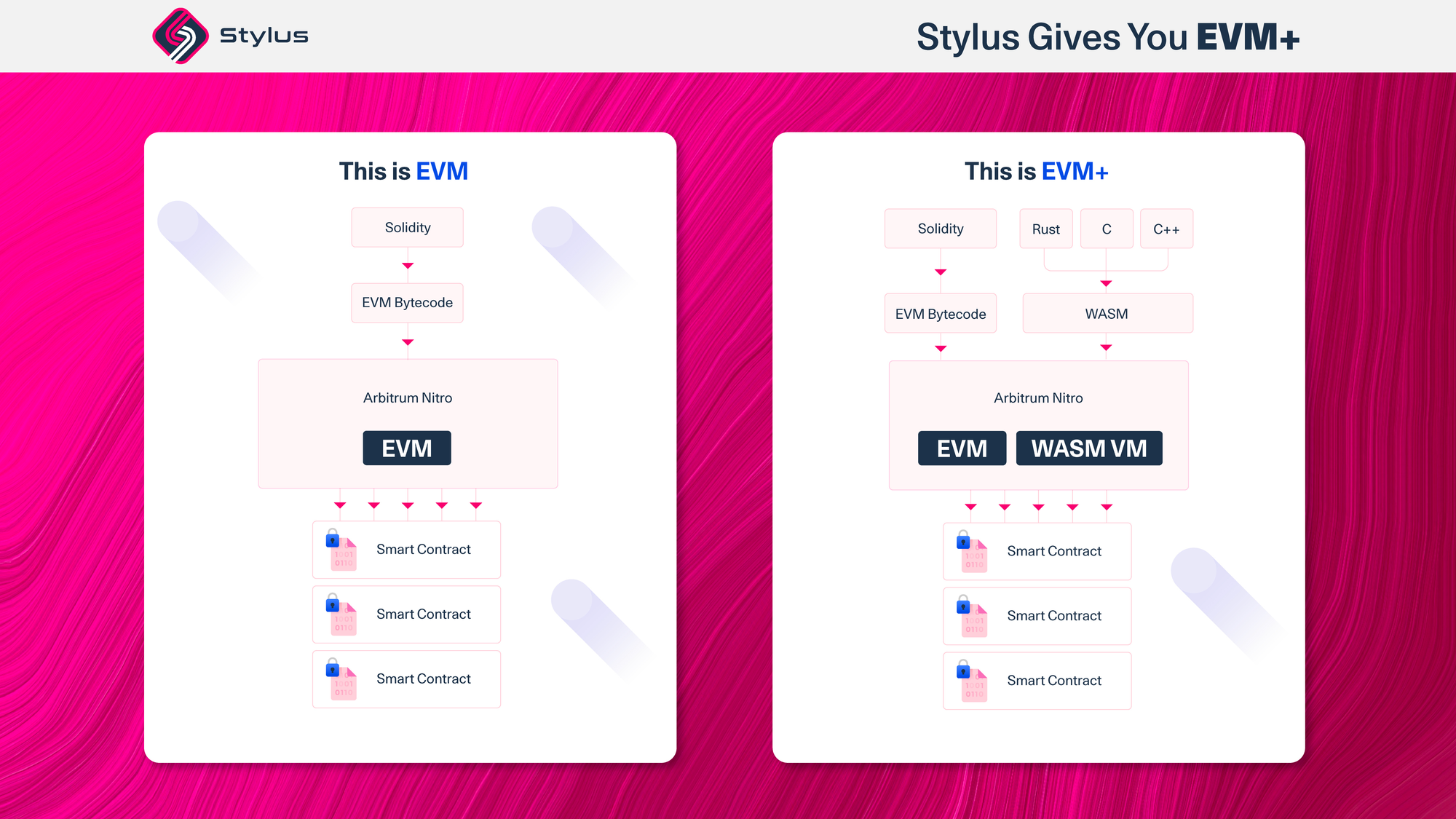

According to the current roadmap, the plan is to first build an EVM-based integrated mainnet on the Klaytn network, followed by migrating Finschia's services and infrastructure to the EVM network. Although there are plans to operate both EVM and WASM VM, the specifics have not been disclosed. It's worth considering how feasible it is to adopt and operate both EVM and WASM VM simultaneously.

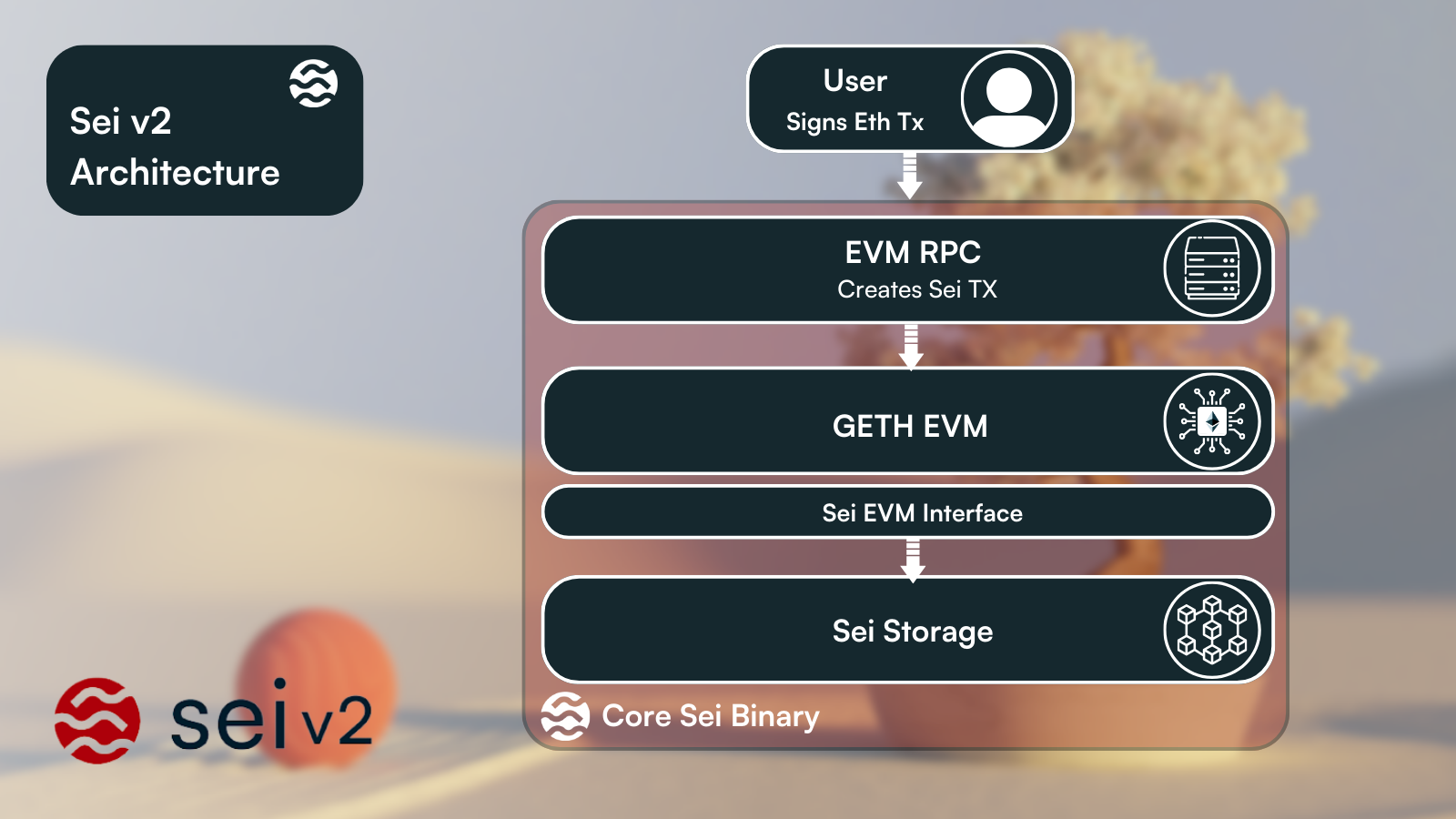

Source: Sei

In the blockchain industry, there have been cases supporting both EVM and WASM VM, but mostly, they were WASM-based networks supporting EVM. Examples include Near's Aurora, Astar's Multi-VM, and Sei's upcoming parallelized EVM. Near and Sei wrap transactions coming through EVM RPC into a network-compatible Tx format, then process them through Aurora Engine and EVM, respectively. Astar and Sei, built on the L1 frameworks Substrate and Cosmos SDK, easily add EVM pallet (Substrate) or EVM module (Cosmos SDK) for multiple VM support.

Source: Arbitrum

However, EVM-based networks supporting WASM VM are rare. This could be due to technical challenges and a lack of incentive for EVM networks to support WASM. A prime example is Arbitrum Stylus. The Arbitrum Foundation upgraded its core tech stack, Arbitrum Nitro, to support not only EVM but also WASM VM. This allows developers to use languages compilable to WASM, like Rust, C, and C++, in addition to Solidity. If Project Dragon plans to support WASM VM in the future, starting from EVM and moving towards WASM VM support, Arbitrum Stylus's case could be very instructive.

One major shortcoming of both the Finschia and Klaytn ecosystems has been their high dependency on the Korean market. Although Klaytn onboarded renowned global projects like DeFi Kingdom, LayerZero, and Wormhole in its later stages, it still heavily relied on Korean services. The challenges associated with ecosystem development and growth are not unique to Korean mainnets like Klaytn and Finschia; global mainnets also face similar issues. The more a market is regionally confined, its ecosystem expansion becomes more limited.

Therefore, the new integrated mainnet should reduce its dependency on the Korean market and strive to build an ecosystem that is at least Asian-wide, if not global. The narrative of a blockchain operated jointly by foundations starting from Kakao and LINE is compelling even in the global market and could be a strong competitive advantage compared to other blockchains. If the merger proposal is approved, I hope the new integrated mainnet will not repeat the past but will reference the strategies of successful ecosystems to emerge as a unique blockchain ecosystem in Asia.

Regardless of whether the merger proposal is approved or not, one aspect I personally found disappointing during my research is the apparent lack of sufficient time dedicated to gathering community feedback before the proposal was announced. While I understand the rationale mentioned in the AMA, aiming to prevent potential issues related to sensitive matters like token exchange ratios, it's still not ideal for significant decisions like a merger proposal in a blockchain ecosystem, which seeks decentralization, to be introduced in a top-down manner by the foundation's decision-makers. Such an approach seems contrary to the ethos of decentralization that blockchain communities typically advocate.

Nevertheless, considering the journey and current state of both blockchains, there are indeed many elements that could synergize. However, if the sudden merger proposal leads to disappointment among the community and then gets rejected, the situation for both blockchains could worsen. It would have been better if enough time had been taken to discuss the merger, including scenarios for community acceptance in case of rejection, in addition to the roadmap if approved.

If both foundations truly desire the mainnet merger, they must now start listening to the opinions of the community and ecosystem participants. They should persuade and prove to the community how the new integrated mainnet can offer a different approach compared to the past and address the concerns mentioned in this article. Regardless of whether the proposal is accepted or rejected, there's a high likelihood of secondary backlash from the community. Therefore, I hope that both foundations prioritize the ecosystem participants and the community. Ultimately, gaining the community's trust is the most crucial issue.

The die is cast. Klaytn and Finschia have presented a detailed merger proposal to the community, and the 7-day on-chain governance vote is scheduled for January 26th. Whatever the outcome, this vote is a critical event that could completely change the future of the Klaytn and Finschia mainnets. Given the importance of this matter, I hope community members from both sides consider objective facts and their circumstances to make a decision that maximizes the benefit of the ecosystem, including their own.

Thanks to Kate for designing the graphics for this article.

We produce in-depth blockchain research articles

November was the month with the fewest EIPs newly proposed or advanced in 2023, with the exception of April. Notable among these were some Core EIPs related to the Dencun update and several Token Standards & Extensions related ERCs.

In October, we saw an even distribution of subcategories across both new EIPs and EIPs that have progressed to the next level, but it's notable that EIPs related to transactions or ERC-4337 are being discussed more and more frequently.

September was a month of adoption for many new Core EIPs, and it was also notable that many EIPs related to contract and token standards moved closer to finalization.