Based on the recently highlighted Ordinals, BRC-20 is an experimental token standard on the Bitcoin network.

This article will examine how BRC-20 tokens are created and traded through actual examples.

In January 2023, Casey Rodarmor introduced the ordinal theory, sparking a surge of activity on the Bitcoin network, reminiscent of Ethereum’s NFT minting craze. By enabling users to embed arbitrary files (images, text, videos, etc.) up to 4MB in size within satoshis (the smallest unit of Bitcoin), a diverse range of files could now be stored on-chain. Intriguingly, the volume of text inscriptions has seen a dramatic rise in recent years among the various file types.

Are individuals now authoring novels on the Bitcoin network? This phenomenon is occurring as domo employs Ordinals to develop a novel standard known as BRC-20 tokens. Essentially, BRC-20 tokens are a new standard that facilitates the issuance and transfer of tokens by inscribing a form of text on a satoshi. This approach gained significant traction in April, causing the number of inscriptions to skyrocket and resulting in a surge of transaction fees on May 8th. At that time, the Bitcoin network faced over 400,000 pending transactions, creating a comical situation in which Binance ceased accepting Bitcoin deposits and withdrawals.

(Date as of May 8, 2023 | Source: BRC-20.io)

As BRC-20 tokens have gained traction, they have also seen their prices rise vertically. The individual price of ordi tokens, the first token in the BRC-20 standard, started at $0.1 per token and increased 310x to $31.0 on May 8, giving it a market capitalization of nearly $650M. A market capitalization of this magnitude would place it at around #70 on Coingecko, higher than Sui and Optimism.

Should we take all this attention for BRC-20 tokens for granted? In this article, we’ll take a look at the oridnals and BRC-20 standard that enable BRC-20 tokens to exist.

Ordinals Theory is not a new concept that came out of nowhere, but rather a derivative of a previous concept: Ordinals, the sequential numbering of Bitcoin’s smallest unit, the satoshi(sat). The dictionary definition of an ordinal number is the order of numbers. According to Ordinals, each sat is numbered in the order it was mined. The technical specification for this is well documented in the following BIP document.

The ordinal numbers assigned to sats are represented in a variety of ways, including the following

Integer notation: 2099994106992659 — The number in the order they were mined, and since the total number of bitcoins is 21,000,000 and 1 BTC=100,000,000 sat, the maximum value of the ordinal numbers is 2,100T.

Decimal notation: 3891094.16797 — The first number represents the height of the Bitcoin block in which the sat was mined, and the second number represents the order (offset) of the sat within that block.

Degree notation: 3°111094′214″16797‴ — The last number is the order in which the sat was mined in the block, followed by the block height in degrees.

Percentile notation: 99.99971949060254% — A way to express where the sat is in the total supply of Bitcoin as a percentage.

Name: satoshi — A method for representing ordinal numbers using the alphabet a-z.

Interestingly, the creator of Ordinals Theory also assigned a rarity to each sat based on the ordinal number assigned to it:

Common: All but the first sat in each block

Uncommon: First sat in each block (appears about once every 10 minutes)

Rare: First sat after difficulty adjustment (appears about once every two weeks)

Epic: First sat after halving events (appears about once every 4 years)

Legendary: First sat after a coincidence of difficulty adjustments and halving events (appears about once every 24 years)

Mythic: The first sat of the Bitcoin Genesis block (only one exists)

Not only does each sats have some sort of unique number thanks to Ordinals, but the Bitcoin network’s SegWit and Taproot upgrades have made it possible to inscribe data to sats.

Initially, SegWit, an abbreviation for Segregated Witness, was a 2017 upgrade applied to Bitcoin Core, the client for the Bitcoin network. The subsequent Taproot upgrade was feasible due to the preceding implementation of SegWit. Although SegWit resolved the chronic problem of Transaction Malleability within the Bitcoin network, paving the way for the Lightning Network to operate, the most significant upgrade pertaining to this discussion is the expansion of block size.

The SegWit upgrade was a backward-compatible soft fork, not a hard fork, even though it increased the block size. How is this possible? SegWit introduces a new concept called block weight, which changes the unit of block size from Bytes to vBytes, where 1 vByte is equivalent to 4 weight units (wu). Therefore, the maximum block size has changed from 1 MB to 1 vMB. In addition, the existing transaction data is divided into two parts: 1) transaction data and 2) witness data. Transaction data contains information about sender, receiver, input, and output, and each byte corresponds to 4 wu, while witness data contains information about script and signature data, and each byte corresponds to 1 wu.

Secondly, the Taproot upgrade advances by updating the script language used in the Bitcoin network to Tapscript. Consequently, a wider variety of transactions became feasible on the Bitcoin network, with ordinal theory employing this to enable the recording of various files on sats through witness data.

Essentially, each sat has a unique identifier and stores data, functioning akin to an NFT. However, unlike the majority of NFTs in the Ethereum ecosystem, the inscription process records all data on the Bitcoin on-chain, potentially making it a more authentic NFT. Users can leverage the Ordinals protocol to inscribe data on sats, and sats containing data can be exchanged via transactions like normal bitcoins.

An important consideration is the necessity of using an Ordinals-compatible wallet. Although the inscription is recorded on sats, enabling their transfer to any Bitcoin wallet, the challenge arises from the inability to distinguish these sats from other bitcoins. As a result, there is a risk of accidentally losing file-recorded sats as miner fees during a regular BTC transaction. Consequently, Ordinals users should opt for a wallet that facilitates satoshi control and selection.

(Source: Ordiscan)

So far, a huge variety of Bitcoin NFTs have been created using Ordinals. Many of the earliest inscriptions utilized images, with the first recorded inscription being the 727,624,168,684,699th sat with an image of dickbutt. Ordinals became famous because of Taproot Wizards, and the first Taproot Wizards image (Inscriptions #652) nearly filled a block, taking up a whopping 3.94 Mwu. Later, Dustlabs packed 535 of their DeGods into one block (Block #776408) with Ordinals, and Yuga Labs, better known as BAYC, put a generative art NFT called TwelveFold on the Bitcoin network.

(Source: DeGods)

There are a lot of interesting experiments going on in Ordinals that utilize text as well as images. BRC-20, which we’ll be focusing on in this article, is a great example of using text, as is the Sats Names.

(Source: Sats Names)

While Ethereum Name Service (ENS) is a naming service on the Ethereum network, Sats Names is a naming service on the Bitcoin network. To register a name, simply inscribe the text according to JSON5 syntax as shown above. Make sure to include “sns” in the “p” field and “reg” in the “op” field to make it easier for other systems and indexers to recognize that this inscription is related to Sats Names. In the “name” field, you can put a nickname of your choice.

Would this enable anyone to use unique nicknames at will? For instance, if person A reserves the nickname “bitcoin.sats” and person B inscribes the same “bitcoin.sats” nickname on a different sat, it could create ambiguity. The Sats Names document acknowledges the ownership of a specific nickname to the sat that first inscribes it. Essentially, the Sats Names system is only a text-recorded sat; to utilize it in real services, it has the limitation of requiring a separate indexer to differentiate between nickname types and ownership. This concept is merely an intriguing text-based system, and the same principle applies to BRC-20 tokens.

BRC-20 (Bitcoin Request for Comment) is an experimental token standard proposed by domo in March 2023 that allows anyone to issue and send FTs on the Bitcoin network via text inscription by Ordinals. For reference, unlike ERC-20, where tokens can be issued and transmitted immediately after deploying a smart contract, BRC-20 assumes that tokens are not actual tokens, but are created based on a specific format recorded in sats. Therefore, as with Sats Names, separate indexing is required to know the status or balance of BRC-20 tokens.

You can creat, mint, and transfer BRC-20 tokens by inscribing three functions in sats: Deploy, Mint, and Transfer.

3.1.1 Deploy Function

(Source: BRC-20 gitbook)

To initially deploy BRC-20 tokens, simply inscribe the above JSON format in a specific sats. Here’s what each key represents

p: Other systems recognize that this inscription is about BRC-20.

op: Write the type of operation (Deploy, Mint, Transfer).

tick: Write a four-letter ticker for the BRC-20 token you want to deploy.

max: The total supply of BRC-20 tokens.

lim: The maximum amount of this BRC-20 token that users can mint at once. (Not required)

dec: Determines the decimal of the token. Defaults to 18. (Not required)

Deploy is merely the process of establishing the presence of a BRC-20 token, whereas actual issuance necessitates executing a Mint function.

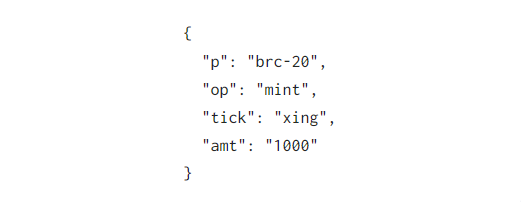

3.1.2 Mint Function

(Source: BRC-20 gitbook)

The Mint Function is only applicable to BRC-20 tokens that have already been deployed. To issue a token, inscribe the preferred token’s ticker into the “tick” section and the amount in the “amt” section in the JSON format on a separate sat, which will then result in the issuance of the BRC-20 token. It is important to note that the value entered in the “amt” section must be lower than the deployed token’s “lim” value. Likewise, the Mint Function will be considered invalid if used for tokens issued beyond the “max” value.

3.1.3 Transfer Function

(Source: BRC-20 gitbook)

To transfer tokens you possess to another person, complete the token transfer preparation by writing the desired quantity in the “amt” section in the JSON format on a different sat. After this step, the token transfer is set. To finalize the token transfer, send this sat to the intended recipient’s Bitcoin wallet address.

As BRC-20 tokens are not issued in the same manner as ERC-20 tokens, the Deploy, Mint, and Transfer stages may be challenging to grasp. To gain better comprehension, let’s explore the example of XING, a real BRC-20 token.

3.2.1 Deploy

(Source: ordiscan)

The deployment of XING tokens was inscribed by bc1q…yycf (Deployer) at 1934771250000000 sat. However, since this deployer only deployed BRC-20 tokens and did not mint any, we can see that the balance of XING tokens is zero.

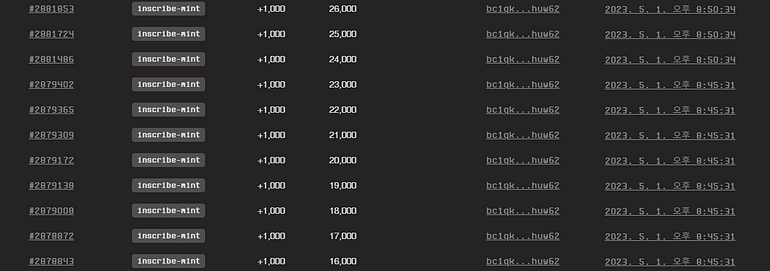

3.2.2 Mint

(Source: ordiscan)

Then, bc1q…uw62 (Minter) inscribed the above text into 26 different sats, minting a total of 26,000 XING tokens as shown below. The reason why 26,000 tokens were issued over 26 sats, rather than all at once, is that the maximum issuance limit (lim) was limited to 1,000.

(Source: UniSat)

3.2.3 Transfer

(Source: ordiscan)

In order to transfer 26,000 XING tokens, bc1q…uw62 (Minter & Sender) inscribed the above text in 5 sats (Inscription #2905812, #2907344, #2934895, #2944521, #2944588) and sent the remaining 4 sats except Inscription #2944588 to another address to transfer 22,000 XING tokens.

(Source: UniSat)

3.2.4 Balance

So what is the final number of XING tokens held by the wallet addresses in the example above?

bc1q…yycf(Deployer): It only deployed BRC-20 tokens, not minted them, so the balance is 0.

bc1q…uw62(Minter & Sender): When searching for this address on ordiscan, the number of XING BRC-20 mint inscriptions held is 26. Obviously, this address minted 26,000 tokens and sent 22,000 tokens, so why does it still have 26 XING BRC-20 mint inscriptions in its wallet? This is because for BRC-20 tokens, the transfer is not done by transferring the existing XING BRC-20 mint inscription, but by recording the XING BRC-20 transfer inscription in another sats and then transferring it. In other words, when the transfer process occurs, the sender’s balance is deducted and the XING BRC-20 transfer inscription is added to the receiver’s balance. Therefore, even if bc1q…uw62 has a XING BRC-20 mint inscription worth 26,000 tokens, the final balance recognized is 4,000 because the XING BRC-20 transfer inscription worth 22,000 tokens was sent to another address.

bc1q…v8mj(Receiver 1): It received 10,000 XING BRC-20 transfer inscriptions (#2934895) from the sender and sends 5,000 XING BRC-20 transfers to another sat with separate inscriptions, resulting in a final balance of 5,000.

(Source: UniSat)

The rest of the receivers can be analyzed in a similar way, with bc1q…vz18 having many XING BRC-20 transfer inscriptions sent to it, but then sending them all back and having 0, bc1p…gy06 having 1,000, and bc1q…utvq having 1,000.

BRC-20 introduced a new way to handle Fungible Tokens (FT) on the Bitcoin network, and it’s gotten a lot of attention recently with the rise of memecoin (e.g. PEPE) on the Ethereum network. As mentioned in the introduction, the number of text inscriptions in Oridnals is exploding, and this has led to a significant increase in average transaction fees on the Bitcoin network.

Moreover, recently, nearly 50% of the transaction fees incurred on the Bitcoin network are related to Ordinals, specifically BRC-20. As of May 9, 2023, the number of BRC-20 tokens deployed was 1,599, with a total of 628.7 BTC in network fees for minting and 46.8 BTC in network fees for transfers, representing an enormous amount of network usage.

The first BRC-20 token created, ordi, started at $0.1 and skyrocketed with the news of listing on various centralized exchanges, reaching a high of $31. Other tokens such as nals, meme, pepe, and piza have a market capitalization of $10M to $40M.

(Source: UniSat)

How does trading in BRC-20 tokens work? The Ethereum network allows for smart contracts, which allows for trustless listing and purchasing on the marketplace protocol, but it is not possible to build such smart contracts on the Bitcoin network. However, if you go to the UniSat Marketplace, you can see all kinds of tokens listed, and buyers can connect their Bitcoin wallets to purchase them. In addition to the secondary trading of BRC-20 tokens, this is also seen on various marketplaces that sell image-inscribed Oridnals (e.g. MagicEden). Are all existing Ordinals marketplaces using a centralized custody method?

The answer is PSBT (Partially Signed Bitcoin Transaction). PSBT is a feature from BIP-174 that allows users to sign some of the inputs and leave others unsigned. This allows multiple users to sign together to create a transaction, and allows for multi-sig transactions. Therefore, UniSat and other Ordinals marketplaces (e.g. Gamma, MagicEden) utilize PSBT to enable sellers and buyers to make transactions in a trustless and non-custodial manner by allowing them to utilize PSBT.

Although the Bitcoin network is the most secure layer among all existing blockchain networks, numerous attempts have been made in the past to list tokens other than BTC on the Bitcoin network, despite its inability to support complex smart contracts. Going back to 2012, there was Colored Coin, which employed Bitcoin scripts to embed metadata such as stocks and real estate into Bitcoin transactions; Rootstock (RSK) and Blockstream’s Liquid Network, Bitcoin network sidechains that can issue various FTs and NFTs in addition to BTC; and more recently, Taro, made possible by the Taproot upgrade.

In this context, BRC-20 tokens represent a novel approach to creating tokens using simple text through Ordinals. It is fascinating to see how one person’s text format has become a standard, leading to the emergence of various BRC-20 tokens, supportive marketplaces, and even CEXs like Gate.io listing them.

A separate question from this trend is how far these BRC-20 tokens can go. The Bitcoin network is fundamentally incapable of implementing complex smart contracts, and since BRC-20 tokens are not tangible like ERC-20 tokens but merely signify the existence of tokens through inscriptions recorded in sats, their utility in services other than trading as meme tokens is questionable. One could envision simple governance activities where users connect their Bitcoin wallets and vote based on the number of BRC-20 tokens they hold, but enforcing governance outcomes on-chain would remain unfeasible.

(Source: ord.io)

Nonetheless, only four months after the January 2023 release of Ordinals, the Bitcoin network has seen a lot of changes. From storing simple image files and small games that can be played in real life, to experimenting with text through Sats Names and BRC-20, Ordinals has driven innovation. We can anticipate more inventive experiments using Ordinals in the future. I maintain a positive outlook on these endeavors, as they may help address the one issue the Bitcoin network has yet to resolve: long term sustainability due to low fee rewards.

Thanks to Kate for designing the graphics for this article.

We produce in-depth blockchain research articles

The crypto industry, initiated by Bitcoin, has developed through the narrative game and is now entering a stage where its technical infrastructure is maturing. Crypto provides a foundation to assign economic value to any idea or interest and enables trading, paving the way for new types of applications and business models. Currently, the crypto industry faces the key challenge of developing popular applications and attracting users. To achieve this, it is necessary to actively apply strategies that leverage speculative demand as a core function.

This article is the last part of a three-part series covering the DeFerence 2024 event, sponsored by Four Pillars.

Base, aiming to onboard 1B onchain users, has emerged as a hub for consumer-oriented onchain applications within a year since its mainnet launch last year, driven by factors such as reduced fees, the memecoin frenzt, and the growth of social network applications like Farcaster. Unlike other blockchain ecosystems focused on DeFi and infrastructure, Base predominantly features consumer-oriented applications similar to Web2 services. It leverages a unique community and brand to onboard more applications. While social and community applications are the most actively developed, new categories of onchain applications in content, gaming, and commerce are also emerging, indicating significant potential for user expansion.

This article is the second part of a three-part series covering the DeFerence 2024 event, sponsored by Four Pillars.