Solana is rebounding strongly from the downfall due to FTX crisis, showing a surge in both on-chain activity, market sentiment and significant enterprise integrations

Jito's emergence as a leading liquidity staking platform on Solana, offering MEV rewards, has been instrumental in its growth, especially amidst challenging market conditions

The adoption of Jito's innovative solutions, including the Jito-Solana client and StakeNet, is addressing critical issues in MEV extraction and liquid staking, enhancing network efficiency

Jito's strengthening market position, bolstered by strategic moves like Lido's exit and successful airdrops, is making it a dominant force in Solana's liquid staking landscape

The growth of Jito positively influences the entire Solana ecosystem, promoting network health and decentralization, and is setting a course for increased adoption and innovation in DeFi

Source: Solana Thesis

The collapse of FTX was an existential crisis for Solana, forcing out all but the most dedicated supporters. However, this left an opportunity as activity recovers on a new stabilized foundation. Developer and enterprise momentum for Solana is now accelerating faster than ever. Its industry-leading scalability and low costs stand out. Despite its young age, Solana is well positioned for a breakthrough mainstream use case. Major integrations with Visa and Shopify validate its capabilities to institutions. Their continued support could catalyze huge network effects if others follow their crypto lead.

Among crypto users, sentiment and activity on Solana keeps improving. Eclipse recently announced its SVM rollup mainnet, and Maker’s founder Rune proposed to fork Solana’s code base to launch Maker’s upcoming chain. Recent figures confirm the resurgence of the ecosystem - all time high DEX volumes and exponential growth in total value locked this year. The bull case will strengthen as more top projects launch. The evidence is clear - Solana has bounced back stronger than ever. Its growth and credentials position it to achieve mass adoption in the coming crypto cycle.

Especially, even though in the barren environment and tough situation, Jito’s achievements are remarkable and note-worthing. Launched in November 2022 amidst the fallout of FTX's collapse, Jito has thrived as the first liquidity staking platform on Solana with MEV rewards. Unlike other staking protocols, Jito uniquely distributes additional MEV earnings to liquidity providers atop usual staking yields.

Apart from focusing on liquidity staking, Jito Labs actively develops MEV infrastructure for Solana as well. They created Jito-Solana, the first third-party validator client, to efficiently capture MEV revenue while minimizing network congestion from the bombardment of bots in Solana. With this dual approach, Jito is strategically positioned to benefit as both the Solana DeFi ecosystem explodes and their validator client adoption grows. The recent sunset of staking giant Lido also clears the runway for Jito to assume greater share of Solana's booming staking liquidity. The growth figures validate Jito's product-market fit. Total value locked has surged 40x from $13M in June 2022 to over $500M presently. Meanwhile, validator share of the custom Jito-Solana client has swiftly climbed to 46% since its August 2022 release. Jito is seeing hypergrowth in both liquidity from retail-side and validator adoption in supplier-side.

Moving forward, the newly established StakeNet demonstrates Jito Lab's ambitions to responsibly scale influence. By coordinating staking providers, StakeNet aims to preserve decentralization and transparency - two pillars of DeFi's ultimate purpose. With this balanced approach, Jito seeks to unlock the full possibilities of liquidity staking and DeFi on Solana. The success of Jito's hybrid liquidity staking and MEV strategy spotlights its first-mover advantage to shape Solana's DeFi future. Backed by surging adoption and TVL, Jito may soon become the default for staking and realizing MEV profits across the network.

To first understand Jito’s value, you should understand a structure of transactions and how MEV works in Solana a little bit. Due to the extremely cheap cost and indeterministic properties of the transaction of Solana, there is nothing to prevent MEV bots from exploiting the network relentlessly. If you’ve had problems sending transactions on Solana during price volatility, you have experienced the chaos these bots cause.

Source: Lifecycle of a Solana Transaction

On Solana, clients update the runtime by submitting a transaction to the cluster.

This transaction consists of three parts:

Instructions(One or More): Specifies what code the transaction should run on-chain

Array of accounts to read or write from

Signatures(One or More)

Source: Lifecycle of a Solana Transaction

When a user signs it in their wallet, the wallet sends the transaction to an RPC server, operated by validators who interface with users. Upon receiving a transaction, RPC servers forward the transactions to the current leader and the next two leaders. Once signed transactions reach the current leader, the leader validates signatures, initializes accounts, and performs other steps to pre-process transactions. The leader then produces a block for four consecutive slots.

Solana client, which is built by Solana Labs, uses a multi-threaded scheduler as a default. This default scheduler assigns transactions randomly to various parallel queues. Each queue orders transactions by priority fees and time received. Importantly, no global ordering exists across threads. Rather, transactions are only ordered within local thread’s queue.

Interacting accounts, which is determined in the transactions, get locked to safely access state during execution. Before executing a transaction, a thread attempts acquiring the necessary locks for the accounts. Transactions failing to obtain necessary locks are re=queued and tried later. This parallel scheduling system allows Solana to maximize transaction throughput at low latency across validators.

Solana transactions currently involve two parts - a fixed base fee and an optional priority fee. The base fee is set at 5000 lamports(0.000005 SOL) per signature. The priority fee, specified in microlamports per CU(Compute Unit) requested, enables transactions to be prioritized. Transactions with a higher priority fee are non-deterministically prioritized by the multi-threaded scheduler. If a payer lacks sufficient SOL at the time of submission, their transaction is skipped and deemed invalid.

For each fee type, 50% goes to the leader as a block inclusion incentive while 50% is burned. This split aims to sustain block production while mitigating inflation. In principle, raising the priority fee should increase inclusion chances. But in practice, the continuous block production means transactions with priority fees can still follow transactions without priority fees.

As such, priority fees only assist searchers who are moderately fast - they do not help searchers who are drastically slower than the pack. Empirically, priority fees rarely exceed 0.02 SOL even for arbitrage bots. This suggests priority fees effectively price general blockspace but fall short for pricing specific blockspace(e.g. priority gas auction) or reducing spam transactions.

Solana is a low-cost blockchain with a deterministic flat transaction fee based on signature count. Currently, the fee is almost negligible; 0.000005 SOL per signature. Unlike Ethereum, Solana does not artificially constrain throughput and instead focuses on scaling bandwidth and compute. Without scarce blockspace, Solana has no need for a public mempool. Validators know the block producer ahead of time, allowing them to directly submit transactions to the leader - the one who is responsible for proposing that block in the slot.

This optimized architecture enables Solana's speed and scalability, facilitating 400-600 millisecond block times. With blocks produced at regular high-frequency, a leader's goal is maximizing transactions executed per fixed window. It makes Solana as an optimal choice for applications which require low latency. However, Solana's raw throughput brings its own challenges in handling the MEV Bots and the health of the entire network.

2.3.1 Searchers spam the network to get MEV opportunities

Solana processes transactions as first-come first-served. Thus, the first searcher who submit the bundle might win the MEV opportunity. Solana searchers compete on speed, instead of a fee bid. To prevent packet loss, searchers submit duplicate messages multiple times - congesting the network. These spikes in blockspace demand have disrupted Solana few times before. Although priority fees and the QUIC protocol are applied to help mitigate congestion, incentives remain for searchers to spam transactions as long as MEV opportunity exists. Without infrastructure to align incentives and communicate signals, searchers are encouraged to amplify activity to boost inclusion odds.

2.3.2 Failed transactions waste network resources

Source: Solving the MEV Problem on Solana: A Guide for Stakers

In the MEV space, numerous bots continuously monitor the blockchain, ready to submit transactions at any sign of an opportunity. Due to fierce competition, most of these transactions fail. Specifically, failed arbitrageurs' transactions on Solana make up about 58% of total transactions and 98% of total arbitrage transactions, as described in the figure above. To further reduce the latency of state change, searchers create an on-chain program that expoits the opportunity even with uncertainty. When activating these programs, searchers don't know if an opportunity is present and end up frequently making speculative calls. Despite many of these calls failing, the low transaction fees on Solana mean that the few successful ones can offset the costs of the others, making these strategies profitable overall.

2.3.3 Few searchers take most of the profit, incurring centralization

MEV extraction poses a potential centralization risk for blockchain networks. The accumulation of value by a single participant could translate into disproportionate voting power, potentially leading to long-term network vulnerabilities. In Ethereum's ecosystem, searchers compete for transaction fee, necessitating a significant revenue share with block proposers to stay competitive in the auction. Conversely, in the Solana network, the competition pivots on speed, encouraging the development of centralized, parallel solutions that favor a few advanced players with faster transaction processing.

This situation benefits the searchers exclusively. In Solana's current framework, searchers reap all the MEV profits, paying only minimal transaction fees to validators. This stands in stark contrast to Ethereum, where searchers typically retain about 30% of the profits, validator has almost no reward without proper auction process. Furthermore, a small set of searchers accounted for the majority of the total extracted value, underscoring the concentration of power and wealth.

Similar to Flashbots’ MEV-boost solution, Jito-Solana is a Solana validator client for MEV marketplaces. Their client mitigates a forementioned problems in Solana network by providing two benefits especially:

Less spam from MEV Bots

Higher revenue for validators, as they can capture profits through auctions

Source: Jito-Solana Is Now Open Source

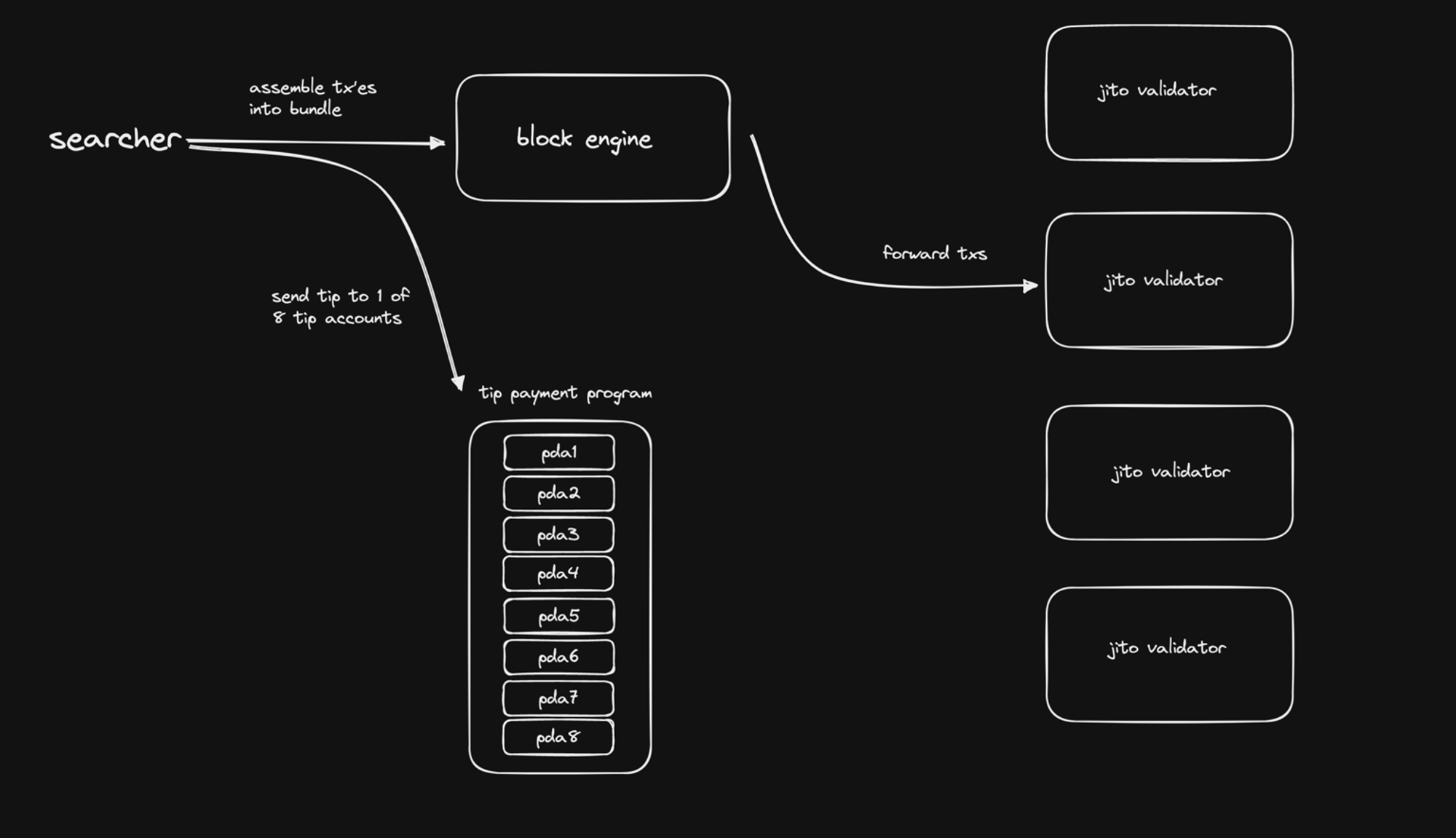

The Jito-Solana client introduces a Flashbot-like auction mechanism, akin to what's seen on the Ethereum mainnet. In this system, traders submit bids for bundles they believe will be profitable. These bids undergo complex simulations by external block engines, which determine the most valuable transaction combinations. Subsequently, these bids are shared with validators and JitoSOL token holders.

However, implementing auctions on Solana presents unique challenges compared to Ethereum and other blockchains. Ethereum operates on a fixed 12-second block time, during which its public mempool collects transactions. At the end of this period, a block is formed from these transactions and executed, creating a distinct time frame suitable for running an auction (accept bids for 12 seconds, then execute the highest bid). In contrast, Solana lacks a traditional mempool. Instead, transactions are sent directly to the network leader and executed on a first-in, first-out (FIFO) basis as they arrive, making it difficult to establish discrete time windows for auctions in its continuous time architecture.

The Jito MEV-client addresses this challenge by creating a pseudo-mempool, conducting auctions every 200 milliseconds. Under normal conditions on Solana, searchers can't identify target transactions until they're executed on-chain, as there's no mempool. This results in the majority of arbitrage MEV on Solana being back-runs.

Jito changes this dynamic. With Jito, searchers can view incoming transactions, simulate potential outcomes, and construct bundles around these transactions to ensure atomic execution. These bundles are then given priority access to the network leader through a dedicated processing pipeline, significantly increasing their success rate. Consequently, searchers' execution strategies shift from relying on probabilistic outcomes through transaction spamming to making decisions based on the highest bid in the auction.

Source: MEV on Solana

When validators operate the Jito-Solana client, searchers have the option to submit their transaction bundles to the Jito bundle auction. These auctions are conceptually similar to those run by Ethereum block builders. In scenarios like top-of-block or backrun opportunities, searchers send their transaction bundles with accompanying bids to this auction. Although these auctions introduce a delay (about 200 ms), pausing continuous block production, they facilitate more efficient MEV extraction by prioritizing price competition over speed. This process also reduces blockchain spam, as failed bundles don’t get recorded on-chain, enhancing the efficiency.

In the current Solana environment, most MEV is captured by searchers. When the leader uses the native Solana client, a searcher's primary strategies for ensuring transaction inclusion are through spam and priority fees, both of which are inherently unpredictable. Furthermore, with half of these fees being burned, the maximum MEV capture by the leader is capped at 50%, presenting an inefficient process for validators to harness the full MEV potential. However, under the Jito-Solana client, searchers can more effectively transfer value to validators through Jito bundle auctions. Since these auctions emphasize price competition, a larger portion of the extractable value must be offered in bids.

Source: Jito Docs

The Jito client is open-source and free to use, requiring no payments or approvals. However, Jito Labs manages a Block Engine that simulates transactions and processes specific trades. This Block Engine collects a 5% fee from the MEV revenue allocated to validators or stakers. Searchers who capture the MEV pay tips to incentivize the validators, submitting these through the Tip Payment Program. These tips are then aggregated by the Tip Distribution Program and distributed to validators and stakers via a configured Tip Distribution Account. At the point of distribution, 5% of the tips are taken as a fee by Jito’s Block Engine. It's important to note that this fee is only applied to the additional MEV earnings, ensuring that validators always earn more than their standard staking income.

The rising adoption of the Jito client by Solana validators signals an increasing acknowledgment of its benefits. Since its initial launch in August 2022, the Jito-Solana client has achieved a market share of 46% as of the current date.

Initially, until late 2023, the MEV rewards from the Jito-Solana client were minimal or even negligible. However, the recent surge in the Solana DeFi ecosystem has led to a significant increase in MEV rewards. This enhancement in profitability makes the choice to operate as a Jito validator or staker increasingly attractive, especially when compared to using the standard Solana client, due to the added advantage of sharing in the MEV profits.

From a research done by p2p.org, it was shown that, on average, Jito validators demonstrate superior uptime compared to other Solana validators. A significant difference in the stake-weighted average block production rate between Jito validators and others is evident, suggesting that the Jito client may enhance transaction block processing efficiency. However, note that this disparity in performance metrics between validators using the Jito client and those not using it cannot be solely credited to the client itself. Factors such as experience in operating validators, hardware configurations, network connections, and operating conditions could also play a role. The large number of Solana validators not utilizing the Jito client, potentially operated by less experienced individuals with more basic hardware, might contribute to these observed performance differences.

The Jito client has emerged as a essential contribution to the Solana ecosystem, offering validators and their delegators a novel revenue source through MEV opportunities and contributing to the network's stability. Furthermore, Jito has demonstrated superior performance for validators and enhanced overall network efficiency. As it gains wider adoption and Defi ecosystme of Solana matures, the MEV profits for Jito validators and their stakers become more substantial. This creates a positive feedback loop: the more validators use Jito, the more searchers are inclined to utilize it to boost their transaction inclusion probability, further attracting more validators to join for the additional revenue benefits.

Jito's contribution to the Solana ecosystem extends beyond offering client diversity; it also revitalizes the DeFi ecosystem through its innovative liquid staking token, JitoSOL. JitoSOL, a Solana liquid staking derivative, enables users to exchange their SOL for JitoSOL, maintaining SOL's liquidity and access to DeFi opportunities while accruing staking yields. Uniquely, JitoSOL rewards its holders with additional income from MEV extraction on Solana, additional to native staking yield.

Jito's traction in the market has recently accelerated, particularly with Lido's sunset, resulting in Jito collecting more total value locked (TVL) and surpassing its competitors. This growth has been further fueled by its airdrop and referral program, which have rapidly attracted liquidity. Jito's strategy leverages the anticipation of future airdrops effectively, encouraging users to hold JitoSOL or engage with JitoSOL in lending and decentralized exchange (DEX) pools. Jito's JTO token airdrop on December 7th made a significant impact, temporarily surpassing Lido in valuation and marking one of the most lucrative airdrops in the crypto space. This success has positioned Jito as the second-largest liquid staker in the market, now posing a threat to Marinade’s leading status.

Jito is not only diversifying its presence within the Solana ecosystem but also bolstering its role in the broader DeFi landscape. The adoption of liquid staking on Solana has been slower than expected, especially when compared to Ethereum. Lucas, the founder of Jito Labs, attributes this to several factors: unclear communication of liquid staking's value proposition; and the lack of technical and institutional-grade products. As more DeFi protocols emerge on Solana, liquid staked SOL will become increasingly preferred, akin to stETH on Ethereum.

In the context of MEV, Solana exhibits less activity per dollar volume than Ethereum. This is due to tighter spreads in centralized order books like Serum compared to AMMs, a lack of common sandwich attack strategies, and aggregators like Jupiter that mitigate arbitrage opportunities by sourcing liquidity from various sources. Nonetheless, as Solana's DeFi sector grows, MEV could account for up to 20% of staking yields, mirroring Ethereum's landscape.

JitoSOL, as a liquid staked token, inherently bears yield, deriving value from the underlying staked SOL and accrued rewards. This quality positions it as a superior long-term value store compared to regular SOL. The acceptance of jitoSOL for boost by emerging DeFi protocols on Solana will create incentives for users to buy and stake jitoSOL, thereby increasing these protocols' TVL and volume. Moreover, the combination of high APY from staking and shared MEV profits transforms jitoSOL into a lucrative asset for protocols, allowing them to unlock yield and revenue for their stakeholders, not just SOL holders.

In essence, jitoSOL’s auto-compounding high yield and potential as a protocol revenue driver uniquely position it to become a fundamental asset in Solana's DeFi ecosystem. As it accumulates more value, jitoSOL is likely to catalyze a positive cycle of adoption among new protocols.

Current liquid staking tokens (LSTs) on Solana are dependent on centralized entities for crucial operations like staking pool management and delegation rebalancing. This centralization poses several challenges to the growth and decentralization of LSTs. Centralized admin keys and hot wallets create risks of a single point of failure. Additionally, there's a lack of transparency in critical areas such as scoring algorithms and delegation strategies, raising concerns about long-term sustainability, especially given the resource-intensive nature of maintaining custom staking bots. If the operating team ceases operations, the LST could become non-functional.

Such centralization contradicts the foundational principles of DeFi and introduces various risks, including censorship, hacking, and potential shutdowns. This current structure is not conducive to widespread LST adoption. A case in point is Lido's decision to sunset its stSOL, which was a significant player in the Solana DeFi space and the second-largest LST at the time. This decision highlights the tangible risks associated with centralized control within liquid staking protocols.

Source: Breakpoint 2023: Jito StakeNet: A Protocol for Timeless LSTs

Jito has identified key issues in current liquid staking tokens (LSTs) on Solana and is introducing a groundbreaking solution: Jito StakeNet. The initial goal is to utilize StakeNet for JitoSOL operations in a permissionless manner, with plans to expand its use to other leading Solana stake pools through community collaboration.

StakeNet comprises two main components:

Validator History Program: This program stores up to three years of detailed data for every validator, including stake amounts, vote credits, commission, software version, and IP addresses. It ensures data integrity by sourcing information directly from on-chain accounts and gossip data, providing a transparent and authentic record for making informed decisions.

Steward Program: Utilizing the on-chain validator history, the steward calculates scores and stake delegation for each validator. A network of keepers coordinates this process, continuously directing stakes to high-performing validators. This system replaces the traditional hot wallet with a Program Derived Address (PDA) controlled by the Steward, enhancing security and automating stake delegation.

By transitioning all staking logic to the on-chain and employing decentralized keepers and governance, Jito StakeNet addresses the centralization, transparency, and sustainability issues prevalent in current LST designs. It paves the way for more widespread adoption and innovation in LST protocols on Solana by providing a transparent, decentralized foundation for staking. This approach promises truly decentralized LSTs without single points of failure, increased protocol auditability, simplified launches of complex staking dApps, and the use of tamper-proof validation data for research. Importantly, it could also attract institutional capital that demands such levels of decentralization and transparency. Jito StakeNet has the potential to catalyze a new phase of growth for decentralized staking on Solana.

The Solana ecosystem is currently experiencing rapid growth, and within this flourishing landscape, Jito stands out as one of the most promising protocols. Jito has already achieved significant success, securing the second-highest market share in client adoption and liquid staking protocols. With its remarkable ascent, Jito appears to have no close rivals and is even expected to soon become the market leader.

The strategic importance of Jito's recent airdrop, combined with Lido's exit from Solana, has been instrumental in Jito's market takeover. As the Solana DeFi ecosystem expands, Jito is well-positioned to accumulate substantial benefits. An increase in MEV rewards would result in greater profits for validators and JitoSOL stakers. Moreover, the JitoSOL token itself holds potential for wider utilization in various DeFi protocols, such as DEXs or lending platforms, enhancing its utility.

Jito's growth represents a positive development for the Solana network as a whole. The protocol is committed to enhancing the health of the Solana network with its MEV-enabled client and further decentralizing liquid staking protocols through StakeNet. This approach indicates that Jito’s expansion is not a zero-sum game but rather a contribution to the ecosystem's overall health and growth.

The interplay of Jito's activities in the fields of MEV, validator operation, and liquid staking protocols is creating a positive feedback loop, fostering greater adoption and innovation in the future. Looking forward, it is exciting to anticipate further growth in Solana's DeFi sector and Jito's continued expansion, marking a new era of development and opportunity in the Solana ecosystem.

Thanks to Kate for designing the graphics for this article.

We produce in-depth blockchain research articles

Let’s learn about Sei DB, one of the most important features of Sei v2.

This covers the Injective Network, which has undergone consistent development and change in the market over the past four years.

Solana is the leading integrated blockchain featuring parallel processing, low fees, and fast transactions. With their practical and developer-friendly technology stack, Solana is rapidly building a unique ecosystem for real-world adoption, overcoming a series of crises and regaining market share.

Explore the origins of the Sui blockchain and its technologies in detail, and investigate how Sui differs from other blockchains