The concept of the sharing economy, which involves lending idle goods or services to those in need to optimize resources, has become a consumer culture and economic system that is garnering significant attention in response to the shift towards more rational consumption patterns and the advancement of IT technology.

However, as the sharing economy market rapidly expands and the number of users increases, various negative side effects have become apparent, including a decline in service quality, monopolistic positions secured by early market entrants, and backlash and regulatory issues from existing industry workers.

Blockchain, which enables the digitization of a wider range of assets and expands economies of scale, can serve as an effective foundation for building the sharing economy. IO.NET is successfully completing the bootstrapping of computing resources, demonstrating its potential in this regard.

We are living in systems, a term that refers to a collection of interacting elements. These systems range from biological systems that sustain numerous lives to social communities sharing common values and identities, and even cosmic systems like galaxies where stars and planets interact. Through the lens of systems, we gain a deeper understanding of our surroundings, analyze them, and make improvements to create a better world.

The inherent purpose of a system is to function in an economically sustainable and stable manner. Therefore, the most crucial aspect of designing a system is the optimization and arrangement of its components (i.e., resources) - for instance, optimizing a healthcare system involves effectively deploying medical staff, electronic medical records (EMR), and telemedicine services to ensure that all patients receive timely and appropriate care. This enhances the efficiency of medical services, reduces treatment costs, and improves patient satisfaction and health outcomes.

However, as the complexity of each system's design increases with the growing diversity of requirements across all industries, the study of system optimization becomes increasingly important. This is exacerbated by the asymmetrical development among various service systems due to limited resources. The relatively recent concept of the sharing economy, which revolves around the idea of lending idle goods or services to those in need, has been providing significant insights into solving resource optimization issues in systems.

The act of sharing resources, like the large communal ovens in medieval European villages or the 'pumasi' culture in Korea where agricultural labor was shared, has been observed throughout history. However, the concept only started to take a business-oriented approach for profit generation (i.e., the sharing economy) relatively recently. Today, the sharing economy attracts significant attention primarily for two reasons: a shift toward more rational consumption patterns and advancements in IT technology.

Before the Industrial Revolution (i.e., in agrarian societies), there was generally a high demand for goods but limited supply. Post-Industrial Revolution (i.e., in industrial societies), although supply increased dramatically, it was not always easy to meet all demands, and there were occasional failures in demand forecasting. As we moved into a knowledge society, where production and technology advanced, both demand and supply became abundant - it's hard to find someone without a cell phone today, yet new models continue to be produced and consumed.

However, such pattern of overconsumption and overproduction, leading to surplus (i.e., stock and idle resources), began to burden both consumers and producers (i.e., suppliers) from the late 2000s, prompting a global shift toward more rational consumption patterns.

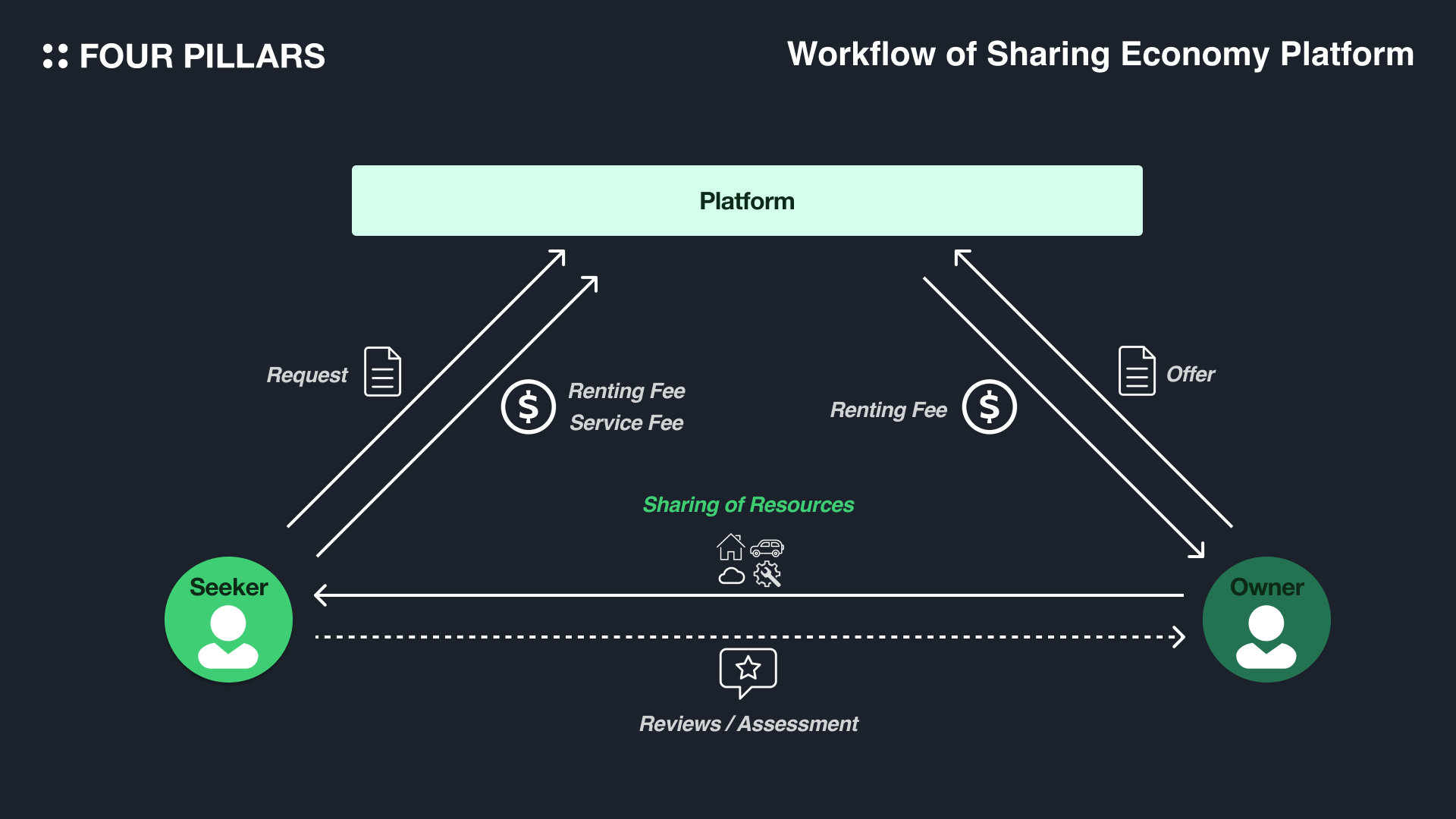

A rational consumption pattern not only involves consumers making thoughtful decisions about price and quality when purchasing goods but also includes sharing and reusing excess or surplus resources. Previously, physical constraints made it difficult to share these surplus resources. However, advances in IT technology have led to sophisticated digital platforms that facilitate connections between individuals, which has significantly contributed to the emergence of the sharing economy, connecting individuals seeking rational consumption with those aiming to maximize profits.

The sharing economy extends beyond individual resources to encompass an entire industry's resources, acting as a new economic system and culture of consumption that can drive social wealth and economic development in the digital age. Today, a wide range of platform services exist that enable not only individuals but also startups and large corporations to utilize various shared resources such as IT technology, data, software, and hardware that they need.

Ride-Sharing & Car-Sharing Services

Uber & Lyft - Connect drivers with their own vehicles to passengers

Turo & Getaround - Allow individuals to rent out their personal vehicles to others

Accommodation Sharing

Airbnb & Vrbo - Enable homeowners to rent out their houses, apartments, or rooms to guests.

Peer-to-Peer Lending

LendingClub and Prosper - Facilitate peer-to-peer lending, allowing individuals to lend idle funds directly to others without going through traditional financial institutions

Freelance and Task Services

TaskRabbit & Fiverr - Allow Individuals can offer or receive services such as furniture assembly, home repairs, and graphic design.

Clothing and Accessory Rentals

Rent the Runway & Poshmark - Facilitate renting or lending pre-owned clothing and accessories

Tool and Equipment Sharing

Fat Llama - Allow individuals be able to rent out tools they own to people in their community

Coworking Spaces

WeWork & Regus - Provide flexible shared workspaces for individuals or companies

ETC.

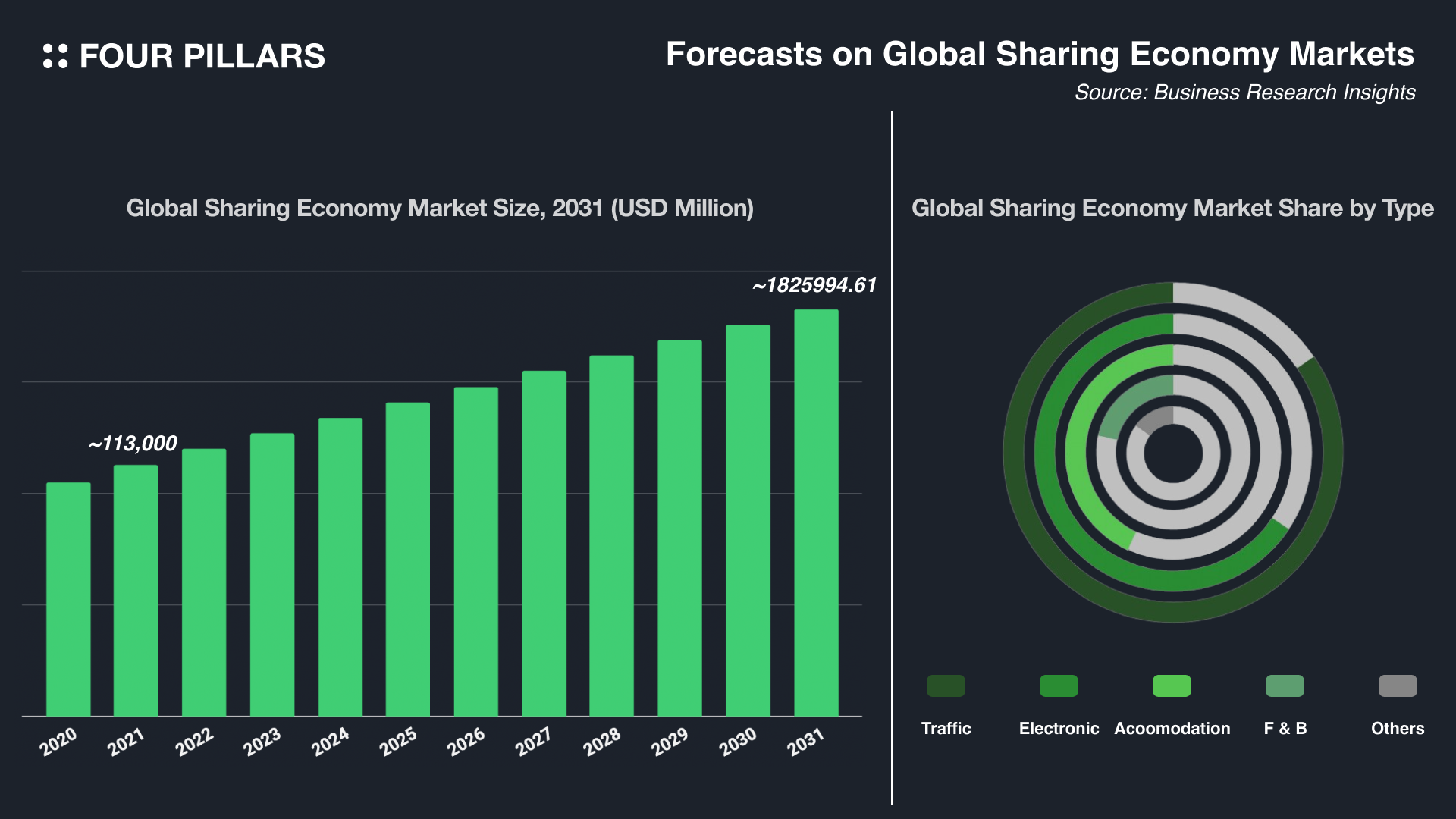

As seen earlier, the concept of the sharing economy has penetrated various industries and started to show significant results, leading to a rapid expansion of the market. According to Business Research Insights, the global sharing economy is expected to exceed $1 trillion by 2031, continuing its upward trend each year.

However, this scenario assumes an ideal condition where sharing economy platforms operate smoothly. Currently, as the sharing economy market rapidly grows and the number of users increases, several negative side effects have emerged. These include the degradation of service quality, monopolistic status secured by early market entrants, and backlash and regulatory issues from existing industry workers.

2.2.1 Dissonance with existing systems

Sharing economy platforms have brought innovation to supply-centric stagnant markets, and it's clear that users have greatly supported these differentiated services from traditional companies. However, new systems invariably clash with the old. The sharing economy industry has faced significant conflicts nationally and internationally, particularly with government regulations related to licensing and with existing companies over market share.

For example, Uber, which connects users with nearby drivers through a smartphone app, is often perceived as disrupting the traditional taxi industry's revenue model and diminishing the value of taxi licenses, leading to regulatory and legal disputes in many cities. Airbnb, by allowing individuals to rent out their homes or rooms, often provides a cheaper and more unique accommodation experience than traditional hotels, impacting hotel room demand, especially in tourist cities, and causing issues such as changes to residential environments and rising rents.

Thus, clashes with existing systems are significant obstacles to the continued growth of sharing economy platforms and present critical challenges that must be addressed. Platforms should not spare efforts in collaborating with regulatory authorities to develop a reasonable regulatory framework for the existing industry, protect the interests of all stakeholders, and promote fair competition in the market.

2.2.2 Unfair Fee Policies

In addition to the above issues, a structural criticism often directed at the sharing economy industry is that, while all sharing economy platforms facilitate exchanges effectively creating a market, businesses operating these services for profit tend to become more centralized. This means that the role of sharing economy platforms in distributing the value generated from transactions among providers and consumers is paradoxically at odds with their role as profit-seeking enterprises. The most apparent manifestation of this is the abnormal fee policies of monopolistic platforms.

A fair fee structure is directly related to the financial sustainability of the platform. For example, excessively high fees can burden service providers, leading to platform abandonment, whereas too low fees can harm the platform's profitability. Therefore, service platforms must determine fees that are acceptable to users and align with industry standards through market research and competitive analysis. Additionally, platforms should ensure transparency in their fee structures to build trust with users, regularly review their fee policies, and respond flexibly to market changes based on user feedback.

2.2.3 Failure to Achieve Economies of Scale

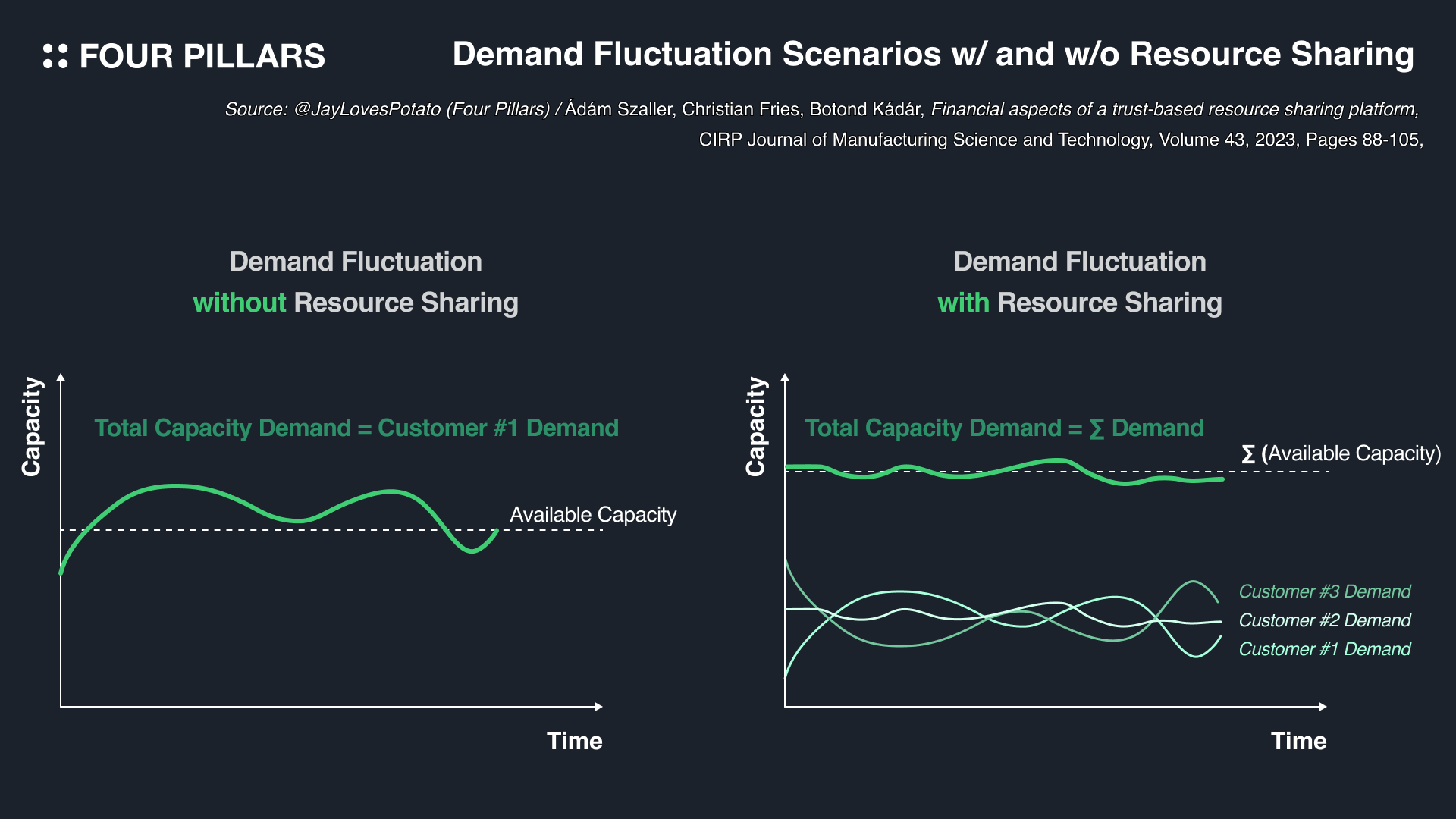

Achieving economies of scale on both the demand and supply sides on sharing economy platforms is particularly crucial for two reasons: first, (obviously) it can improve customer satisfaction by lowering the fees that need to be collected to keep the service running, and second, it can ensure continuity of service.

Typically, traditional systems predict demand for service resources and manage supply, thus likely ensuring service continuity. However, in the sharing economy platform, where the platform does not control the amount of resources provided and transactions are almost P2P, a large pre-prepared supply capacity across the platform is necessary to secure demand and generate numerous transactions.

Therefore, platforms must not only ease entry barriers for demanders, such as simplifying user interfaces, offering various payment options, and supporting multiple languages but also improve accessibility for suppliers by simplifying the service registration process and introducing training/support programs, as well as providing tools and resources that help manage their services effectively and optimize their earnings.

2.2.4 Counterparty Risk & Lack of Operational Policies for Quality Control

The growth and scale expansion of sharing economy platforms attract users and service providers from various backgrounds and skill levels. As the range and nature of resources provided on the platform diversify, maintaining consistent service quality becomes increasingly challenging and could potentially erode user trust. To address this issue, platforms need to establish a systematic and robust quality control system.

For instance, it may be necessary to conduct thorough pre-screening and training programs for all service providers to establish basic service provision standards. Additionally, continuous feedback and performance monitoring systems should be implemented to provide further training or guidance as needed. Alternatively, actively utilizing user feedback to quickly address any shortcomings in service quality could be an effective approach - indeed, many sharing economy platforms currently offer a rating system where providers receiving ratings below a certain level are penalized for their service actions.

However, realistically, it won't be easy for sharing economy platforms poised for significant growth to fully address the challenges mentioned above. Moreover, we must continuously pay the uncertain cost of trusting that these platforms, especially those operated for profit, do not increasingly allocate the value generated from transactions to themselves.

One idea that could make the sharing economy more sustainable by structurally reducing the authority of intermediating platforms is the use of blockchain. Blockchain, based on its own incentive mechanisms, can induce unintended spontaneity among a vast number of participants, enabling rich sharing of resources and allowing service systems to operate in a more transparent and trustworthy manner.

2.3.1 True P2P Resource Sharing

As mentioned earlier, one goal of profit-seeking sharing economy platforms is to protect the platform profits (i.e., fees) generated from individual transactions. Therefore, traditional platforms restrict users to their platform by not disclosing contact details, almost prohibiting connections outside the platform. Including these sorts of examples, operating a platform involves various administrative costs in addition to the basic costs of infrastructure operation and maintenance.

However, the decentralized nature of blockchain networks can facilitate true P2P transactions, eliminating the need for additional administrative costs and high mediation fees, and minimizing the impact of failures or attacks on centralized servers.

2.3.2 Securing Abundant Idle Resources with Incentives

Maximizing the use of idle resources is a fundamental principle considered in system optimization. Often, a vicious cycle that hinders the sustainability of the sharing economy systems stems from a lack of resource supply. If the system is built using blockchain, assuming a well-designed incentive mechanism, it can easily attract many providers with idle resources. This provides a buffer to meet overall demand, significantly enhancing the efficiency of sharing economy platforms.

With the abundance of supply ensuring the continuity of service and reduced fees due to the absence of intermediary platforms, it becomes easier for platforms to attract service users. Achieving economies of scale on both the demand and supply sides under these conditions can contribute to forming a sustainable sharing economy system, assuming a certain level of service quality is maintained.

2.3.3 Defining Codes of Conduct Using Smart Contracts

Smart contracts on the blockchain offer automatic execution of specific transaction conditions, making transactions in the sharing economy model more efficient and transparent. For example, in a car-sharing service, once a user finishes using the vehicle, a smart contract can automate the payment process and, if necessary, the return of a security deposit. Smart contracts thus significantly reduce the cost of service management and enhance user experience, ensuring that all transactions adhere to global standards/policies.

Smart contracts can also design appropriate incentive mechanisms and slashing rules to deter malicious behavior and promote fair play within the system. This motivates users to comply with regulations and plays a crucial role in maintaining the quality and reliability of the entire service system. In essence, using smart contracts enables sharing economy platforms to offer more stable and sustainable services, creating a transaction environment beneficial for both users and providers.

2.3.4 More Trustworthy Open Services

Today's sharing economy platforms face the challenge of adapting to different regulations and environments in each service area. Of course, this could be a limitation due to the fact that many services still primarily share physical resources like vehicles or spaces. However, if real assets can be digitized through blockchain technology, future sharing economy platforms can facilitate cross-border transactions of various digital assets. Additionally, using cryptocurrencies for payments can lower transaction costs, enabling microtransactions and providing opportunities for low-income individuals to rent low-value goods. Thus, these changes can democratize the sharing economy further, enabling transactions with the same currency value worldwide.

As previously mentioned, most existing sharing economy services are still largely limited to physical resources that are quite dependent on local regions, making it difficult to apply the same rules and operate on a transnational scale. However, digital resources (i.e., digital assets) managed online are less affected by such regional characteristics, making them easier to operate internationally.

In this section, we explore the operation and long-term vision of IO.NET, which aims to democratize computing resources in a blockchain context. We will also explore how IO.NET can offer advantages in efficiently utilizing computing resources compared to traditional cloud computing platforms like AWS.

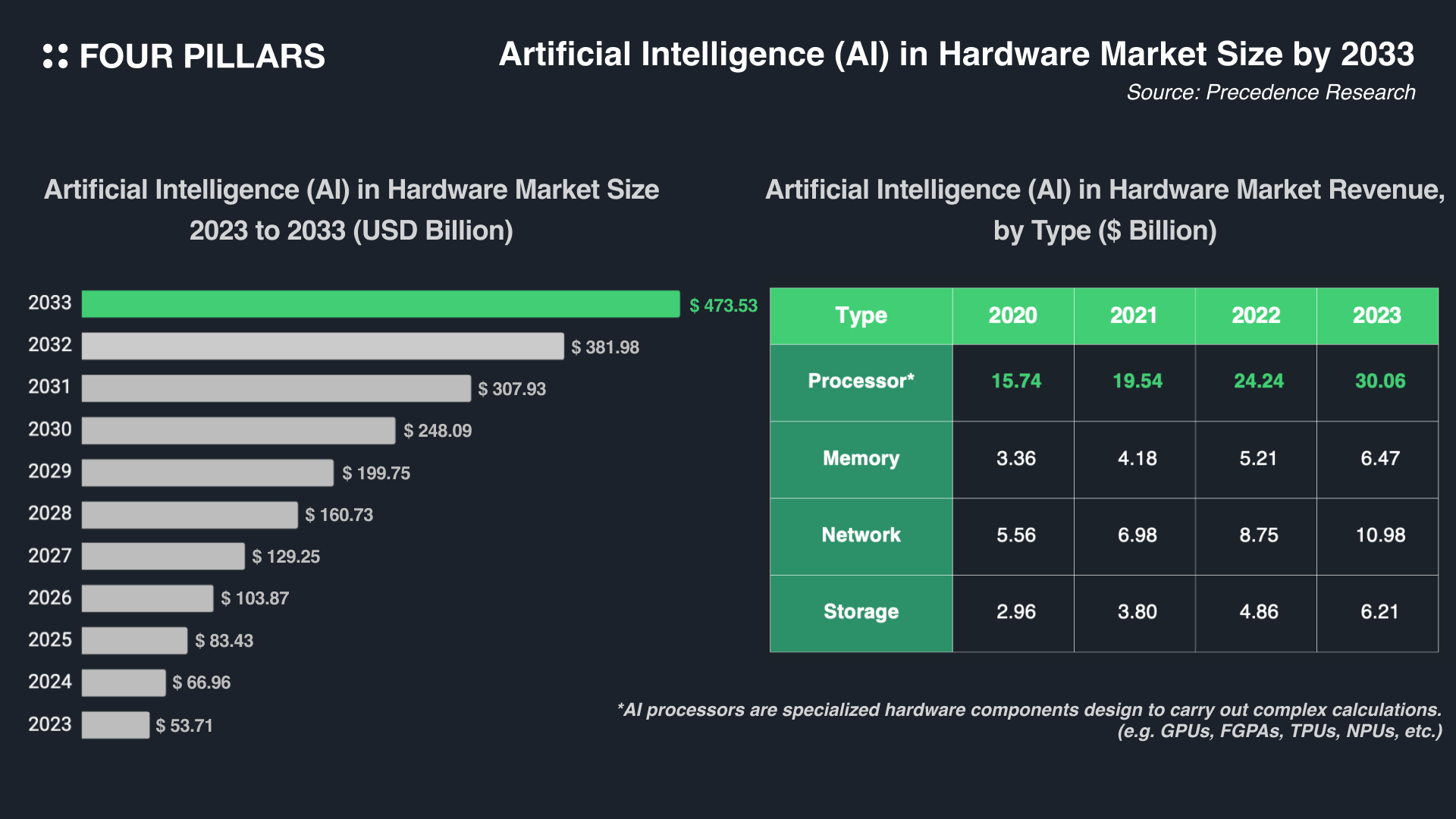

The advancement of AI technology has dramatically increased the demand for high-performance computing resources such as GPUs. According to Precedence Research, the global AI hardware market is expected to grow at a compound annual grow rate(CAGR) of 24.3% and exceed $473.53 billion by 2033.

However, despite the booming demand and the increasing sophistication of AI/ML models, the global AI hardware market struggles to keep up with production facing challenges, exacerbated by transnational political/diplomatic conflicts, leading to crises in supply. Consequently, obtaining popular computing chips can require high costs and long waiting times, with limited options for renting. This particularly hinders AI startups from expanding the scope and functionality of their projects.

While AI has the potential to change and improve our lives in various ways, observing more diverse innovations requires that many AI startups are backed by cost-effective and scalable computing resources. Without addressing such issues of computing resources, the AI industry could face a crisis where various innovative efforts are halted, and asymmetry in AI market development could lead to significant social repercussions.

3.2.1 Overview on IO.NET

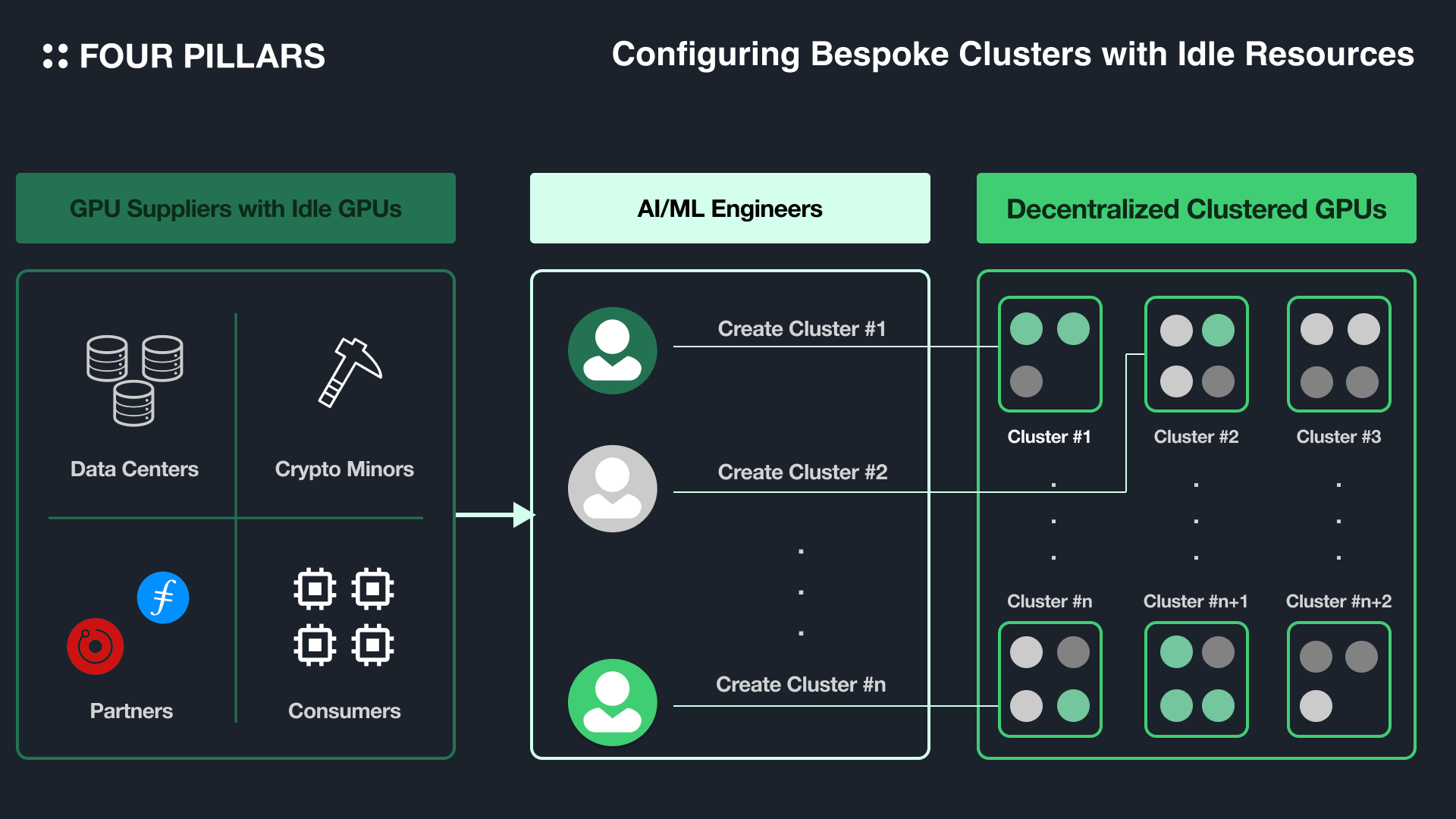

After all, the critical issue is how to simultaneously achieve sufficient supply of computing resources that are cost-effective and ensure quality. IO.NET, an orchestration layer based on Solana, addresses this by integrating idle computing resources from data centers, miners, crypto projects (e.g., Render Network, Filecoin), and consumers - suppliers of computing power receive tokens as rewards, and users use these tokens to economically configure their GPU clusters with various types of idle computing resources*.

*Currently, payments support fiat and USDC before the launch of $IO tokens, but other network tokens including $IO tokens can be supported in the future, with a 2% fee for non-$IO token payments.

Source: cloud.io.net

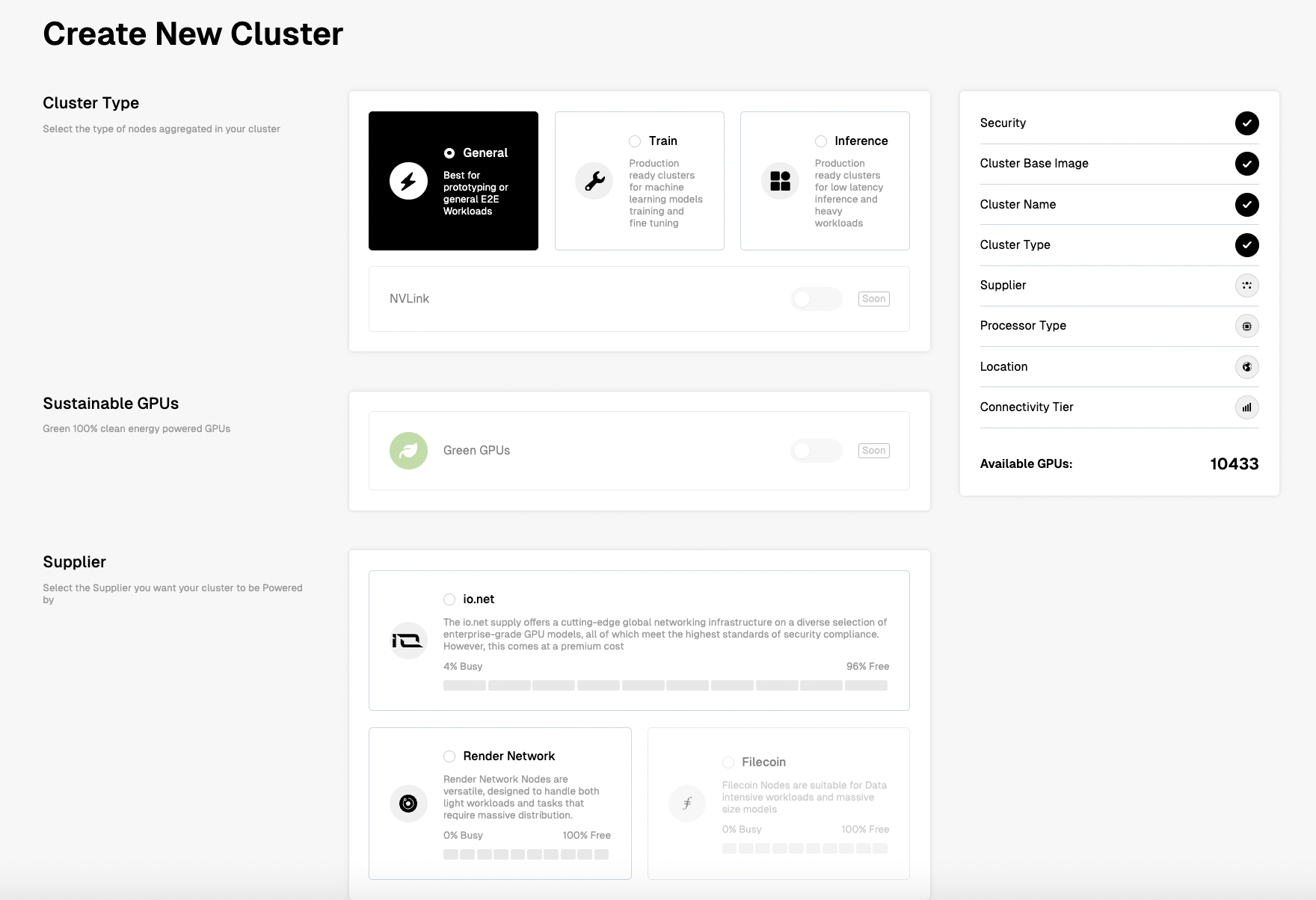

IO.NET utilizes clustering frameworks such as Ray and Kubernetes*. Users can configure clusters on IO Cloud and parallelize workloads by setting processor type, location, communication speed, security compliance level, and duration time. Clusters configured through IO.NET can be used for general computing purposes but are primarily optimized for AI/ML development tasks such as batch inference, model serving, parallel training, parallel hyperparameter tuning, and reinforcement learning.

IO.NET has partnerships with the mining networks of Render Network and Filecoin, so users can choose chips from these two networks as well as IO.NET as cluster suppliers. The supported processors include a wide range of GPU and CPU options such as NVIDIA RTX series, AMD Ryzen series, and Apple's M series, offering users a high level of flexibility in configuring processors and the ability to organically adjust the number of GPUs in the cluster as requirements change.

*Frameworks for various purposes such as Ludwig, PyTorch, Unreal Engine 5, Unity Streaming, etc. will also soon be supported.

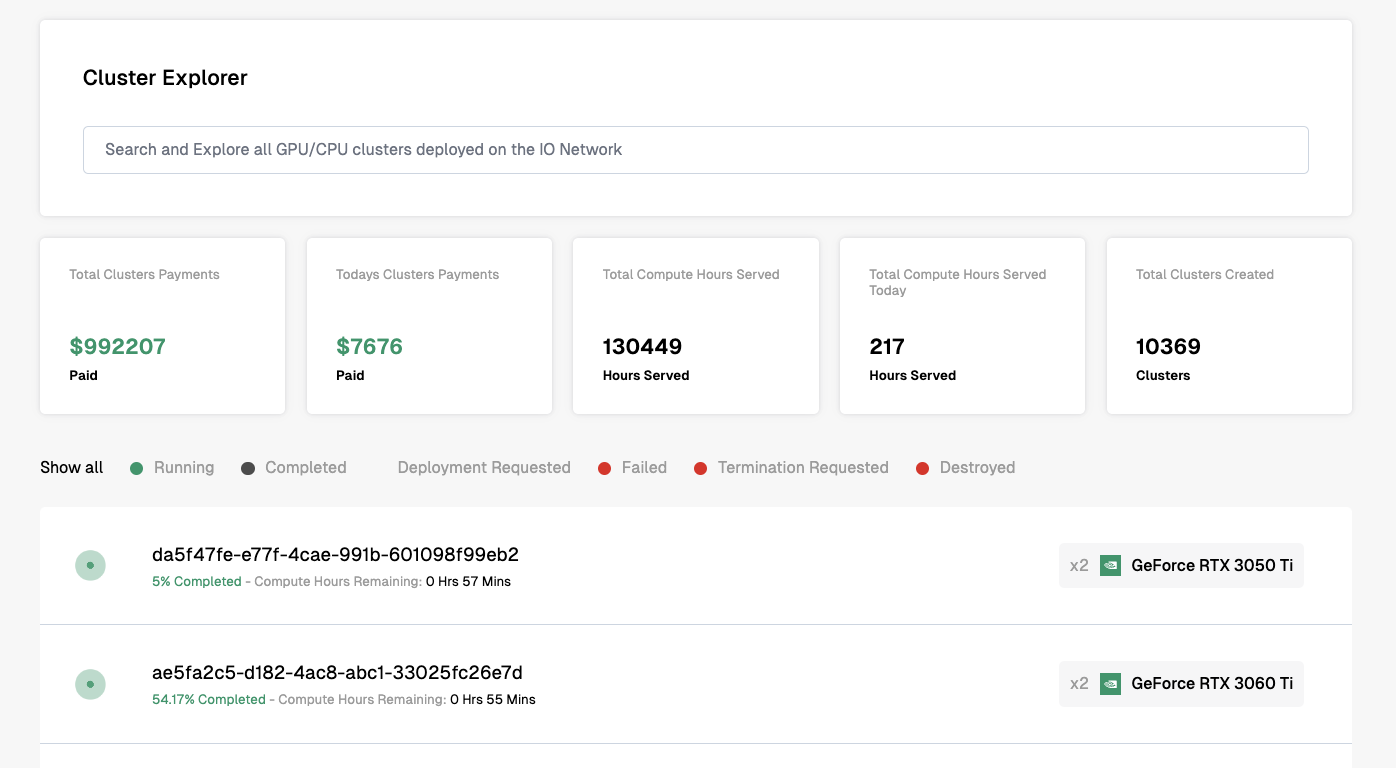

As of April 29th, 2024, users can configure clusters across about 89 countries, and the total number of available GPUs on the platform is nearly 10k. However, the actual number of users utilizing GPUs through (nascent) IO.NET is still not very high. Most GPUs have a workload of 0%, and popular processors often had limited initial supply or are already being used at over 90% capacity (e.g., A100 PCIe 80 GB K8S(NVIDIA), H100 80GB HBM3(NVIDIA), RTX A5000(NVIDIA)). According to IO Explorer, approximately 10,369 clusters have been created so far, with payments amounting to about $990k.

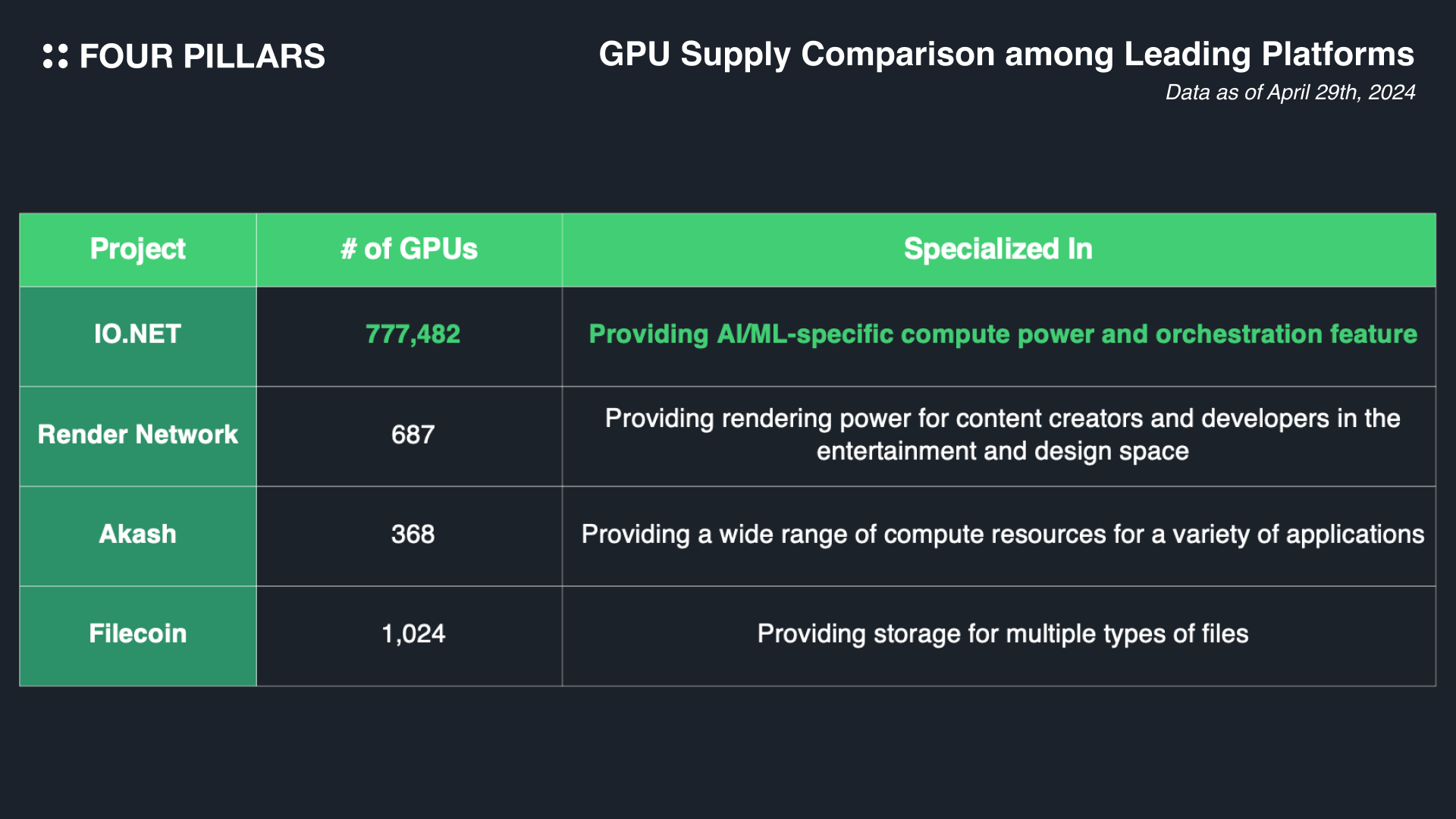

In fact, IO.NET is not the only project in the Web3 market supplying computing resources; there are various other projects leading this space including Akash, Render Network, and Filecoin. However, as mentioned earlier, IO.NET's competitive advantage lies in providing specialized computing capabilities for AI/ML and introducing clustering instead of single instancing, which allows for dynamic allocation of computing resources and optimized distribution of workloads among connected GPUs.

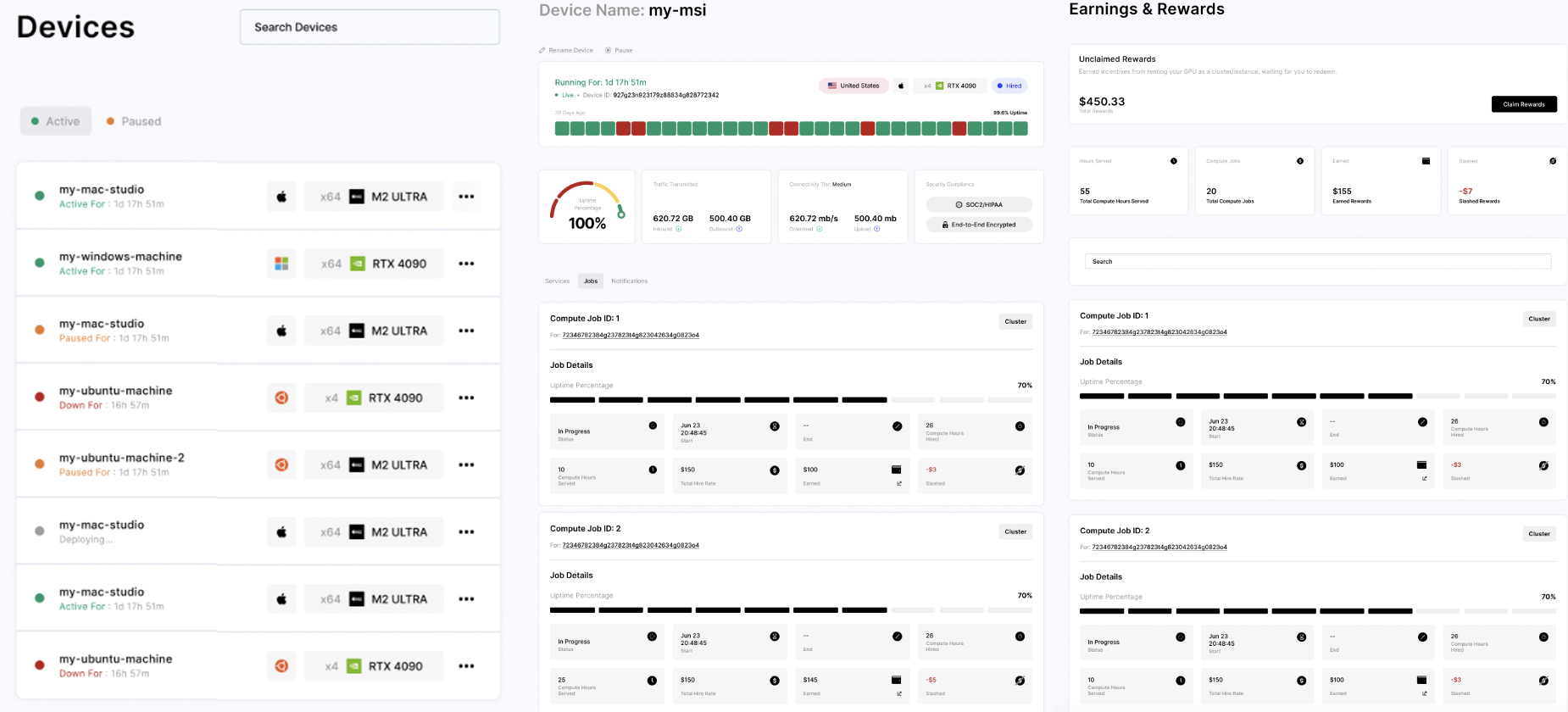

To become a GPU supplier (i.e., IO Worker) and generate revenue, users can start by adding 'New Devices' in the Worker tab. After filling in the details of the OS and Device users wish to supply, the process proceeds, and as shown below, users can manage multiple devices and check earnings status on the Worker tab..

3.2.2 Architecture of IO.NET

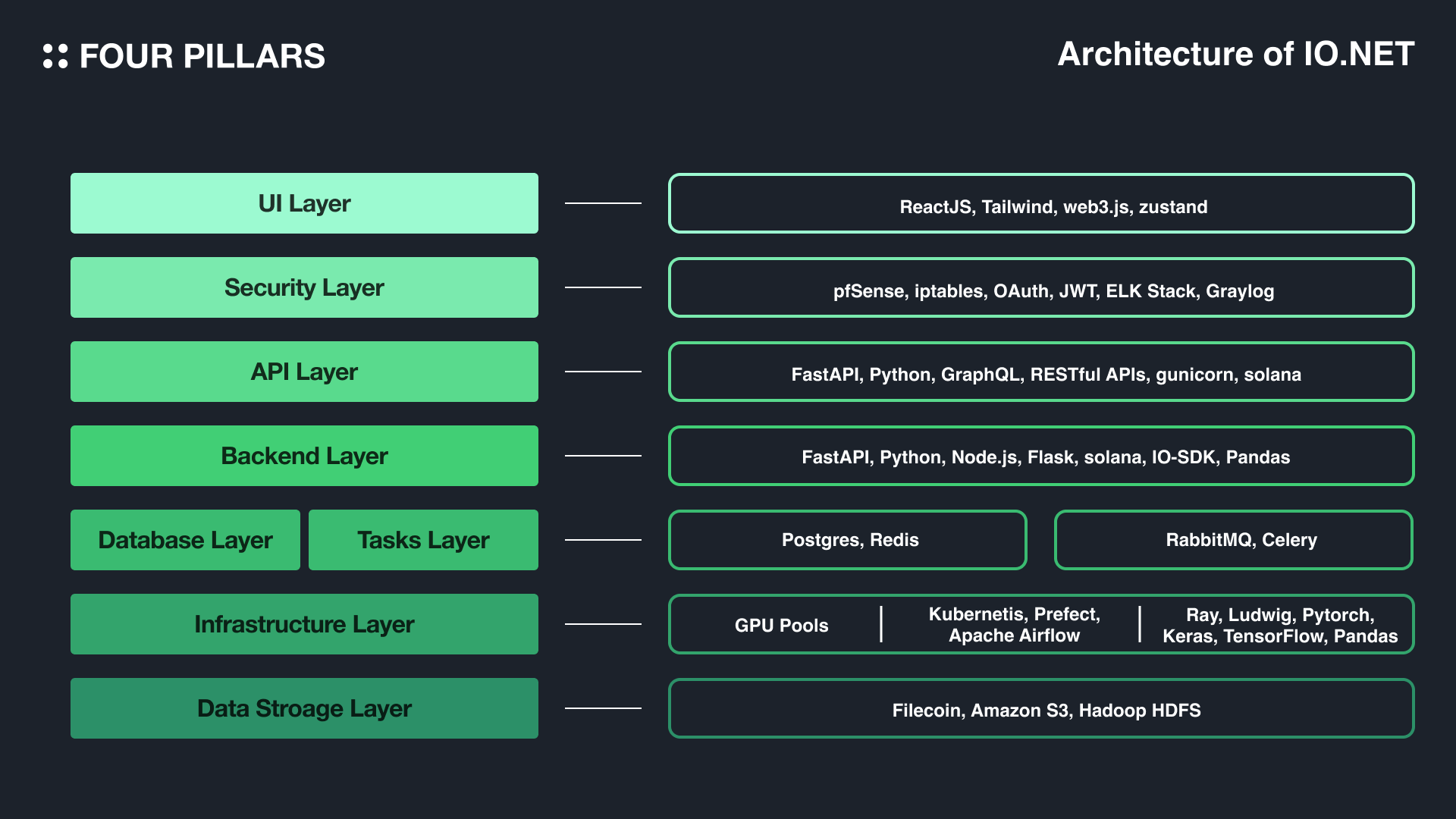

IO.NET adopts a modular architecture composed of several layers, each optimized to perform its unique functions. In addition to the technology stack listed for each layer below, IO.NET incorporates Reverse Tunnels and Mesh VPN Networks to enable engineers to access and smoothly control the data securely.

UI Layer

Serves as the gateway for users to access IO.NET services.

(e.g., ReactJS, Tailwind, web3.js, zustand)

Security Layer

Ensures the integrity and security of the system.

(e.g., Firewall(pfSense, iptables), Authentication(OAuth, JWT), Logging Service(ELK Stack, Graylog))

API Layer

Acts as the middleware layer for communication hub.

(e.g., FastAPI, Python, GraphQL, RESTful APIs, gunicorn, solana)

Backend Layer

Manages suppliers (Workers), Cluster/GPU operations, customer interactions, monitoring, etc.

(e.g., FastAPI, Python, Node.js, Flask, solana, IO-SDK(Fork of Ray 2.3.0), Pandas)

Database Layer

Manages the main storage for structured data and caching for transient data.

(e.g., Postgres(Main Storage), Redis(Caching))

Tasks Layer

Orchestrates asynchronous communications and task management to ensure efficient data flow.

(e.g., RabbitMQ(Message Broker), Celery(Task Management))

Infra Layer

Manages GPU Pools, deployments, computing, and machine learning tasks.

(e.g., Orchestration(Kubernetes, Prefect, Apache Airflow), Execlusion/ML(Ray, Ludwig, Pytorch, Keras, TensorFlow, Pandas), Monitoring(Grafana, Datadog, Prometheus, NVIDIA DCGM), etc)

3.2.3 Tokenomics of $IO and IOG Network To Be Released

IOG Network and Ecosystem

The long-term vision of IO.NET is to create a currency for computing operations (i.e., $IO tokens) and establish an ecosystem based on it. Accordingly, the $IO token, following the Solana token standard (SPL), is set to be launched around Q2, and the 'IOG Network,' which will also be based on Aptos and Solana, is being developed. The IOG Network will onboard a suite of services for building, training, and deploying different machine learning models, with the previously discussed IO.NET suite also being onboarded to this network. In addition, a universal ID for the IO ecosystem, IO ID, and an open-source SDK for developers to deploy their services are being developed.

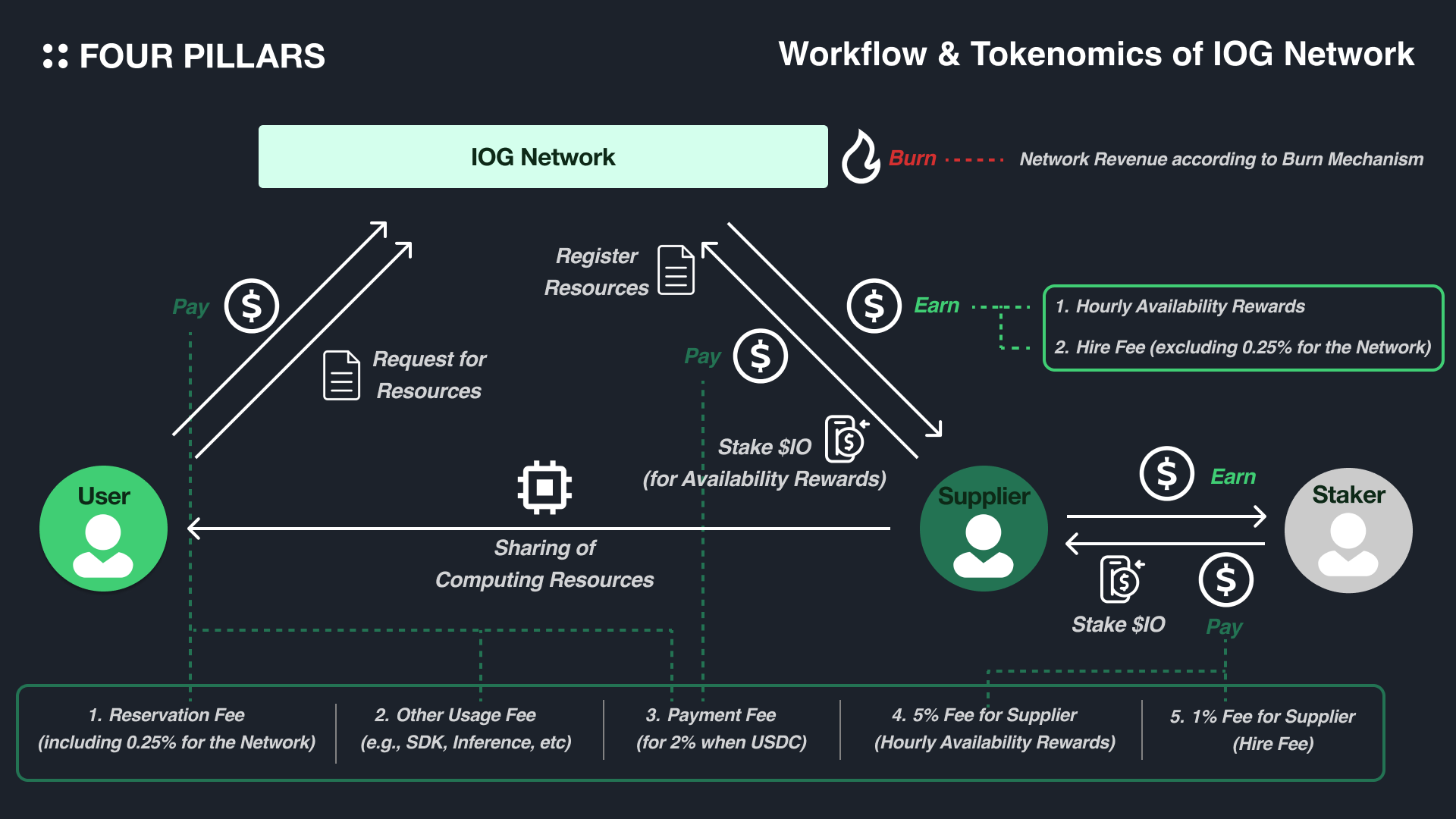

The operation of the IOG Network will be managed by nodes providing on-demand computing resources. For these nodes to receive operation rewards - availability rewards(i.e., idle rewards), they must stake a minimum of 100 $IO. Like other Delegated Proof of Stake (DPoS) protocols, $IO token holders can also stak*e up to a predefined maximum per node(i.e., Per Node Max Stake) and secure network fidelity in return for rewards (excluding a 5% fee for the node).

Per Node Max Stake = Device Max Stake x (2 + 3 x [SUM of Modifier Options])

*Once staked, it takes 7 days for $IO to be unstaked, and $IO cannot be unstaked while the node is being hired.

Demand for $IO Token and Suppliers’ Rewards

$IO tokens can be used not only for reserving GPU clusters through IO.NET but also for deploying various types of applications (or instances) hosted on the IOG Network using the SDK, as well as for utilizing several inference models. When GPUs are reserved or hired, a fee of 0.25% is collected by the network. Following the review of the performance and operational time of the reserved node against slashing conditions, rewards are paid to the supplier—referred to as the 'Hire Fee or Hire Rate' in the IOG Network. If a supplier has received staking from $IO token holders, 1% of this reward is returned to the stakers.

Total Hire Rate=Current # of Cards on the Worker x Current Card Price x Computation Hour Reserved x (1 + SUM of Modifier Options) x 99% Supplier Share*

*Modifier Options are items that IO.NET recognizes as additional services and hardware that the provider has deployed to increase the performance of the overall cluster (e.g., Bandwidth, Location, GPU Interlink options, Node Disk Attributes).

(Hourly) Availability Rewards, previously mentioned, are separate node operation rewards introduced to encourage a sufficient supply on the network, aside from the Hire Fee. These rewards are calculated per node and take into account various factors such as bandwidth, operational uptime percentage, hardware type, etc. Like the Hire Fee, if a supplier has received staking from $IO token holders, 5% of these rewards are returned to the stakers. Additionally, to prevent nodes from continuously connecting and disconnecting, there is a 12-hour cooling-off period to activate availability rewards each time a node is reconnected after being shut down or paused.

Approximate Per Node Hourly Availability Rewards = Staker Collateral Multipler x (Hardware CapEx / Hours in 18 Months) Uptime Percentage x 95% Supplier Share

Token Distribution Plan of $IO

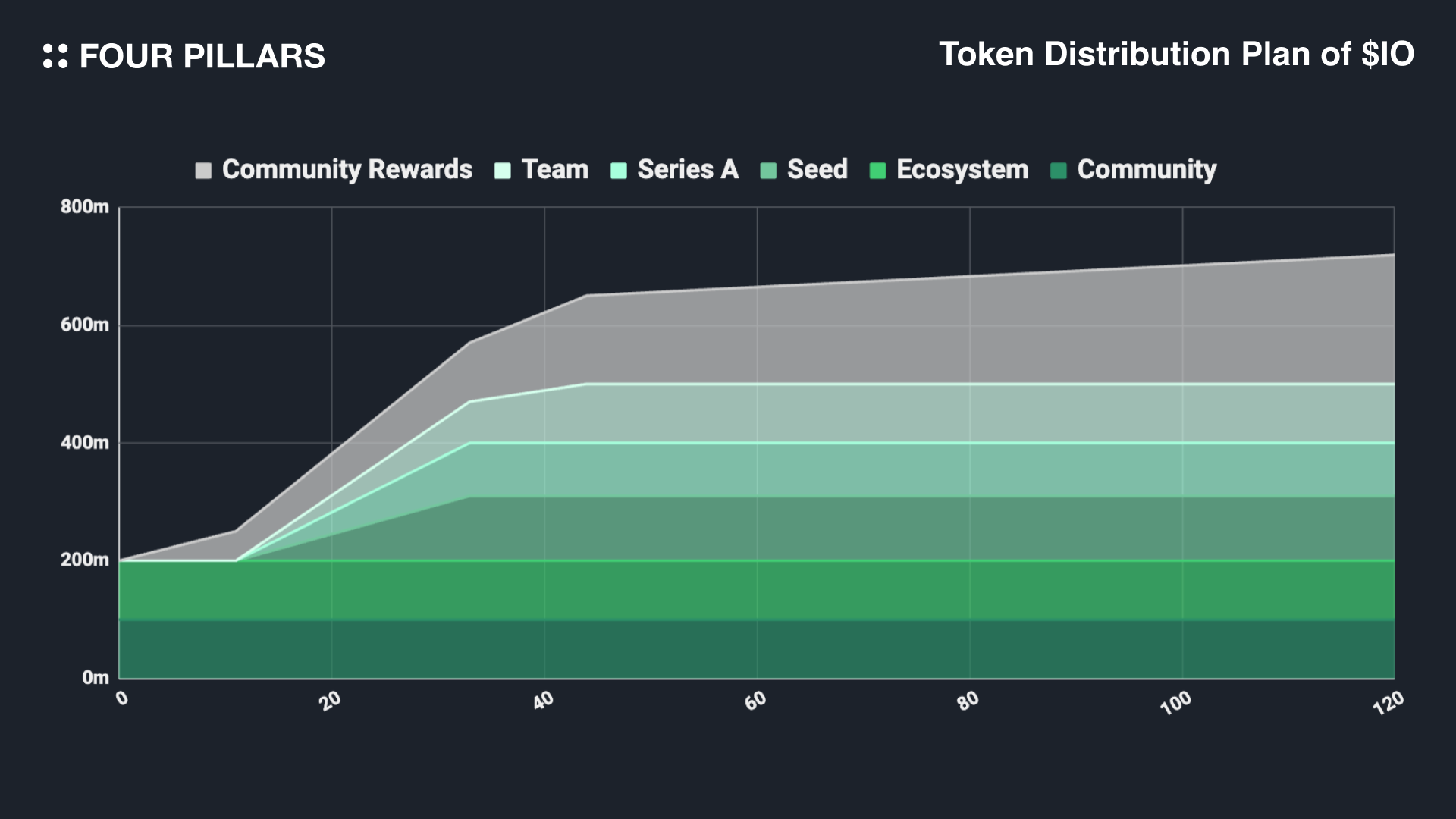

The total fixed supply of $IO tokens is 800 million, with 500 million initially circulating and the remaining 300 million distributed to suppliers and stakers (i.e., Community Rewards). These Community Rewards start at 8% in the first year and decrease monthly by about 1.02% (approximately 12% annually) until the total of 800 million $IO tokens is reached, following a deflationary model.

As previously discussed, the IOG network generates revenue through fees charged for reservations and hiring (i.e., 0.25%) and for payments and withdrawals (i.e., 2% when withdrawing in USDC). The network then determines the amount of $IO to be burned based on the $IO price, using the revenue to purchase and burn $IO tokens.

Firstly, one of the most evident advantages of IO.NET compared to traditional cloud services is that anyone can easily share their idle computing resources and receive rewards with just a few clicks, regardless of their technical expertise. This significant reduction in barriers to entry means that, assuming rewards are appropriately allocated, individuals can effortlessly share their idle resources and it facilitates the easy bootstrapping of abundant computing resources from the supply side. Consequently, users can quickly assemble clusters with their desired GPUs without the need for long-term contracts or enduring lengthy wait times, which are typical with conventional cloud services.

IO.NET also offers a relatively cheaper and more flexible development setup. The resources shared on IO.NET are primarily individuals' idle computing resources, which means they don't incur the high maintenance costs like large data centers do - this results in a lower marginal cost for suppliers. Additionally, the diversity of suppliers ensures a broad selection of computing resources and elimination of system downtime risk. IO.NET further supports various frameworks through IO Cloud, enhancing users' development efficiency beyond what is typically possible with cloud services.

The third advantage is the prosperity of the IOG network ecosystem, driven by the extensive demand for $IO tokens. As mentioned, $IO tokens can be used not only for reserving computing resources but also for building and utilizing various applications or instances hosted on the IOG network. A high demand for the tokens increases the supply needs for $IO tokens, which in turn facilitates the liquidity of rich computing resources within the ecosystem.

Furthermore, the success of IO.NET enables small investors to actively participate in the computing resources market. Until now, the distribution of computing resources has been monopolized by a few large corporations such as AWS, GCP, and Azure. However, for small investors who view computing resources as an investment asset, IO.NET provides a marketplace where anyone can easily purchase and trade idle computing resources. If one of the core objectives of finance is its democratization, then IO.NET stands as a prime example of achieving such financial inclusion.

Additionally, if large-scale idle computing resources are managed efficiently, their utilization rates will increase, contributing to a greener environment.

As continually emphasized, the optimistic future of blockchain-based sharing economy systems like IO.NET assume that the incentive mechanisms are well-designed to achieve economies of scale. In other words, if these mechanisms are poorly designed, or if the initial supply bootstrapping or the delicate balance between supply and demand are not managed well, it could lead to a vicious cycle where the value of tokens, supply of resources, and quality of service all collapse simultaneously.

Therefore, system designers must not only ensure that the current level of resource supply is adequate but also be vigilant to prevent an oversupply relative to demand. If too many suppliers are active on the network compared to demand, it could lead to a significant dilution of token value in the short to medium term, potentially causing a mass exodus of suppliers or increased volatility in resource supply.

Similarly, it is crucial to ensure that rewards for suppliers are not excessively high. Overly generous rewards might encourage potential suppliers to purchase additional resources beyond their idle assets simply for higher profits, which could disrupt the balance of supply and demand in the overall computing resource market and potentially lead to market failure.

Lastly, if financial access to resources is excessively expanded, it could foster a speculative mentality, obscuring the original purpose of the demand. Thus, ensuring that token liquidity circulates primarily among actual users is also of utmost importance.

The concept of blockchain, where a multitude of unspecified individuals gather around a P2P network centered on valued assets, closely mirrors the philosophy that the sharing economy aims to pursue. Or rather, if we assume that more values can be digitalized reliably on the blockchain in the future, it might be appropriate to consider that the future of the sharing economy lies not in the physical realm but in blockchain space.

IO.NET serves as a prime example of this potential. It has successfully bootstrapped valuable digital shared resources that many people can utilize. While maintaining a delicate balance between the agile adjustment of token demand and supply to continuously provide high-quality, abundant resources on the platform will be crucial, as mentioned in the text, the expanding clear use cases for the tokens foster optimism that this balance can be well-managed.

In the face of ongoing uncertainty in the global economy and enduring value-based consumption patterns, resource optimization becomes an inevitable task. To effectively expand the sharing economy approach for this purpose, it will be essential to build even larger economies around a wider array of assets.

Digital resources can transcend physical limitations and instantly connect with someone on the other side of the globe. Blockchain technology has the capability to liquefy the value of various assets and fully integrate them into a digital network, gathering many people in this flow of value to build an efficient economy. Starting with the example of IO.NET, it is hopeful that soon experiments in optimizing a broader range of resources on the blockchain will begin, potentially leading to innovations in our lives similar to another Uberisation.

Thanks to Kate for designing the graphics for this article.

We produce in-depth blockchain research articles

The crypto industry, initiated by Bitcoin, has developed through the narrative game and is now entering a stage where its technical infrastructure is maturing. Crypto provides a foundation to assign economic value to any idea or interest and enables trading, paving the way for new types of applications and business models. Currently, the crypto industry faces the key challenge of developing popular applications and attracting users. To achieve this, it is necessary to actively apply strategies that leverage speculative demand as a core function.

This article is the last part of a three-part series covering the DeFerence 2024 event, sponsored by Four Pillars.

Base, aiming to onboard 1B onchain users, has emerged as a hub for consumer-oriented onchain applications within a year since its mainnet launch last year, driven by factors such as reduced fees, the memecoin frenzt, and the growth of social network applications like Farcaster. Unlike other blockchain ecosystems focused on DeFi and infrastructure, Base predominantly features consumer-oriented applications similar to Web2 services. It leverages a unique community and brand to onboard more applications. While social and community applications are the most actively developed, new categories of onchain applications in content, gaming, and commerce are also emerging, indicating significant potential for user expansion.

This article is the second part of a three-part series covering the DeFerence 2024 event, sponsored by Four Pillars.