The trend of inscriptions that originated in the Bitcoin network has spread to many other networks since November, significantly impacting them. Over a period of approximately six weeks starting from mid-November, inscription transactions accounted for a remarkable 50% of the total transactions across major EVM networks.

An examination of the token inscription methods employed across various networks reveals that although the majority utilize a JSON format akin to BRC-20, their approaches to on-chain recording differ significantly. The article delves into the various inscription techniques and their impacts on networks including Ethereum, Arbitrum One, Avalanche C-Chain, zkSync Era, Polygon PoS, Solana, Cosmos, and Celestia.

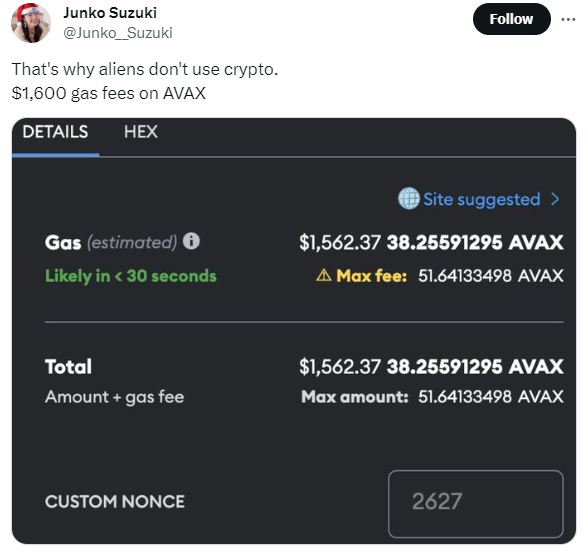

Source: @Junko__Suzuki

At the hopeful year-end, when everyone eagerly awaits the approval of a BTC spot ETF, various EVM networks experienced tremendous difficulties due to Inscription. On December 15th, the Arbitrum network could not withstand the numerous Inscription transactions, causing its sequencer to stop for 1.5 hours, failing to process users' transactions. The Avalanche network saw a transaction fee soar to over $1,500, and from December 13th to December 25th, over $38.7M in gas was used in Inscription-related transactions, causing congestion in the network.

Not only EVM networks but also networks such as Celestia, Injective, Cosmos, and other parts of the Cosmos ecosystem, Aptos, Sui in the Move ecosystem, Solana, and the Telegram Open Network experienced a surge in Inscription activity. This article will explore what Inscription is, how it occurs on networks other than the Bitcoin network, and the results it has produced.

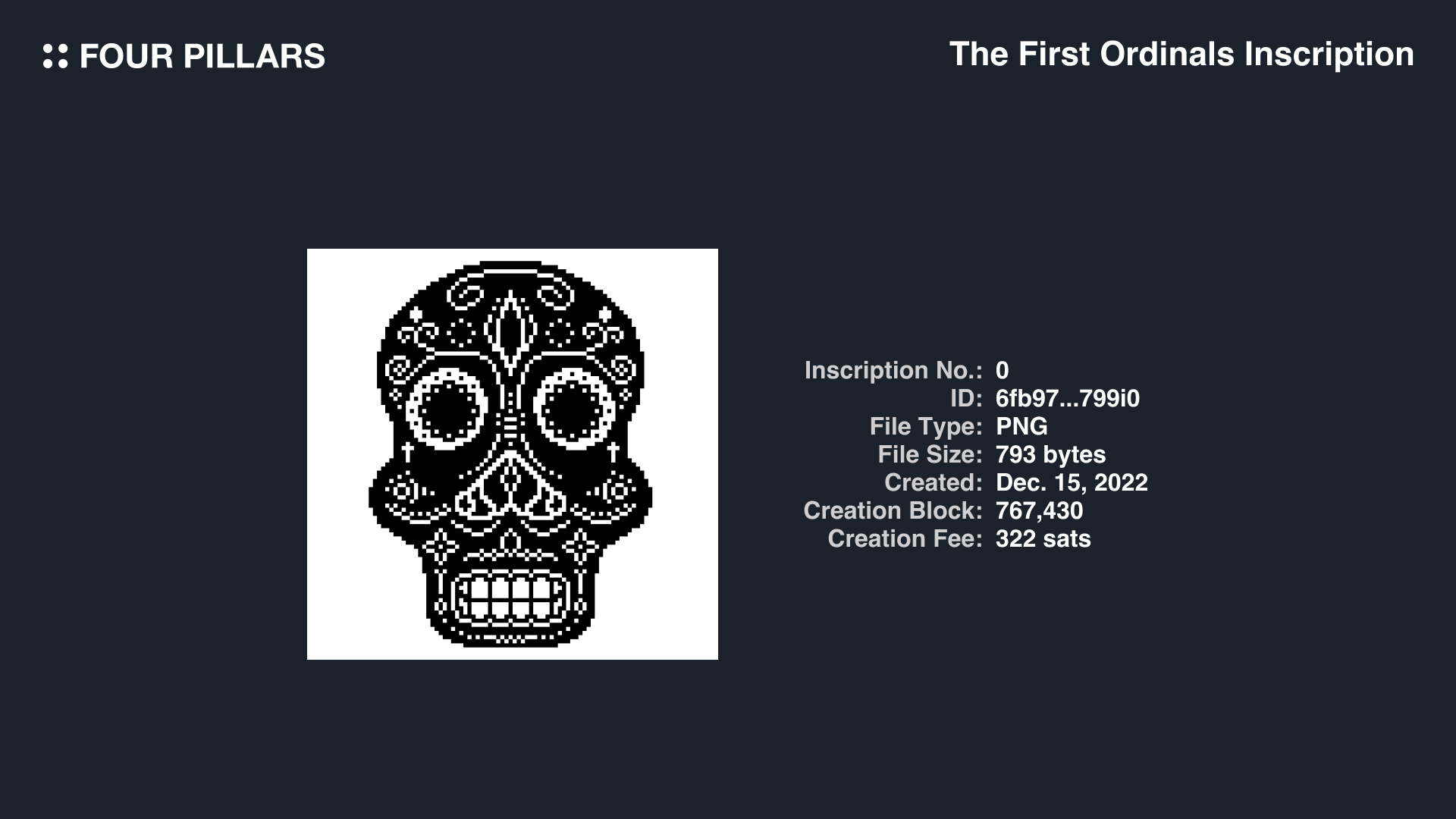

To understand inscriptions, it's essential first to grasp the concept of Bitcoin Ordinals. Ordinals are a protocol that allows recording arbitrary data on the smallest unit of Bitcoin, known as satoshis (sats), utilizing the Bitcoin network's SegWit and Taproot upgrades. Unlike Ethereum NFTs, Bitcoin Ordinals are considered true NFTs because the data, including images and videos, are directly recorded on the Bitcoin blockchain. The Ordinals ecosystem has grown rapidly, starting with the first inscription of a skull image. Notable NFT projects like DeGods and Yuga Labs have been minting NFTs using Ordinals, and even low-spec games playable on the Bitcoin blockchain have been recorded. Recently, Sotheby’s announced the auction of the first Ordinals PFP collection, Bitcoin Shrooms.

2.2.1 BRC-20 Overview

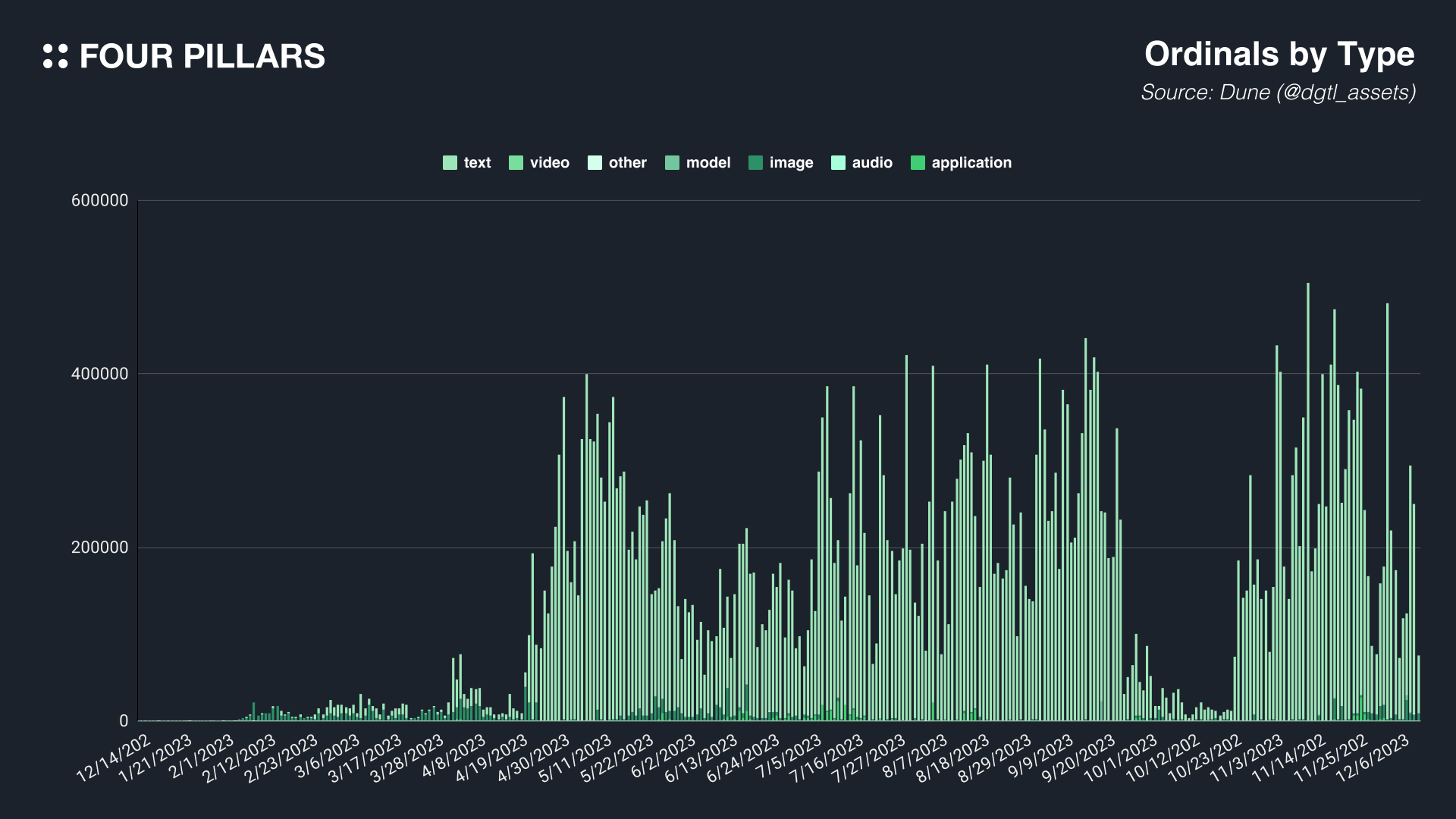

Shortly after the launch of Ordinals, most of the data inscribed were image files. However, the peak era of the Ordinals began with the introduction of a concept called BRC-20 by Domo. The BRC-20 standard was initially an experiment to implement fungible tokens (FT) on the Bitcoin network. It uses Ordinals to record text in a specific JSON format onto satoshis, thereby realizing the implementation of FTs.

2.2.2 BRC-20 Operations

The BRC-20 standard involves three types of operations: 1) Deploy, 2) Mint, and 3) Transfer. To create a BRC-20 token, a text conforming to the Deploy format must be recorded on a satoshi. Tokens can be issued through the Mint operation and transferred using the Transfer operation.

p: Protocol (e.g., brc-20, orc-20)

op: Operation (e.g., deploy, mint, transfer)

tick: Token ticker (e.g., ordi, sats)

max: Maximum issuance of tokens (e.g., 21000000)

lim: Maximum number of tokens per Mint (e.g., 1000)

amt: Number of tokens to Mint/Transfer (e.g., 300, 1000)

For BRC-20 tokens that are only deployed, anyone can issue them on a first-come, first-served basis using the Mint operation. Even if the 'lim' is set at 1000 and the 'amt' specified in the Mint operation exceeds 1000, or if the total minted tokens exceed the 'max' value, the corresponding text for the Mint operation can still be recorded on satoshis. However, this would contravene the text specified in the initial Deploy operation. Therefore, off-chain indexers like BRC-20 explorers (e.g., unisat, brc-20.io) should track and filter such instances effectively.

Transferring tokens in BRC-20 involves recording text conforming to the Transfer operation format on a satoshi and then sending that satoshi to the recipient. This means that even if a user 'A' holds only five satoshis with a Mint operation text for issuing 1000 ORDI each, A's ORDI balance might not be 5000. This discrepancy can occur because A might have recorded ORDI Transfer operation texts on other satoshis and then transferred them to different users.

2.2.3 Impact of BRC-20

BRC-20 has had a significant impact on the Bitcoin network. During the height of BRC-20 token minting in May 2023, transaction fees soared to as high as 635 BTC in a single day. The first BRC-20 token, ORDI, achieved a market capitalization of $1.4 billion as of December 26, ranking it 56th among all cryptocurrencies in terms of market cap. However, what's even more remarkable is that the influence of BRC-20 and Ordinals inscriptions extends beyond just the Bitcoin network.

Just as a swarm of locusts ravages crops, the trend of Inscriptions is sweeping through various networks beyond the Bitcoin network. This phenomenon is not limited to the previously mentioned Avalanche and Arbitrum cases in '1. What Happened?' but is also prevalent in numerous networks like Polygon PoS, BNB, and non-EVM networks such as Solana and TON. From November 15 to December 26, Inscriptions accounted for a staggering 50% of all transactions on major EVM networks, meaning that half of the transactions during this six-week period were Inscriptions. In extreme cases, the Fantom network experienced 97.8% of its transactions as Inscriptions from November 23 to 26, and Avalanche saw 92.6% from December 14 to 25, highlighting the significant impact of Inscriptions at the network level.

Interestingly, while Inscriptions aim to achieve similar goals across different networks, their implementation methods and impacts on the networks vary. Therefore, this part will examine the implementation methods and impacts of Inscriptions on each network.

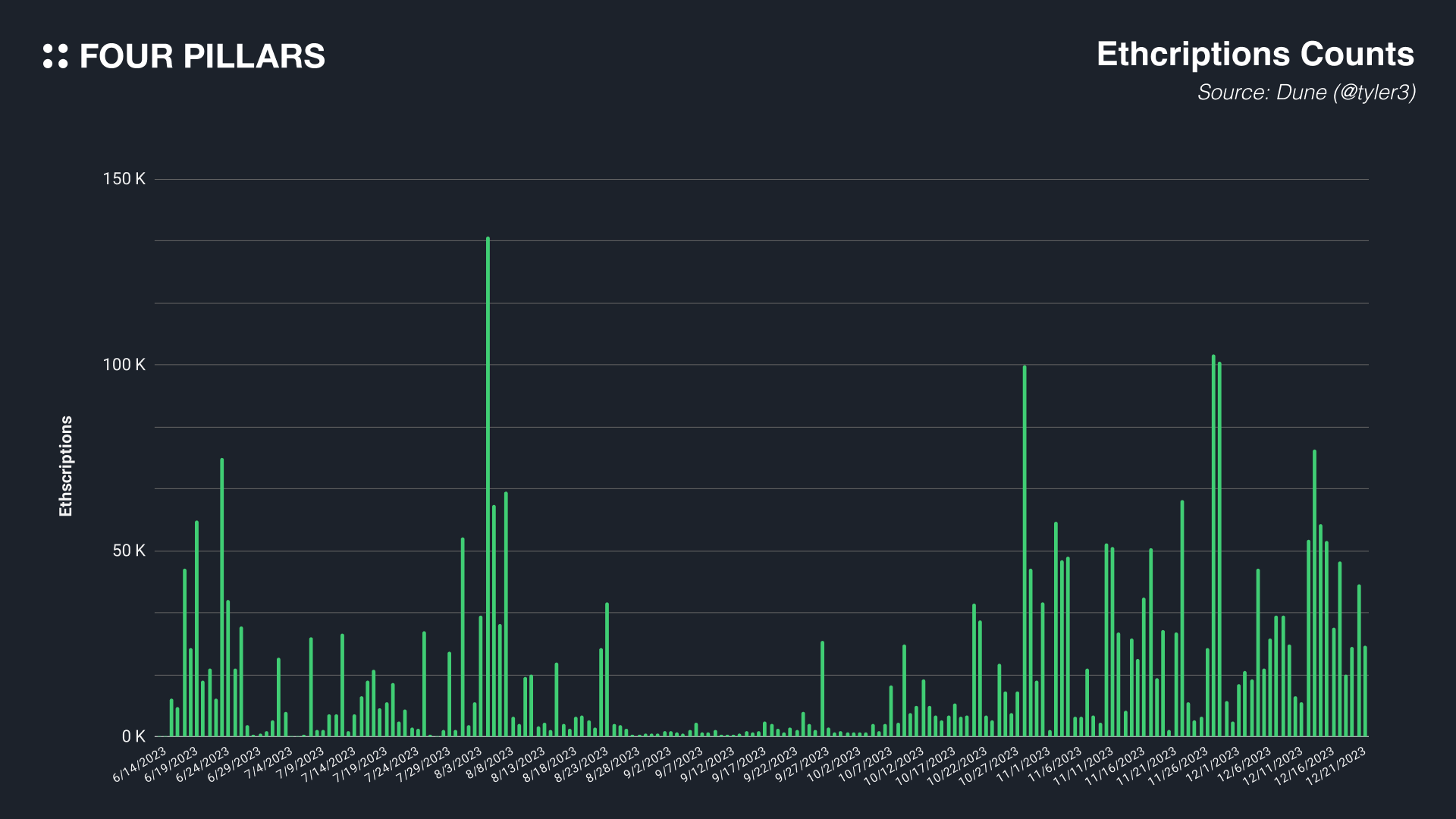

3.2.1 Ethscriptions

Among EVM networks, Ethereum was the first to popularize Inscriptions. The earliest Inscription service on the Ethereum network was Ethscriptions, started by Tom Lehman in June 2023. Although Ethereum generally has high transaction fees which limited Inscription activities, the significance lies in the fact that other EVM networks followed the Ethscription model.

3.2.2 Ethscriptions Basics

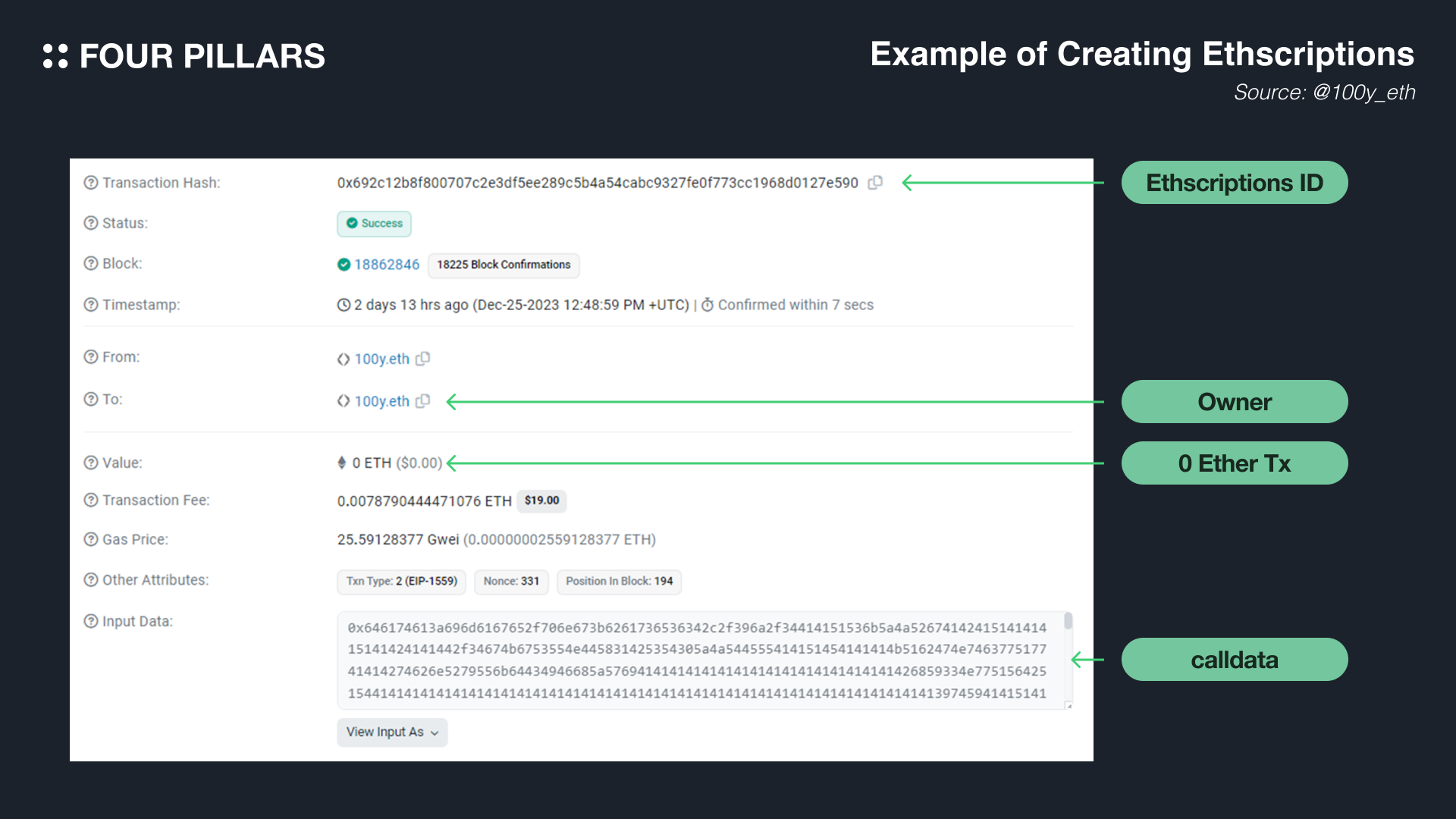

Ethscriptions records arbitrary data in the calldata existing on the Ethereum network. Calldata is a field associated with transactions used to record arguments required for calling specific functions in smart contracts. Ethereum-based rollup networks also use calldata to store transaction data. Notably, while Bitcoin Ordinals can record up to 4 MB of data in a satoshi, Ethscriptions is limited to recording only up to 96 KB in its calldata.

Anyone can easily create an Inscription on the Ethereum network using the create tab on the Ethscriptions website. While Bitcoin Ordinals involves recording data in satoshis, which allows for ownership determination through those satoshis, the calldata on the Ethereum network is not owned by anyone. To establish clear ownership of an Inscription, the Ethereum network utilizes a '0 Ether transaction.' By creating a transaction sending 0 ETH to oneself, the creator of the Ethscription becomes its owner, and can store up to 96 KB of arbitrary data in the calldata of that transaction. The Ethscriptions ID is determined by the transaction hash of the transaction in which the Inscription was first created. For text, the calldata directly contains the text, while for images, the Base 64-encoded URI is converted into hex data and stored.

The transfer of Ethscriptions also occurs through a '0 Ether transaction.' To transfer an Ethscription, the creator inserts the Ethscriptions ID (the hash of the original transaction) into the calldata and creates a '0 Ether transaction' to the address to which the Inscription is being transferred. This process changes the ownership of the Inscription.

3.2.3 Ethscriptions Impacts

Among EVM networks, Ethereum was the first to experience the trend of Inscriptions, but their impact on the network was relatively minor. For instance, on August 5, 2023, the peak day for Ethscriptions transactions, they only constituted about 12.0% of all transactions. This modest impact is attributed to Ethereum's generally higher transaction fees compared to other EVM networks. Nonetheless, the method pioneered by Ethscriptions paved the way for the widespread adoption of Inscriptions across other EVM networks.

In contrast to the early onset of Inscription activities on the Ethereum network, other major EVM-based networks saw a surge in Inscription activities post-November 2023. All these networks, being EVM-based, experienced Inscription activities by storing arbitrary data in the calldata area, similar to Ethscriptions. Networks where Inscription activities were particularly prominent include Polygon PoS, Avalanche C-Chain, and BNB Chain. Although all these networks are EVM-based, the impact of Inscriptions varied significantly across them, leading the community to regard this trend as a stress test for blockchain technologies.

3.3.1 Arbitrum One

On Arbitrum One, a massive surge in Inscription activities occurred due to the fair-20 standard token called fair. Transactions related to the fair token amounted to roughly 8M, comprising the majority of Inscriptions on the Arbitrum network. The Fair20 website reveals a mission to bridge BRC20 and EVM networks, but the lack of updates on their official Twitter account post-minting suggests uncertainty in their roadmap. Transactions associated with Fair20 led to a significant load on the Arbitrum One sequencer, causing it to halt for 1.5 hours.

3.3.2 Avalanche C-Chain

While Arbitrum One experienced a one-off surge in Inscription transactions, the Avalanche C-Chain has been seeing steady Inscription activities throughout November and December. Inscriptions on Avalanche are primarily minted through Avascriptions, supporting asc-20 token distribution and marketplace transactions. The largest market capitalization asc-20 token is avav, with a whopping market cap of $55M. A sudden increase in Inscription activity at one point led to a spike in transaction fees on the Avalanche C-Chain, causing inconvenience to users. It is noteworthy that, as mentioned earlier, from December 13 to 25, the gas fees related to Inscription transactions alone exceeded $38.7M.

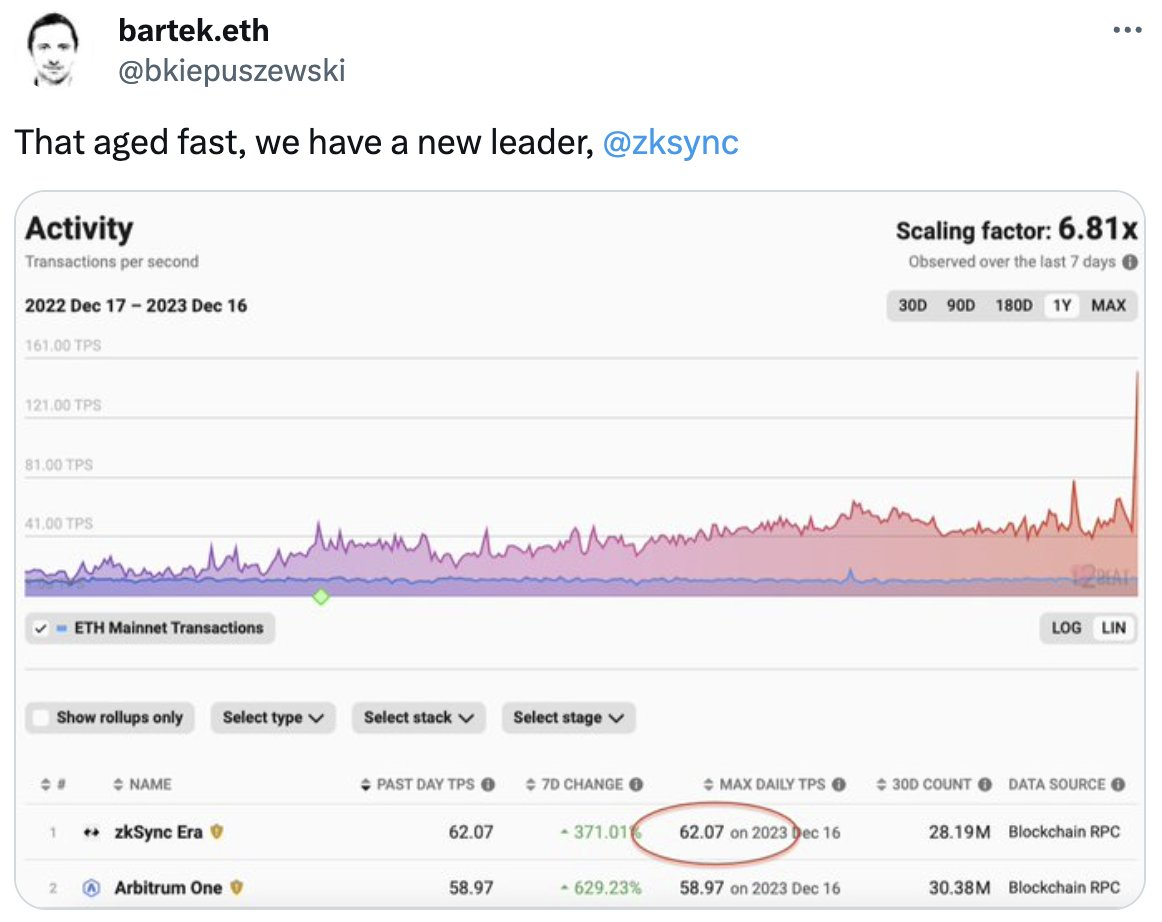

3.3.3 zkSync Era

Source: bartek.eth

In the zkEVM Layer 2 ecosystem, zkSync Era emerged as a standout performer. On December 16, 2023, as Inscription activities surged, zkSync showcased the highest TPS among all rollup networks. During a 14-hour span, zkSync Era maintained an impressive performance by handling 150 TPS with an average transaction fee of $0.12. However, it eventually encountered a database-related issue, leading to about 15 minutes of downtime. Interestingly, despite the sharp increase in transactions, the transaction fees decreased. This is because zk rollup networks batch transactions and submit them to the Ethereum network with proofs. As long as there is no intense competition for priority fees, the cost per zk proof decreases with the increase in the number of transactions.

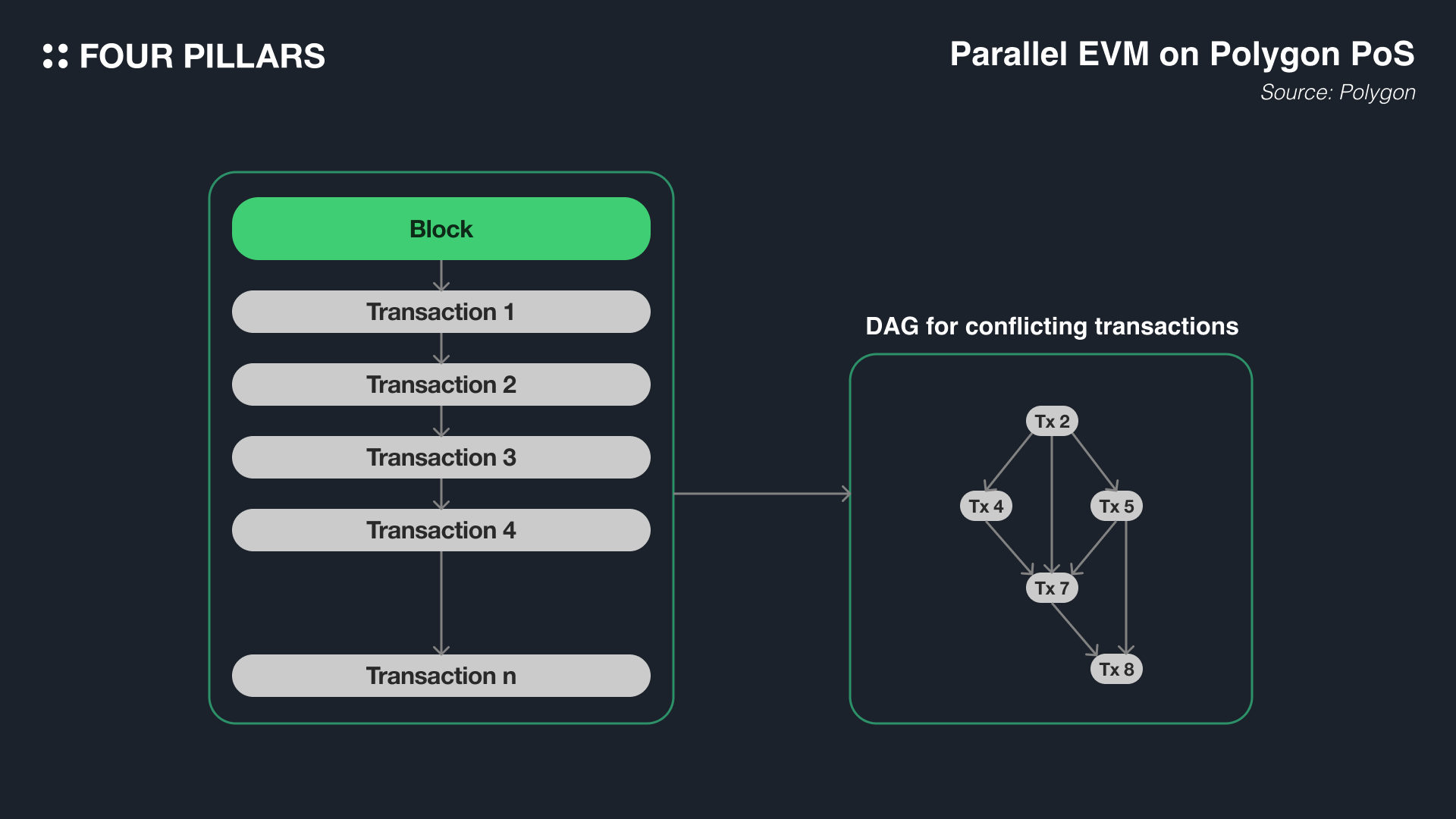

3.3.4 Polygon PoS

Polygon PoS, along with Avalanche C-Chain, was one of the chains with the highest Inscription activities. From mid-November, as activities related to prc-20 token standard surged, so did the transactions. However, unlike Avalanche and Arbitrum, the Polygon PoS network neither halted nor exhibited extreme spikes in gas fees. This can be attributed to Polygon PoS adopting a Block STM-based parallel EVM, distinct from other EVM networks.

EVMs inherently process transactions sequentially, a major bottleneck limiting the scalability of EVM-based networks. To address this, understanding the dependencies among transactions submitted by users is crucial for parallel processing at the virtual machine level. Transactions that do not depend on each other can be processed in parallel without issues. However, processing interdependent transactions in parallel could cause problems if the processing order affects the outcome.

Polygon PoS adopted Aptos Labs' parallel processing technique, Block STM, and implemented it during the July 2023 Indore Fork update. Block STM initially executes transactions assuming they won't conflict; if a conflict is detected, it rebuilds the block. However, given Polygon PoS's vast ecosystem, developers found that transaction conflicts were common. Instead of rebuilding the block, which was deemed redundant and caused overhead, Polygon decided to add a DAG (Directed Acyclic Graph) to the block metadata. This DAG acts like a map, showing transaction dependencies, enabling nodes receiving the block to easily check which transactions conflict without needing to reconstruct the block.

Source: Polygon

Polygon publicly shared the results of testing the parallel EVM in December 2022, achieving about a 1.6-fold improvement in TPS. Thanks to the introduction of parallel EVM, Polygon PoS could withstand the Inscription stress test without major impact.

Special thanks to @b_loved_deok from Ativ for assisting with the analysis of Solana Inscriptions.

Solana, now a major ecosystem following Bitcoin and Ethereum, also couldn't escape the Inscription craze. Compared to other ecosystems, Solana's approach to Inscriptions is relatively complex. Solana Inscriptions primarily follow the libreplex protocol. When a user generates an Inscription transaction, the JSON format text is stored in a specific account, and corresponding FTs and NFTs are minted. The FTs are escrowed in the program, while the NFTs are immediately transferable and sent to the user's wallet.

Source: Solscan (Sa3…wqM)

The example provided is a direct spl-20 Inscription minting transaction from solscribe.io, based on the libreplex protocol. The Inscription information is stored in the 56h…LJR account, an NFT corresponding to Hu9…DBy is minted to the wallet of 100y.sol, and 100 general tokens corresponding to 6Au…Jrw are escrowed to 5Tz…YPh. By accessing the account information of 56h…LJR, you can view the JSON formatted text inscribed with 100y tokens, as shown in the image below.

Source: @b_loved_deok

Solana's most notable Inscription token, SOLS, experienced a significant price surge on Magic Eden, although the Inscription activity itself hasn't garnered much attention since its peak in November 2023.

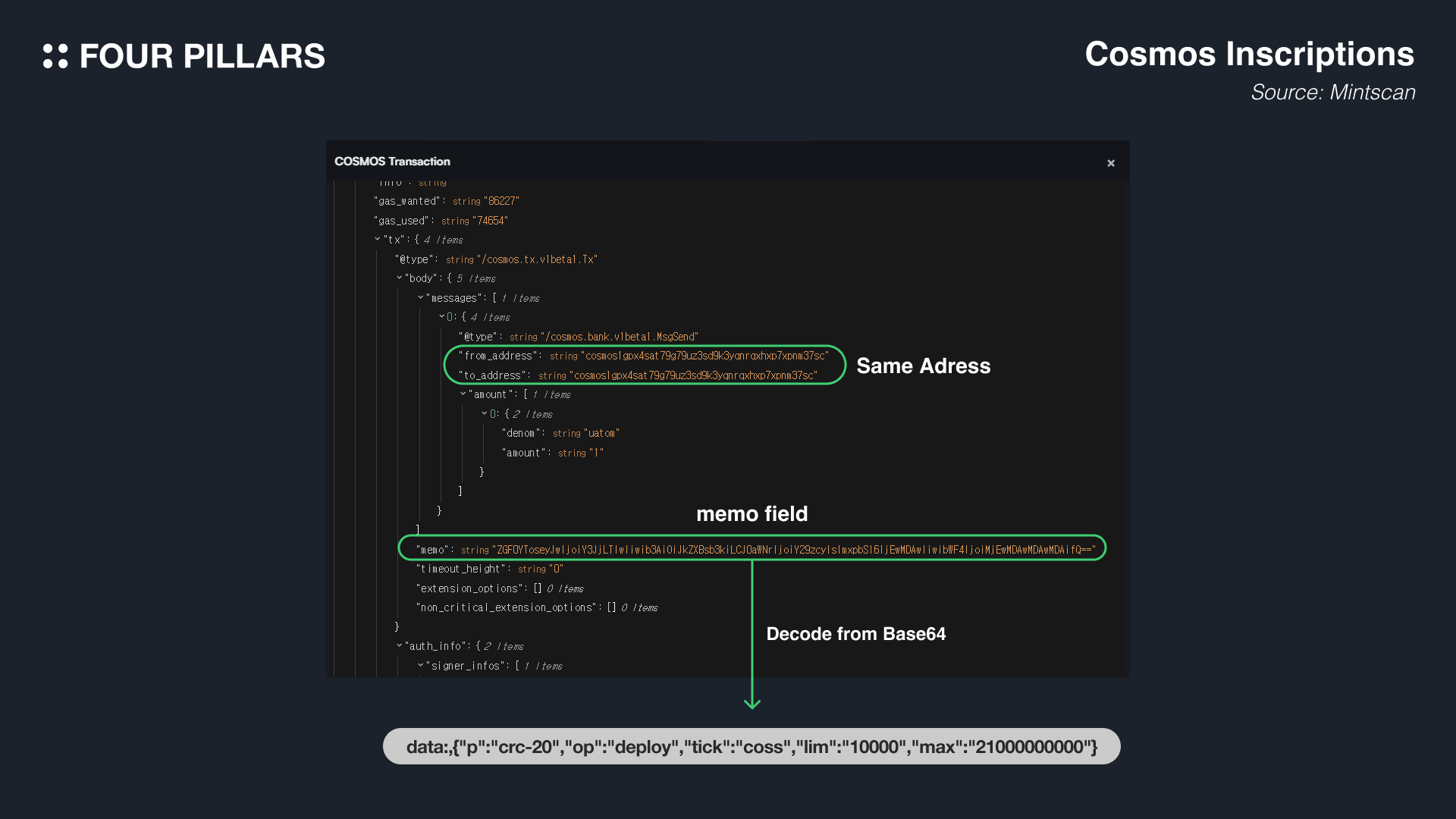

3.5.1 Cosmos Hub

The first Inscription token on Cosmos Hub is the crc-20 standard COSS token. As of December 29, COSS has a market capitalization of $6.2M. The Inscription process on Cosmos mirrors that of EVM networks. Cosmos transactions have a memo field where any file can be recorded. To create an Inscription transaction, a transaction sending 1uATOM (=0.000001 ATOM) is created, similar to Ethereum's '0 Ether transaction'. The figure's example shows the deployment of a COSS token, creating a transaction that sends 1uATOM to oneself. Decoding the base64 formatted text in the memo field reveals a text following the crc-20 standard. The JSON formats for Deploy, Mint, and Transfer operations in crc-20 are the same as those in brc-20.

3.5.2 Celestia

The first Inscription token in Celestia is the cia-20 standard CIAS token. Similar to Cosmos Hub, a transaction sending a small amount of TIA (≥ 1 uTIA) to oneself is created, and the desired operation's base64 format is entered in the memo field. Decoding the base64 format ("ZGF…CJ9") in the memo field of CIAS's first deployed transaction reveals {"op":"deploy","lim":10000,"max":21000000000,"tick":"cias","p":"cia-20"}, which can be verified.

3.5.3 Injective

The injrc-20 standard in Injective also uses the same method as mentioned above for Cosmos and Celestia. However, the first token of the injrc-20 standard, INJS, encountered several issues related to fees in the Minting process and had to announce a suspension of services due to the participation of many bots, which is contradictive to fair launch, a critical aspect of Inscriptions.

In addition to the networks we have explored, Inscription activities have spread like an epidemic across many other networks.

Aptos: apt-20 is the prominent standard here. There was a brief surge in activity on December 10-11, followed by a sharp decline.

Sei: Despite being a network with low fees, Sei experienced active Inscription activities, generating network fees of approximately $0.5M. Thanks to its optimization for transaction processing, Sei did not face any issues related to Inscriptions.

Near: NEAR introduced its first Inscription service, NEAT, following the nrc-20 standard. To store data, users need to call the inscribe function of the inscription.near contract and store data in the function call arguments field.

TON: TON network's first Inscription service is Tonano, introducing the ton-20 standard. There were 83M transactions, leading to a slowdown in transaction processing due to the overload.

The year 2023 started with Bitcoin Inscriptions and ended with Inscriptions across all networks. While the BRC-20 standard on the Bitcoin network, with limited smart contract capabilities, garnered much interest, it begs the question: why did Inscriptions become popular on other networks with their own token standards? The answer lies in fairness and speculation.

Most protocols issuing tokens typically allocate a portion to the team and investors. However, recalling Bitcoin's early mining, anyone could participate and mine tokens fairly. The same is true for Inscription tokens. Once someone deploys an Inscription token, anyone can mine tokens by creating Mint transactions with gas fees. Even the deployer can miss out on issuing tokens due to competition. This fairness, combined with the speculative success of BRC-20, sparked the Inscription craze in networks beyond Bitcoin.

Inscriptions, good or bad, have provided some implications for the blockchain industry. The first is utility. Inscription tokens, being merely on-chain recorded texts, struggle to offer utility. Furthermore, blockchains themselves are not designed to verify the text inscribed in tokens, making Inscription tokens reliant on centralized off-chain indexers. Despite the risks, the high level of activity causing network paralysis implies that speculation currently outweighs decentralization and security in blockchain utility.

The second implication is an inadvertent stress test. Inscriptions, spreading like an epidemic, naturally led to a stress test of blockchains. This revealed issues like network halts and soaring transaction fees in single EVM networks, drawing attention to parallel EVMs, next-gen VMs, and next-gen consensus mechanisms. Cryptocurrency markets saw a significant rise in tokens related to parallel EVMs, and it's expected that discussions on adopting parallel EVMs in the blockchain industry will increase.

Currently, although many Inscription tokens have been issued across various networks, only a few are actively traded, and many networks still lack Inscription market services. Whether Inscription activities on networks other than Bitcoin will shine next year or remain just a midsummer night's dream remains to be seen.

Thanks to Kate for designing the graphics for this article.

We produce in-depth blockchain research articles

The crypto industry, initiated by Bitcoin, has developed through the narrative game and is now entering a stage where its technical infrastructure is maturing. Crypto provides a foundation to assign economic value to any idea or interest and enables trading, paving the way for new types of applications and business models. Currently, the crypto industry faces the key challenge of developing popular applications and attracting users. To achieve this, it is necessary to actively apply strategies that leverage speculative demand as a core function.

This article is the last part of a three-part series covering the DeFerence 2024 event, sponsored by Four Pillars.

Base, aiming to onboard 1B onchain users, has emerged as a hub for consumer-oriented onchain applications within a year since its mainnet launch last year, driven by factors such as reduced fees, the memecoin frenzt, and the growth of social network applications like Farcaster. Unlike other blockchain ecosystems focused on DeFi and infrastructure, Base predominantly features consumer-oriented applications similar to Web2 services. It leverages a unique community and brand to onboard more applications. While social and community applications are the most actively developed, new categories of onchain applications in content, gaming, and commerce are also emerging, indicating significant potential for user expansion.

This article is the second part of a three-part series covering the DeFerence 2024 event, sponsored by Four Pillars.